Excerpts from analyst reports

UOB KH says "OUE REIT and special dividend are in sight"

Analysts: Vikrant Pandey and Terence Khi

Mandarin Orchard, established in 1971, has 1,051 guest rooms. Photo: Company• OUE H-Trust (OUE Hospitality Trust) imminent with Mandarin Orchard (S$1,190m) and Mandarin Gallery (S$540m) confirmed as initial assets.

Mandarin Orchard, established in 1971, has 1,051 guest rooms. Photo: Company• OUE H-Trust (OUE Hospitality Trust) imminent with Mandarin Orchard (S$1,190m) and Mandarin Gallery (S$540m) confirmed as initial assets. The properties will be divested to OUE H-Trust at a minimum price of S$1,705m (maximum 1.4% discount to valuations of S$1,730m), comprising gross cash proceeds of S$$1,359.5m and OUE H-Trust units worth S$345.5m.

The listing is expected to take place in 3Q13.

• Special dividend of 6-10%, assuming OUE distributes at least 30-50% of the proceeds. OUE has committed to distribute up to 50% (S$305m) of the gross cash proceeds (S$610m) following the repayment of existing S$750m debt secured against the properties.

• OUE to retain 30% stake in OUE H-Trust. OUE is expected to retain a 30% stake (S$345.5m) in OUE H-Trust post-listing.

• OUE to retain 30% stake in OUE H-Trust. OUE is expected to retain a 30% stake (S$345.5m) in OUE H-Trust post-listing.

• EGM on 25 June for shareholders to approve the divestment of Mandarin Orchard and Mandarin Gallery into OUE H-Trust and the distribution of special dividends.

Maintain BUY with unchanged target price of S$3.63/share, which is pegged at a 20% discount to our RNAV of S$4.54/share. We leave our RNAV unchanged pending confirmation of the successful listing of the hospitality REIT. OUE is trading at a steep 35% discount to its RNAV.

Maintain BUY with unchanged target price of S$3.63/share, which is pegged at a 20% discount to our RNAV of S$4.54/share. We leave our RNAV unchanged pending confirmation of the successful listing of the hospitality REIT. OUE is trading at a steep 35% discount to its RNAV.

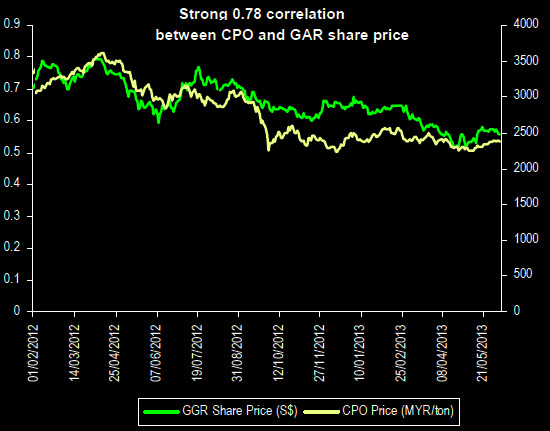

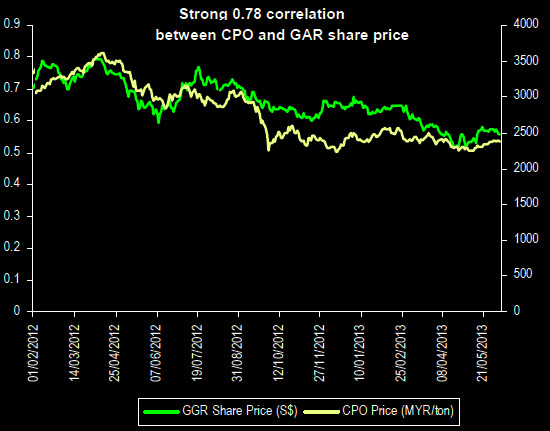

OCBC Investment Research maintains 'buy' on Golden Agri Resources as CPO prices firm up

Analysts: Carey Wong and Lim Siyi

Golden Agri-Resources (GAR), being one of the largest palm oil plantation owners in the world, should benefit from the recent rebound in CPO (crude palm oil) prices to MYR2450/ton; this from a recent low of MYR2200/ton, buoyed by expectations of a potential fall in the CPO stockpiles in both Malaysia and Indonesia due to the upcoming Muslim holiday.

While the general outlook for commodities is still uncertain (as China’s economic growth continues to sputter along), we believe that headwinds appear to be dissipating.

In 1Q13, its China operations had put in a much improved performance, turning in net profit of US$6m, compared to loss of US$23m in 4Q12, which GAR attributed to the result of a strengthening of the management team.

Furthermore, management remains fairly upbeat about its prospects as it continues to expand its integrated operation capabilities to benefit from the firm industry outlook.

Maintain BUY with an unchanged S$0.63 fair value (based on 12.5x FY13F EPS).

Source, Bloomberg, OIR

Source, Bloomberg, OIR

In 1Q13, its China operations had put in a much improved performance, turning in net profit of US$6m, compared to loss of US$23m in 4Q12, which GAR attributed to the result of a strengthening of the management team.

Furthermore, management remains fairly upbeat about its prospects as it continues to expand its integrated operation capabilities to benefit from the firm industry outlook.

Maintain BUY with an unchanged S$0.63 fair value (based on 12.5x FY13F EPS).

Source, Bloomberg, OIR

Source, Bloomberg, OIR

We met with 12 investors during our 11th Annual Pacific Leaders' Conference in London to present our views on the regional plantation sector. Most investors have little or zero holdings in the regional plantation space. However, some expressed interest in taking a closer look given the sector's YTD underperformance. We are Neutral on the sector. Although valuations are not expensive, we feel that the sector lacks near-term catalysts. We recommend investors bottom-fish our key picks in the sector, which are First Resources, Wilmar and IOI Corporation.