• In the past few years, analysts from various houses seemed to view Singapore-listed China Aviation Oil (CAO) with mixed feelings. • Recommendations have been muted, as they shifted emphasis at varying times in response to fluctuating risk factors. Things like oil price volatility, trading margins, and associate contributions (from Shanghai Pudong International Airport Aviation Fuel Supply Company).

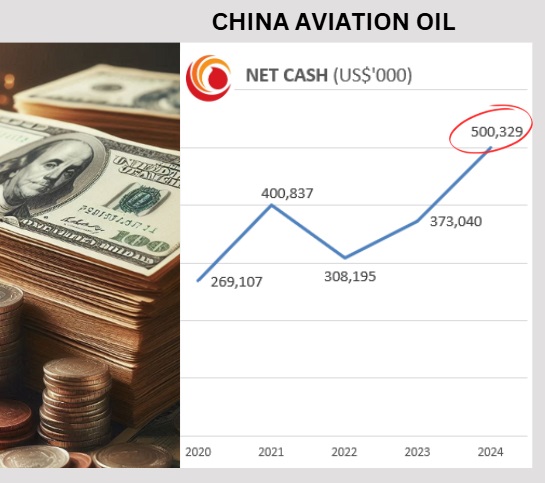

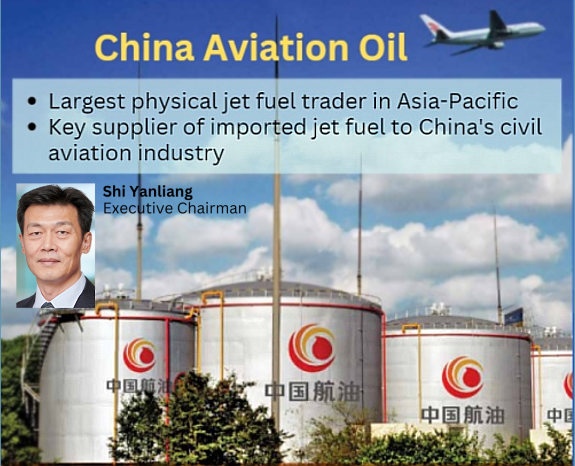

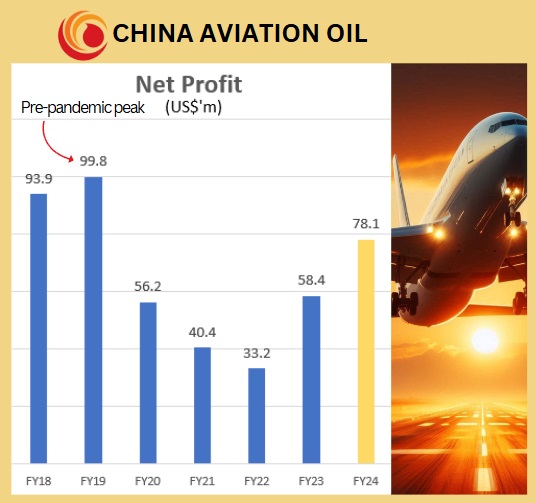

• Breaking out of that sentiment, CGS International has now put out a 'buy' call and a high $1.40 target price.  CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to three key Chinese international airports -- Beijing, Shanghai and Guangzhou. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to three key Chinese international airports -- Beijing, Shanghai and Guangzhou.• A striking thing is CAO had amassed a cashpile of US$500 million by end-2024, up from US$373 million a year earlier. • When you look at the company's current market value of S$972 million (US$747 million, stock price S$1.13) and subtract all that cash, the actual business is valued at only S$328 million. For a company pulling in ~US$85 million in profit, that's dirt cheap -- with ex-cash PE of 3.  • Wait, there's a downside risk -- CAO's trading of oil products is high volume and thin margin. CAO reported losses for its 2H24 "other oil products" trading segment. • Bottomline: SPIA's contribution is on an uptrend with Chinese aviation growth, while oil trading risks pose uncertainty for CAO. • For more, read what CGS says below ... |

Excerpts from CGS International report

Analysts: Tan Jie Hui & Lim Siew Khee

|

■ We view CAO as a strong beneficiary of China’s continuing air travel recovery given CAO’s monopoly in the imported jet fuel market in China.

■ The stock trades at CY26F 8.5x P/E and ex-cash P/E of 2x. |

||||

Resume coverage; Add and a TP of S$1.40, ex cash 2x CY26 P/E.

We resume coverage on CAO with an Add call and a higher TP of S$1.40 as we roll over our valuation to FY26F and adjust our P/E multiple from 9.5x to 10x (CAO’s 10-year historical average).

The stock trades at CY26F 8.5x P/E and ex-cash P/E of 2x.

We estimate US$500m net cash at end-FY25F along with healthy operating cash flows, which should allow CAO to keep its FY25F dividend payout ratio at 30% minimum.

Re-rating catalysts: strong recovery in outbound China flight volumes, GPM improvement through sustainable aviation fuel (SAF) trading and M&As.

Downside risks: geopolitical tensions and economic slowdown impacting China’s outbound flight volumes and CAO’s GPM.

Geopolitical tensions may weaken 2H25F margin

In Jun 25, escalating hostilities between Israel and Iran heightened concerns over disruptions to oil production and shipping through the Strait of Hormuz, a critical chokepoint for global crude supply.

We reckon a potential volatility in freight costs for oil trading could impact GPM in 2H25F as not all of it can be passed through to customers, though CAO could capitalise on the rising oil prices for arbitrage opportunities.

As such, we estimate 1H25F contributed 57% of FY25F net profit.

| Dividends and M&A |

| "CAO has maintained a robust net cash position for more than 10 years and it stood at US$500m as of FY24. Its debt-free balance sheet accords dry powder for M&As, which we see as a catalyst for longer-term growth. CAO was also able to sustain its 30% dividend payout (c.US$25m as of FY24). We believe CAO will pursue opportunities related to vertical integration across the value chain." --CGS |

Visa reforms and airline expansions to drive aviation growth

In Dec 24, China expanded its visa-free policy, allowing ordinary passport holders from 38 countries to enter China for up to 30 days without a visa while extending the permitted stay for eligible foreign travellers from 72 hours to 240 hours (source: gov.cn).

According to Centre for Aviation, airlines are ramping up China-bound services in 2025F.

We forecast EPS growth of 7%/7%/5% for FY25F/26F/27F.

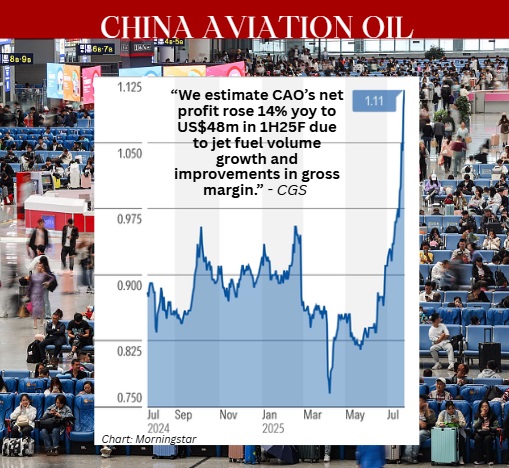

Tan Jie Hui, analyst1H25F preview: strong volumes likely led by aviation boom Tan Jie Hui, analyst1H25F preview: strong volumes likely led by aviation boom More than 90m travellers (+7% yoy) passed through China’s aviation system during the spring festival season in Jan-Feb 25 while the May Day holiday brought a record 11m passenger trips on civil aviation networks (+12% yoy), according to Civil Aviation Administration of China. We estimate CAO’s net profit rose 14% yoy to US$48m in 1H25F due to jet fuel volume growth and improvements in GPM due to better SAF trading with higher GPM. We also believe share of associates’ profits climbed 19% yoy to US$28m in 1H25F as passenger traffic at Shanghai Pudong International Airport likely spiked during the abovementioned festive seasons. |

The CGS report is here.