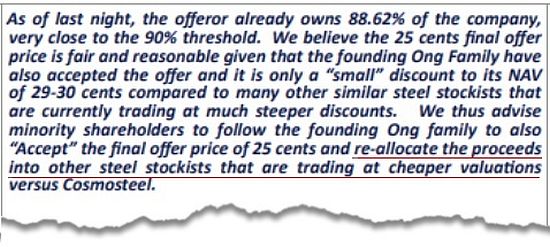

In a note last Friday, Lim & Tan Securities advised those who still held CosmoSteel shares to accept the takeover offer -- and swap over the proceeds to other steel stockists trading at cheaper valuations than CosmoSteel:  Lim & Tan Securities did not name "other steel stockists" -- but here is a list:

|

On the face of it, AnnAik Limited and Asia Enterprises are the most interesting cases with the biggest discounts to book values.

AnnAik's price-to-book (P/B) ratio is a low 0.28.

Ow Chin Seng, Executive Chairman and CEO of AnnAik. He has an interest in 43.69% of the company. Photo: annual reportAnnAik Limited manufactures and distributes stainless steel piping products, primarily serving sectors like water management, construction, and infrastructure in Singapore and regionally.

Ow Chin Seng, Executive Chairman and CEO of AnnAik. He has an interest in 43.69% of the company. Photo: annual reportAnnAik Limited manufactures and distributes stainless steel piping products, primarily serving sectors like water management, construction, and infrastructure in Singapore and regionally.

The company has maintained a niche in sustainable and high-quality steel solutions.

AnnAik's financials show resilience in a challenging steel market, with revenue stabilizing after a sharp decline in prior years.

Here's a summary of its key metrics over the last three fiscal years (ending December):

|

Fiscal Year |

Revenue (SGD Million) |

Net Income (SGD Million) |

Key Notes |

|

FY24 |

47.64 |

2.05 |

Revenue flat y-o-y; net profit down ~37% due to higher costs and global steel price volatility. Gross profit at SGD 14.99 million. |

|

FY23 |

47.66 |

3.25 |

Revenue down 42% from FY22 amid reduced demand; net profit declined 41%. |

|

FY22 |

82.73 |

5.53 |

Strong year with higher sales driven by post-pandemic recovery in infrastructure projects. |

Insider activity bolsters investor confidence with recent acquisitions by the spouse of the executive chairman-cum-CEO Mr Ow Chin Seng.

These were large married deals of an illiquid stock.

|

Date |

Person Involved |

Nature of Change |

Details |

|

July 7, 2025 |

NG KIM KEANG |

Open market sale |

Sold 225,600 shares for $13,761.60 |

|

June 9, 2025 |

LOW KHENG |

Married deal |

Bought 2,850,000 shares for $171,000 |

|

Dec 6, 2024 |

LOW KHENG |

Married deal |

Bought 2,850,000 shares for $179,500 |

Asia Enterprises is a distributor of steel products to industrial end-users, including shipbuilding, oil & gas, and manufacturing sectors.

The company has recently pursued diversification, acquiring a 28.64% stake in GKE Metal Logistics for SGD 3.7 million, aiming to expand into logistics and enhance supply chain resilience.

Asia Enterprises, with a P/B of 0.51, has suffered a steeper FY2024 downturn:

|

Fiscal Year |

Revenue (SGD Million) |

Net Income (SGD Million) |

Key Notes |

|

FY24 |

40.74 |

0.37 |

Revenue down 57% y-o-y; net profit dropped 94% due to weak demand and higher operating costs. |

|

FY23 |

95.45 |

6.06 |

Strong revenue growth from industrial recovery; net profit up significantly. Dividends paid. |

|

FY22 |

73.52 |

3.75 |

Steady improvement post-COVID, driven by higher steel prices and volumes. |

Insider transactions here are neutral, mostly adjustments without clear buys.

AnnAik edges out as the preferred stock for upside potential.

Its undervaluation, consistent profitability, and strategic focus on eco-friendly products position it well for recovery. The book value breakdown—SGD 38.86 million in share capital, SGD 26.46 million in retained earnings, offset by reserves like foreign currency translation (SGD -2.49 million)—highlights solid fundamentals. Recent insider purchases by the spouse of the executive chairman spell optimism for the long haul. |

|||||||||||||||||