From latest analyst reports....

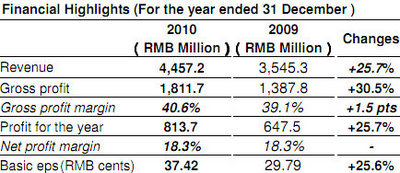

XTEP INTERNATIONAL Holdings (HK: 1368), sponsor of Birmingham City Football Club’s blue kits, has several leading brokerages bullish on the Chinese firm after the fashion sportswear maker’s 2010 bottom line jumped 25.7% to 813.7 mln yuan.

One house even called Xtep its “new sector top BUY.”

Xtep’s performance last year was 5.7% above consensus, which had houses abuzz with the Hong Kong-listed firm’s prospects going forward.

Xtep’s 2010 revenue rose at the same pace as its bottom line – adding 25.7% to 4.6 bln yuan, with full-year dividend payout consistent with expectations at 0.22 hkd per share, representing a 50% payout ratio.

Revenue of the flagship Xtep branded products rose 26.4% year-on-year to 4.2 bln yuan, comprising 94.5% of the top line.

* BOCOM said it raising FY11F/FY12F EPS by 2% mainly due to lower effective tax rate assumptions. The brokerage called Xtep’s current valuation “undemanding” when comparing its 9.9X FY11F P/E (ex-net cash 7.5 X P/E) to 17.3% FY10F – FY12F EPS CAGR.

The company was not resting on its laurels, boosting its total retail presence last year to 7,031 stores from 6,103 at the end of 2009.

“Xtep looks to add 800-1000 retail outlets in 2011. About A&P expense ratio and effective tax rate, management targets 11-13% and 16-18% respectively.”

A BUY recommendation and 6.7 hkd target price was reaffirmed on Xtep.

* CCB International is staying OUTPERFORM on Xtep following its robust earnings performance.

“Xtep’s 26% YoY rise in earnings in FY10 is better than we expected, with reported net profit of RMB814m, 4% higher than forecast. The difference was driven by strong sales (up 26%) while gross margin was broadly in line.”

The investment bank said that management remains positive on the company’s outlook, saying Xtep believes it can sustain margins going forward thanks to its “cost-plus” pricing model, in which it establishes its ASPs only after solidifying costs of production.

* Guotai Junan was also more upbeat on Fujian Province-based Xtep following the fashion sportswear maker’s standout financial year.

“We have revised up our FY11-12 revenue forecasts by 4.3% and 5.2%, respectively to reflect better than expected FY10 revenue growth and 1-3Q11 order book growths.

"We have revised up our FY11-12 Basic EPS forecasts by 6.1% and 6.6% to RMB0.452 and RMB0.542, respectively due to higher gross profit margin but lower A&P expenses forecast.”

Guotai said it is “still positive” about the company’s future outlook, maintaining a target price at 7.32 hkd, representing 13.8x FY11 PE, and reiterating its BUY recommendation.

* HSBC called Xtep’s current share price “undemanding” at 10x 2011e PER for 21% earnings CAGR over 2010-12e, and is maintaining its OVERWEIGHT rating and 7 hkd target price on the company.

“The 2010 results were 5% higher than our estimates, due mainly to higher-than-expected revenue growth as there were some replenishment orders in 2H-2010.

"Despite the increase in raw material costs, management is confident of achieving steady gross margins in 2011 as it is raising retail ASP and accumulating more lower priced raw materials,” HSBC said.

* UBS Investment Research called Xtep its “new sector top BUY” and maintains its 7.9 hkd target price on the firm.

“We see potential upside to our 2011 sales growth assumption of 15% YoY as 3 trade fairs for 2011 have been completed with order growth of 23-25% YoY. We believe ASP hike may have less impact on sell-through volume in 2011 as all sportswear brands are increasing ASP in concert.”

UBS added that Xtep compares favorably to its Hong Kong-listed competitors, as it is “cash rich” and trades at 7.8x 2011E P/E ex-cash, lower than Anta (12.9x) and Li Ning (11.5x).

See also:

XTEP: Birmingham City Kit Deal Marks Global Stepping-Out Party