Excerpts from analysts' reports

US Bank Tower in Los Angeles was bought by OUE in 2013. Photo: www.skyscrapercity.comDaiwa Capital Markets says bet on OUE's overseas investments

US Bank Tower in Los Angeles was bought by OUE in 2013. Photo: www.skyscrapercity.comDaiwa Capital Markets says bet on OUE's overseas investments

Analyst: David Lum, CFA

OUE's recent overseas ventures in the Midan City resort and the US Bank Tower in downtown Los Angeles for USD367.5m last year highlight management's view that now is not the right time to invest in Singapore real estate, given the elevated capital values across almost all segments.

Instead, management believes that shareholders would be better off if OUE acquires a landmark asset (US Bank Tower) deeply below replacement value, with the potential to create value through active leasing and adding a restaurant and observation deck on top of the building.

US Bank Tower in Los Angeles was bought by OUE in 2013. Photo: www.skyscrapercity.comDaiwa Capital Markets says bet on OUE's overseas investments

US Bank Tower in Los Angeles was bought by OUE in 2013. Photo: www.skyscrapercity.comDaiwa Capital Markets says bet on OUE's overseas investmentsAnalyst: David Lum, CFA

OUE's recent overseas ventures in the Midan City resort and the US Bank Tower in downtown Los Angeles for USD367.5m last year highlight management's view that now is not the right time to invest in Singapore real estate, given the elevated capital values across almost all segments.

Instead, management believes that shareholders would be better off if OUE acquires a landmark asset (US Bank Tower) deeply below replacement value, with the potential to create value through active leasing and adding a restaurant and observation deck on top of the building.

Management is considering adding a boutique hotel or possibly even selling off strata condo space. We also understand that Chinese buyers have recently offered to buy the property at several times what OUE paid for it.

Management recognises that its business decisions by executive chairman, Stephen Riady, could be regarded as unconventional and that it might not be the right fit for every investor.

Nonetheless, management has been dismayed by the stock's poor performance (down 22% YoY, underperforming the FSSTI by 16.9% over the period) even though it has delivered tangible value for shareholders recently.

Nonetheless, management has been dismayed by the stock's poor performance (down 22% YoY, underperforming the FSSTI by 16.9% over the period) even though it has delivered tangible value for shareholders recently.

For instance, it has paid a special dividend of 20¢ following the listing of OUE Hospitality Trust (OUEHT) (Not rated) and a 1-for-6 dividend in specie of OUEHT units following the listing of OUE Commercial REIT (Not rated), which led to the increase in its book value to SGD4.06 as at 31 March 2014 from SGD3.18 as at 31 December 2013.

Although it caught some investors buy surprise, the company's 1Q14 net profit of SGD946m, which included a gain of SGD986m from the deconsolidation of OUEHT, was only 2% higher than our forecast.■ What we recommend

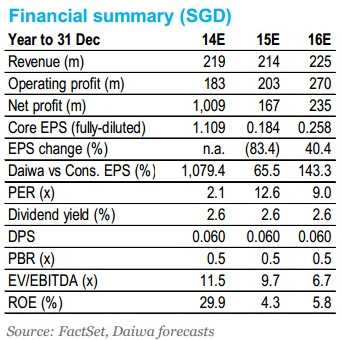

We reaffirm our Buy (1) rating and target price of SGD3.20, derived from our SOTP valuation of SGD3.50 after applying a 10% discount to OUE’s Singapore office property valuations.

In addition to significant value, we believe management's proactive approach in identifying and creating value from assets that are neglected or underappreciated by the market could eventually pay off for shareholders in the longer term. A risk to our call would be the persistence of investor scepticism following corporate actions.

For the target prices of other analysts, click here.

In addition to significant value, we believe management's proactive approach in identifying and creating value from assets that are neglected or underappreciated by the market could eventually pay off for shareholders in the longer term. A risk to our call would be the persistence of investor scepticism following corporate actions.

For the target prices of other analysts, click here.

OSK-DMG maintains buy call on Mencast and 76-c target

Analyst: Lee Yue Jer (left) Recent story: XMH -- target trimmed to 41 cents, MENCAST -- 76 cent Target |