In our article "NASI LEMAK PORTFOLIO: After two years ...." we welcomed fresh stock ideas for a brand-new portfolio.

Some investors then lamented, when approached for stock ideas, that stock prices of many "good" companies have gone up significantly in recent months or the past year.

That spells difficulties for anyone trying to share a good stock idea with substantial upside potential.

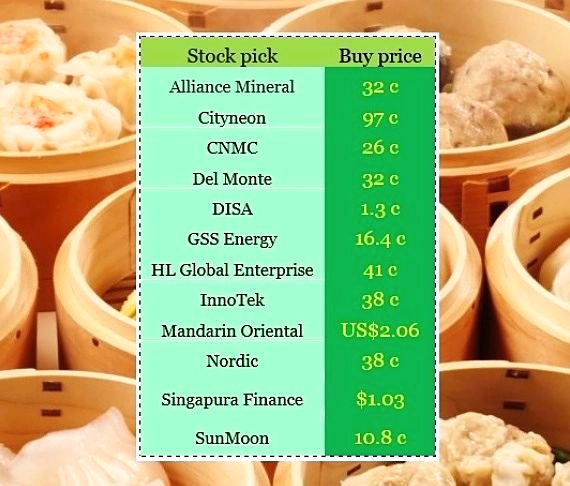

Still, with some trepidation, 10 investors eventually offered 12 stock ideas, as follows:

There are several past articles on five stocks (Alliance Mineral, CNMC, GSS Energy, InnoTek, and Nordic) on NextInsight.

There was a recent piece each on Mandarin Oriental and Singapura Finance but for the other stocks, we don't have prior stories.

The name "dim sum portfolio" was given by an investor, in line with the food theme that inspired the "nasi lemak portfolio".

In case you forgot, the nasi lemak portfolio returned an excellent 143% in two years -- truly, a number of good stocks have risen to the heavens.

Still, why "dim sum"?

Because it suggests variety -- the stock ideas came from investors with widely differing risk appetites and investment objectives.

Because it suggests deliciousness -- the stock ideas are "tasty" for some reason and at least a few hold the promise of solid returns.

You will note that some stocks...

♦ Have risen strongly (such as Nordic, HL Global Enterprise and Cityneon).

♦ Have strong re-rating potential (such as Alliance Mineral and GSS Energy).

♦ Are crawling at the bottom of their price charts (such as CNMC, Del Monte and Sunmoon).

Over time, investors may contribute new stock ideas to the portfolio, or remove existing ones.

We will update such movements in the Comments section below and publish a fuller article in due course.

For those who are keen to invest, please do your own due diligence.