MENCAST HOLDINGS has delivered strong revenue and profit growth in 1H2012. Click here for Mencast's financial statements.

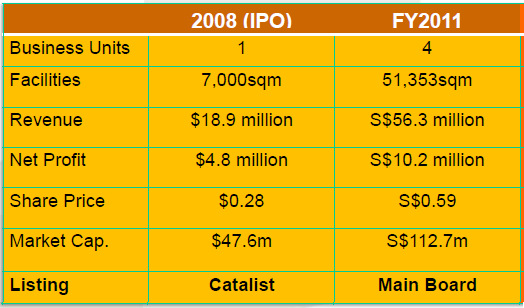

Looking at the big picture, its latest peformance reflects the company's transformation in the past 2 years as it expanded the scale and diversity of its business through acquisitions.

Shareholders have been rewarded by an increase in its stock price despite the market turmoil caused by the financial crisis in the West -- from 28 cents at its IPO in 2008 to 60 cents recently.

The new business units have established Mencast as a MRO (maintenance, repair and overhaul) player in the booming oil & gas industry.

Mencast used to be mainly a manufacturer of sterngear for ships.

Recognising that even analysts could do with more clarity on the new business units, Mencast CEO Glenndle Sim took them through a presentation recently (photo above).

Taking Unidive Marine Services as an example .....

> Installing thrusters: Thrusters are vital parts of semi-submersible oil rigs. With the acquisiton of Unidive Marine Services for S$14.85 million in July last year, Mencast now can do installation and dismantling of thrusters.

If in need of repair and maintenance, the thrusters can be serviced by another subsidiary of Mencast. That's cross-selling.

> Rope access: Unidive also provides 'daredevils' to work on oil and gas platforms as high as 50-60 storeys for work such as cleaning and inspecting and repair and maintenance.

Such are the niche services offered by the various companies that Mencast acquired in the past 2 years, and will be increasingly cross-sold by Mencast.

Even as it was busy making acquisitions, Mencast was building up its new waterfront facility in Penjuru Road. It was completed last year.

It secured a job from Keppel Fels, which is a feat considering the difficulty of becoming suppliers to such major companies.

In the picture at the bottom of this page, fabrication work by Mencast of 600-tonne leg blocks is close to completion, and the products will be delivered soon, in Sept 2012, to Keppel Fels.

"The significance is not in the dollar value of the contract but in the activities we executed.

"Three years ago, we would not have been able to secure such a contract. The unification of our new subsidiaries has worked, the cross-selling has worked," said Mr Sim.

"A door to a new space has opened up for Mencast.

"Each individual subsidiary on its own will never be able to garner that kind of contract."

With a wide range of service offerings, Mencast is confident it can win more business from the big boys.

Recent stories:

Oil & Gas Buzz for ASL MARINE, KEPCORP, TECHNICS, MTQ, MENCAST, CH Offshore

MENCAST, ROXY-PACIFIC : Latest happenings....