|

China Aviation Oil (CAO) is a big player in the jet fuel game -- it's based in Singapore and listed in Singapore but it's closely tied to China’s booming aviation market.

At its AGM in April 2025, a shareholder stood up and offered comforting news to fellow shareholders fretting over the underperformance of CAO stock: "The good news is Elliot Management (known for its activist force) has bought into BP. You may have a chance at a later stage to see CAO price go much higher."

BP owns nearly 21% of CAO, which is a non-core asset of the British oil giant.

That came about way back in 2005, when BP teamed up with Singapore’s Temasek Holdings and CAO's parent company to pump US$130 million into CAO to help it recover from a speculative trading scandal.

With Elliot recently becoming BP's second largest shareholder with a ~5% stake and throwing its weight around, (See: Activist investor Elliott wants BP to shut down divisions), BP could well divest its stake in CAO.

In fact, BP already has identified some assets to divest (See: BP Begins Sale of Castrol in $20B Asset Divestment Strategy).

CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.

|

While there’s no official confirmation that BP’s CAO stake is for sale, the possibility is real.

BP’s in the middle of a publicly-declared US$20 billion divestment exercise through 2027 to cut its US$23 billion debt.

Selling its stake in CAO will bring in cash that could help BP fund big projects, fend off potential takeover attempts -- and keep Elliott happy.

But there are reasons this sale might not happen anytime soon.

For one, compared to BP’s bigger divestments—like Castrol, which could fetch US$10-US$11 billion—the CAO stake is small potatoes.

BP might focus on juicier deals to hit its US$20 billion goal instead.

| Who might buy, and so what? |

China National Aviation Fuel Group (CNAF), which owns about 51% of CAO, probably has a “right of first refusal,” meaning they could swoop in and match any offer.

If BP's stake is up for sale, CNAF’s a likely buyer, as are Chinese state-owned enterprises or private equity firms.

How about a foreign buyer? Difficult to say if China will be too protective of CAO and refuse it.

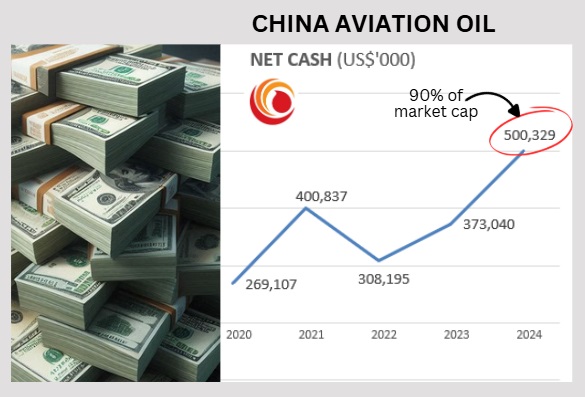

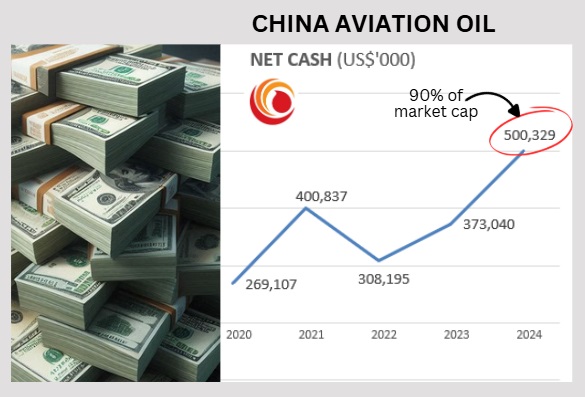

CAO stock currently trades at 85 Singapore cents, giving it a market cap of S$723 million (US$560 million).

US$500 million of that is net cash, meaning the actual business is valued at only US$60 million.

For a company pulling in ~US$80 million in annual profit, that's dirt cheap -- with ex-cash PE of less than 1.

A BP stake sale will surely go for a premium to the current stock price.

How will investors react to a BP sale? Perhaps they would buy in too, recognising the stock’s undervalued.

Additionally, China’s aviation market, which is set to be the world’s biggest, represents a significant growth story.

Big deals like this attract attention, so speculators and traders might jump in on the news, driving short-term price spikes.

That boost to trading volume could in turn boost market sentiment, perhaps drawing in institutional investors or funds.

While CAO’s strong cash position and earnings make it an attractive target, the path to a successful sale is far from assured. Regulatory obstacles, priorities at BP, etc could all delay or derail a deal.

|

CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.

CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.