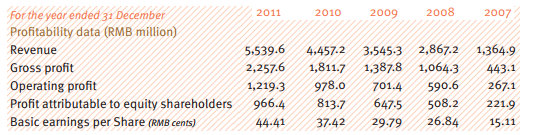

XTEP INTERNATIONAL (HK: 1368), a leading fashion sportswear firm that has lately been making major inroads into the running shoe sector, saw its 2011 revenue rise over 24% to 5.54 billion yuan in a tough operating environment.

Management told media and investors in Hong Kong it considered its 40.8% gross margins “very impressive.”

“Despite the debt woes in the EU, the economic stagnation in the US and the aftereffects of the Japanese tsunami disaster, we still managed to have a pretty good set of results last year," said Xtep International Chairman Ding Shuipo.

While not being completely immune from these market shaking events, the Fujian-province based firm was not fretting too much as its home market would continue to be its major impetus for growth.

“Last year was a difficult year for many given the problems overseas. But timely and effective moves by the Mainland Chinese government to sustain growth helped us maintain strong momentum in the PRC market, with good retail sales at home,” he added.

Xtep’s chairman added that the Hong Kong-listed maker of athletic footwear, apparel and accessories was not putting all its eggs in the saturated urban markets of Beijing, Shanghai and Shenzhen, but also relying for a large part of its revenue on slightly smaller city markets.

“Tier II and III cities will be our main focus going forward and we are very upbeat on prospects in these urban areas,” he said.

Looking ahead, he said the current year and its challenges will not permit Xtep to let down its guard, or rest on its laurels.

“The year 2012 will be a very challenging year for us and all our peers, especially given the overcapacity situation of last year and the major impact it is likely to have on the scene this year. So we will continue to focus on sportswear, especially the ‘running’ theme, and keep pushing the concept of sports and fitness as a part of a healthy, trendy, popular lifestyle choice.

“In this way, we feel we can most effectively maximize our market reach and potential, as we’re not just providing sportswear per se but also casual wear that promotes the ethos of a healthy, active and stylish lifestyle.”

Running Strong

Xtep was hoping to differentiate itself from its peers by not only being the fashion sportswear brand of choice, but also to be the "go to" name for running apparel, whether it be a brisk walk in the park, a light jog around the neighborhood or a serious long-haul attempt to beat one’s personal best in a full marathon.

“We are fully aware that standards of living are improving across Mainland China. And in this enduring phenomenon’s wake comes the growing realization that physical fitness is just as important a quality of life issue as financial fitness.

“Add to this the fact that Beijing is actively trying to promote homegrown brands in the domestic retail space and we cannot help but be very sanguine on prospects in the regional markets going forward,” Mr. Ding said.

But one activity was hopefully going to allow the Fujian Province-based firm to run away with the prize – running.

“Running footwear will be a major driver for us. We want to see Xtep become the ‘runners’ choice’ in China among brands within five years.”

Part and parcel to this push is Xtep’s plan to set up more runners’ clubs, teaching clinics and most importantly – design and market even better running shoes in terms of comfort, lightness and functionality.

Pursuant to this, Xtep hosted nine international marathons last year, attracting over 300,000 runners.

“Seven of these were in Mainland China and two in Taiwan. They undeniably offer excellent platforms for us to promote our Xtep brand and products on-site,” Mr. Ding said.

He added that Xtep’s sponsorship of professional football clubs in both England and Spain also brings an enviable cachet and elevated status to the brand in overseas markets.

On the financial side, CFO Terry Ho is very upbeat on Xtep’s prospects going forward.

“Our 40.8% gross margins last year were in fact very impressive, despite only rising 0.2 percentage points year-on-year, especially when you take all the domestic overcapacity and overseas financial problems in context,” he said.

In addition, he said that Xtep’s 18.7% rise in earnings per share to 44.4 RMB cents was “very high compared to our peer group.”

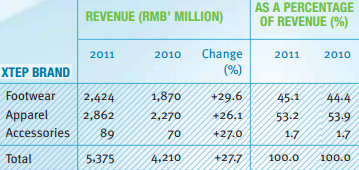

“Our footwear sales last year alone rose by nearly 30% to over 2.4 billion yuan. This is mainly driven by running shoes. We actively seek to separate ourselves from our competition by putting more emphasis on running gear. This differentiates us from most of our domestic rivals who are much more likely to focus very heavily on the basketball theme,” Mr. Ho said.

And Xtep believes that running and fashion sportswear apparel and accessories will always have a wider practical market appeal and functionality that basketball sneakers.

“We keep our brand very much in touch with customers through advertising campaigns as well as frequent marathon sponsorships.”

See also:

XTEP Orders Lead Sector

XTEP: In It For The Long Run With Marathon, Social Media

XTEP: Fashion Sportswear Co's 1H Net Soars 25% To 466 Mln Yuan

The Company is still making good revenue and profit growth and dividend payout is 50%.the cash flow also looks impressive. they have 7000+ outlets in china.

seems quite a good company