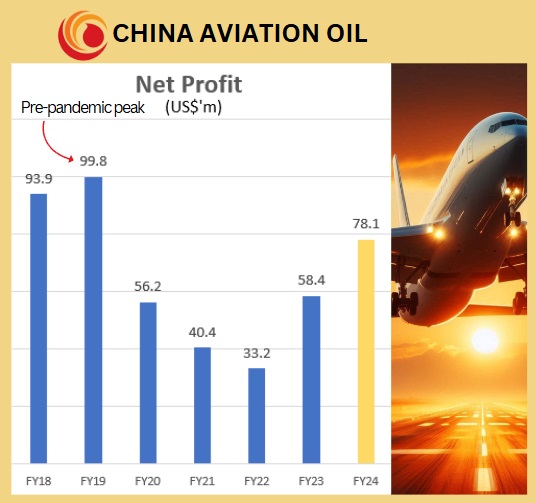

• From having mixed feelings about China Aviation Oil (CAO) in recent years, analysts have noticeably shifted towards optimism in the run-up to the 1H2025 results. (See July 2025 article: CHINA AVIATION OIL: There's New Analyst Optimism for This Company with US$500 m Net Cash) • Following CAO's results release last week, analysts are pretty unaminously warmed up (see table) OCBC's report was cheerfully titled: Fly Me To The Moon.

• CAO is a strong proxy for China's growing aviation sector. Outbound travel recovery is expected to accelerate, supporting long-term jet fuel demand amid rising affluence and middle-class expansion.

• CAO continued to grow its cashpile, reaching US$515.3 million by end-1H2025, up from US$500.3 million at end-2024 and after paying US$24.4 million in dividends. • The cash amounts to 60% of its current market value of S$1.1 billion. • Wait, there's a downside risk -- CAO's trading of oil products is high volume and thin margin. CAO reported losses for its 2H24 "other oil products" trading segment. • For more, read what OCBC Investment Research says below ... |

Excerpts from OCBC Investment report

Analyst: Ada Lim

• Margin expansion was supported by increased sustainable aviation fuel (SAF) trading in Europe, despite only contributing to a low single-digit share of overall trading volume |

|||||

| Investment thesis |

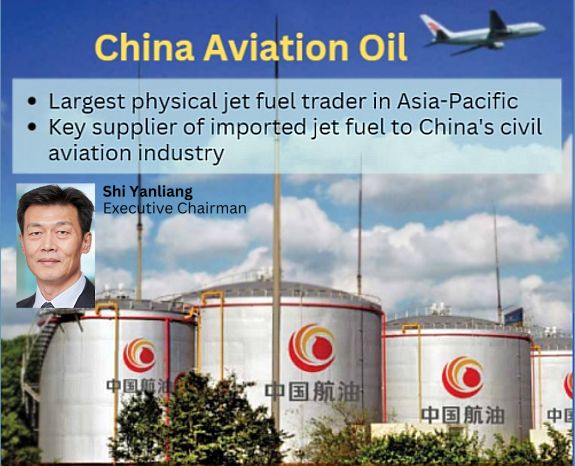

China Aviation Oil (CAO) is the largest physical jet fuel trader in the Asia Pacific (APAC) region, with Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA) being its crown jewel.

A key supplier of imported jet fuel in the civil aviation industry in the People’s Republic of China (PRC), CAO is a strong proxy to the growing Chinese aviation industry.

Although CAO’s post-pandemic recovery has been gradual due to lacklustre Chinese outbound travel momentum, we think it is well positioned to capture long-term growth in jet fuel demand, given:

| (i) its entrenched presence in China and status as a market leader in the region; and (ii) the increasing affluence of the APAC region and burgeoning middle class in China. |

Coupled with a strong net cash position to support the pursuit of inorganic growth opportunities, this makes CAO an attractive multi-year investment story.

| Investment summary |

• Bottom line beat on better-than-expected margins – CAO’s 1H25 revenue increased 13.6% YoY to USD8.6b, driven by a 25.4% YoY rise in total supply and trading volume to 13.8m metric tons (mt).

| Potential Catalysts & Risks |

| Potential catalysts • Faster and stronger-than-expected recovery in Chinese air travel • Deployment of cash through accretive acquisitions • Introduction of initiatives to improve profitability Investment risks • Slower-than-expected international flight recovery, either due to demand or supply constraints • Geopolitical tensions • Regulatory risks --OCBC |

The volume growth for middle distillates and other oil products came in at 18.7% and 61.8% YoY to 7.4m mt and 6.4m mt, respectively.

Gross profit improved 25.7% YoY, supported by optimisation gains from trading activities and positive SAF trading momentum in Europe, reaching USD30.4m.

Together with an 18.6% YoY increase in share of results from associates to USD27.4m – largely driven by a 13.9% growth in contribution from SPIA to USD25.5m on higher refuelling volumes – net profit gained 18.4% YoY to USD50m.

1H25 revenue and net profit constituted 51.3% and 60.1% of our initial full year forecasts, respectively.

|

Key Financial Highlights |

1H2025 |

1H2024 |

Change (Y-o-Y) |

|

US$'000 |

|||

|

Revenue |

8,560,530 |

7,535,525 |

13.6% |

|

Gross profit |

30,383 |

24,181 |

25.7% |

|

Total expenses |

9,855 |

9,180 |

7.4% |

|

Share of results of associates |

27,444 |

23,144 |

18.6% |

|

Net profit |

50,042 |

42,264 |

18.4% |

|

Net Asset Value per Share (US cents) |

118.15 |

114.66* |

3.0% |

Going into 2H25, we expect CAO’s performance to be supported by:

All things considered, we finetune our forecasts, factoring in stronger growth at CAO’s associates and better margins; that being said, we prefer to remain conservative in our estimates, given the volatility of trading revenue and oil prices. As a result, our FV estimate is further raised from SGD1.40 to SGD1.50, and this remains pegged to a forward 12-month target price-to-earnings (P/E) multiple of 11.0x. CAO is sitting on a significant net cash position of USD515m as at 30 Jun 2025, and any activities to improve shareholder returns – be it management’s commitment to a higher dividend payout ratio or accretive acquisitions – could be catalysts that drive a further re-rating of the stock, in our view. |