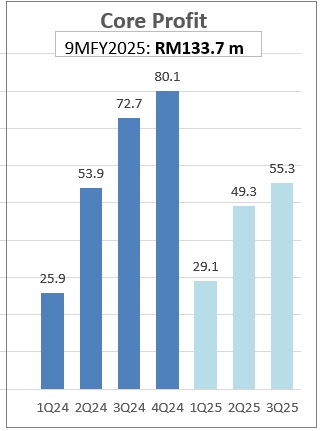

Nam Cheong has a standout year-to-date, securing RM400 million in long-term charters, kept gross margins above 50%, and lifted core profit to RM133.7 million for 9M2025. Nam Cheong’s fleet stands at 38 vessels, with three more vessels coming in by year-end and starting to contribute next year. |

| Softer Utilisation and Fleet Reprofiling |

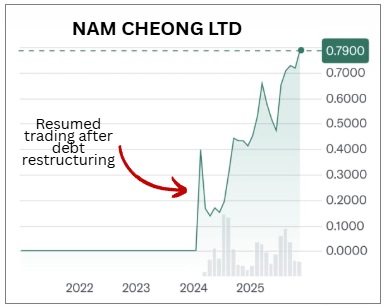

Giving a run-down on the financials, CFO Chong Chung Fen said 2024 was a "super year" with sky-high utilization. Chart: Yahoo!2025 normalized: 70% utilization in 3Q25 compared to 86% last year.

Chart: Yahoo!2025 normalized: 70% utilization in 3Q25 compared to 86% last year.

Nam Cheong has secured long-term contracts—RM400 million worth, no less—and 60% of the fleet is already locked in on multi-year charters.

This gives the company much-appreciated visibility.

Financially, things are steady:

-

9M25 core profit: RM133.7 million (-12% yoy)

-

9M25 gross margin: above 50%

-

Net gearing: down to 0.53x

Management explained vessel sales, which has become a recurring income stream.

Each year, Nam Cheong offloads older or less productive vessels and reinvest into younger, higher-earning ones.

Gains from sale: RM42M in 2022, RM44M in 2023, and RM60M in 2024.

Market Outlook: Middle East Hot, Malaysia Holding, Wind Still a Question Mark

Demand wise, Nam Cheong highlights:

-

Malaysia remains steady but not booming.

-

The Middle East? “Forever not enough vessels.” Nam Cheong already has five vessels there and expects this number to rise.

Meanwhile, Accommodation Work Boat (AWB) utilization is at 50–60%.

Management agrees it’s not ideal but said they’re leveraging their Qatar contract experience to secure more long-term AWB deals in the Middle East.

| Shipbuilding Question: Will They or Won’t They? |

Shipbuilding is on the cusp of a comeback and Nam Cheong could clinch orders in the near future.  While conventional bank financing for newbuilds is still very limited, there are potential orders using alternative financing.

While conventional bank financing for newbuilds is still very limited, there are potential orders using alternative financing.

Nam Cheong owns a shipyard in Sarawak which has been building a few vessels for its own fleet and doing ship repairs in recent years.

It is keen on third-party orders but wants good margins.

And it is not going for run-of-the-mill vessels, said CEO Leong Seng Kiat, outlining some features of the vessel types it will build, as follows:

-

Suitable for both O&G and wind

-

More autonomous

-

More digital

-

Lower crew count

-

Modern, fuel-efficient

Charter rates remain supported by serious supply constraints.

Fleets globally are ageing as are vessels in Malaysia (average age: 13.2 years).

The philosophical bit came at the end from the CEO. |

→ See Nam Cheong's 3Q results announcement here.

→ See Nam Cheong's 3Q results announcement here.

→ DBS Research's report is here.