• 12 months ago, China Aviation Oil was flagged as a potential winner as it was experiencing tailwinds from of higher Chinese travel. It had a cash-rich balance sheet that could translate into higher dividends. (CHINA AVIATION OIL, HONG LEONG ASIA: Broker highlights 2 under-appreciated stocks with +30% upside) Investors seemed to have appreciated it more positively since -- as the stock has gone from 90 cents to $1.49. • It surged 12.9% yesterday (29 Oct) after DBS re-initiated coverage of CAO and put out a target price of $1.75, putting it way above consensus (see table).

• What's new from DBS? Its earnings forecast is more optimistic and it underscores tailwinds from an expected "shareholder-centric priority" by the management of CAO. And, it points out CAO still trades at a significant discount to its global peers. • For more, read excerpts of the DBS report below ... |

Excerpts from DBS Research report

Analyst: Jason Sum, CFA

From cash-rich to shareholder-centric

• Our earnings projections are 12–18% above consensus, reflecting a more favourable environment as backwardation eases and regional price differentials remain elevated. |

|||||

| Investment thesis |

CAO is Asia’s largest physical supplier of jet fuel and the key importer for China’s civil aviation sector, backed by its parent, China National Aviation Fuel Group (CNAF).

CNAF’s role as China’s exclusive aviationfuel distributor grants CAO privileged access to the country’s import market and a secure demand base.

The company’s strength lies in its integrated network spanning procurement, logistics, and infrastructure, supported by associates such as SPIA and OKYC.

The company has also emerged as an early adopter of sustainable aviation fuel (SAF) in Europe and parts of Asia, effectively leveraging its global supply expertise to meet the growing demand from airlines for lower-carbon fuel solutions.

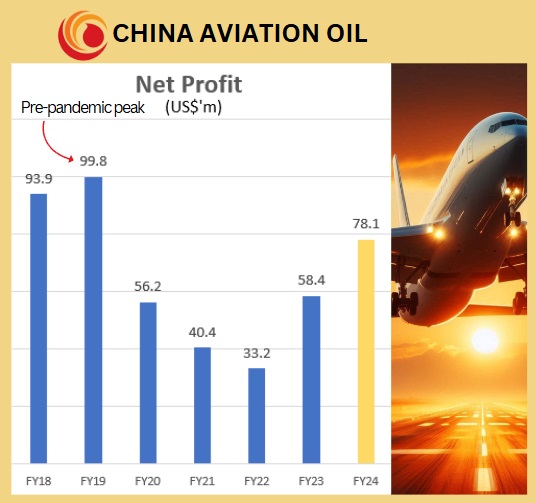

Multi-year earnings growth, supported by improving market conditions and resilient global air travel demand growth. We forecast a mid-teens CAGR in net profit between FY24-27F, subsequently moderating to high single digits between FY25-27F.

We believe shareholder returns are set to become a strategic priority for CAO. The group has less incentive to maintain a large cash balance as interest rates decline, as lower deposit yields will reduce interest income. Chinese state-owned enterprises (SOEs), such as telcos and energy companies, have been directed by the government to boost shareholder returns, resulting in higher dividends and share buybacks across the sector. While CAO is not directly an SOE, its parent, China National Aviation Fuel Group (CNAF) is, and similar expectations for improved capital discipline and stronger payouts are likely to cascade down. In Singapore, the Monetary Authority of Singapore (MAS) will launch a Value Unlock Programme in late 2025, aimed at helping listed companies enhance shareholder value through better capital management and governance, offering an additional policy tailwind for CAO to refine its capital strategy. --DBS Research |

This growth will primarily be driven by mid-single-digit increases in fuel volumes supplied, a gradual improvement in trading margins as backwardation narrows and a mild contango potentially returns, and persistent regional arbitrage windows.

We also expect a steady rebound in associate contributions, although SPIA’s earnings will remain constrained by ongoing US flight quotas.

Capital management presents a key re-rating catalyst. CAO’s substantial net cash position, equivalent to nearly 60% of its market capitalisation, indicates capital inefficiency.

Given CAO’s steady cash flow generation and asset-light strategy, we believe the group can sustain a 60%-70% dividend payout, implying a yield of 7%-9%.

Furthermore, there is potential for even higher payouts to strategically reduce its excess cash position.

A more explicit and firm commitment to shareholder returns would unlock significant value and help narrow CAO’s valuation discount relative to its global peers.

|

CAO’s considerable valuation gap to peers |

|||||||

|

|

|

P/E |

P/E ex-cash |

||||

|

Company |

Market Cap (USD mn) |

CY25F |

CY26F |

CY27F |

CY25F |

CY26F |

CY27F |

|

Adnoc Distribution |

12,252 |

16.7x |

16.3x |

15.4x |

18.6x |

17.8x |

17.0x |

|

Vibra Energia |

5,003 |

13.3x |

10.9x |

8.7x |

11.8x |

11.7x |

11.7x |

|

Ampol |

4,838 |

18.9x |

15.3x |

13.7x |

30.4x |

22.7x |

18.9x |

|

Viva Energy |

1,888 |

17.8x |

19.4x |

13.0x |

67.6x |

40.5x |

27.0x |

|

Global Partners LP |

1,557 |

15.1x |

13.5x |

12.5x |

26.8x |

23.3x |

21.0x |

|

World Kinect Corporation |

1,481 |

12.8x |

9.9x |

9.2x |

- |

- |

- |

|

Bangkok Aviation Fuel Services |

197 |

16.0x |

9.8x |

- |

45.0x |

27.8x |

- |

|

Sector average |

15.8x |

12.2x |

11.2x |

32.0x |

21.1x |

18.4x |

|

|

China Aviation Oil |

882 |

8.8x |

8.0x |

7.5x |

3.5x |

3.0x |

2.8x |

| Re-initiate coverage with BUY and a TP of SGD1.75, based on 10.8x FY26F EPS (+1SD above historical average). We see re-rating potential driven by enhanced earnings visibility, robust capital management catalysts, and an undemanding valuation. Key Risks Inventory losses amid price volatility, sustained/deeper backwardation limiting trading profitability, and inefficient capital management prolonging its valuation discount vs peers. |

→ The DBS report is here.

→ The DBS report is here.

→ Read about another deep-value stock: Cash-Rich, Privatisation Potential: The Deep Value of This Company's Hotels Remains Unnoticed