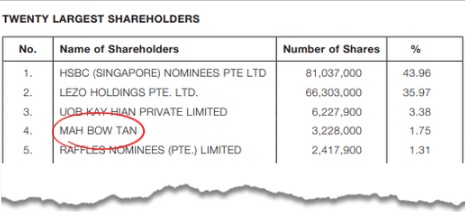

| Singapore’s construction boom has boosted many well-known industry players, but not all the beneficiaries are traditional builders. Downstream in the value chain is Alpina Holdings—an integrated building services and engineering provider that is experiencing a sharp upswing in profitability. It even announced an interim dividend which is the largest single payout since its listing in January 2022. This is what the CEO says:  As an aside, Mr Mah Bow Tan, who held three ministerial posts in the Singapore government, including Minister for National Development (1999–2011), appears in the Top 20 shareholder list of Alpina's FY2024 annual report (see below). In fact, he has appeared in all past Alpina annual reports (FY2021-2024) with his 3,228,000 shares.  |

| Understanding Alpina’s Business |

For those not familiar with Alpina, it has an operating history of over 20 years as a specialist in the following sectors:

|

| Good revenue visibility |

| • In June 2024, Alpina was part of a consortium that was awarded a contract for the provision of integrated facilities management services for a tertiary education institution in Singapore. Provisional contract sum: ~S$115.7 million. • In total, the Group secured 20 new contracts with an aggregate provisional contract sum of S$172.7 million. Expected completion dates: between April 2024 and March 2030. (Source: FY2024 annual report) |

The clientele is primarily public sector: government ministries, statutory boards, and public education institutions.

Alpina also owns investment properties and participates in Singapore’s growing renewable energy sector, having won in 2022 a S$117 million joint contract to deliver 70MW-peak of solar capacity.

Alpina holds the highest accreditation for integrated building and electrical engineering services in Singapore, allowing it to bid for unlimited-value public sector projects—a major competitive advantage.

| 1H2025 Financial Performance |

The first half of 2025 saw robust growth for Alpina, underpinned by the strong performance in its core segments and boosted rental income from a 2024 property acquisition, including a workers' dormitory:

|

Metric |

1H2025 |

1H2024 |

Change (%) |

|

Revenue |

$47.9m |

$44.1m |

+8.7% |

|

Gross Profit |

$6.2m |

$4.1m |

+50.5% |

|

Gross Profit Margin |

13.0% |

9.4% |

+3.6ppt |

|

Net Profit |

$2.7m |

S$0.8m |

+239.6% |

|

Net Cash from Operations |

$8.6m |

$9.4m |

+8% |

-

Revenue growth was driven primarily by the IBS segment, which saw a 29.2% uptick thanks to higher-value projects.

Rental income soared by 87.8%, reflecting the full period contribution from the Group’s newly acquired property situated at 180 Woodlands Industrial Park E5. -

The gross profit margin improved to 13.0%, up from 9.4% a year earlier.

Older contracts signed before COVID-19 have been completed, incuring higher operating costs but clearing the way for newer, more normalised profitable deals. -

Net profit surged by 239.6% to S$2.7million—already exceeding the full-year 2024 figure of S$2.4million.

| Management Outlook |

Alpina’s Executive Chairman and CEO, Mr. Low Siong Yong, credits the Group’s strong start in 2025 to improved contract margins and a disciplined approach to operational costs.

He stressed a dedication to delivering value for stakeholders and confidence in the company's business model—a stance echoed in the highest-ever single dividend payout.

|

FY |

Interim (c) |

Final (c) |

Total (c) |

|

2021 |

-- |

0.2712 |

0.2712 |

|

2022* |

0.4339 |

0.1085 |

0.5424 |

|

2023 |

-- |

-- |

-- |

|

2024 |

-- |

0.1899 |

0.1899 |

|

2025 |

1.0 |

N/A* |

N/A |

|

*Alpina listed in Jan 2022 |

|||

With an operating history of over 20 years, Alpina is closely connected to the efficient functioning of Singapore’s public infrastructure ranging from HDB blocks to tertiary institutions, from schools to ministries. Its ability to secure and profit from multi-year contracts from a reliable client (ie the government) and strategic investments is vital for long-term stability. |

|||||||||||||||||

Alpina Holdings' financial statement is here.