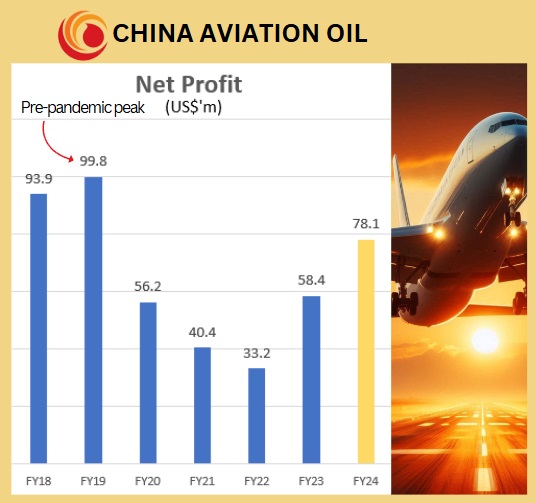

• Not too long ago, analysts were kind of sitting on the fence about China Aviation Oil (CAO) but things have really looked up this year. (See July 2025 article: CHINA AVIATION OIL: Analysts turn more optimistic on stock after 1HFY25 profit rise) • The latest sign: CGS found reason to up its target price during the Golden Week, cheerfully titling its report: "Getting the Golden Week glow." CAO stock is +66% in the past 6 months, closing at $1.31 last week.

• CAO is a way to gain exposure to China's growing aviation sector. With more Chinese travelling abroad and a growing middle class, long-term jet fuel demand is expected to rise.  • Another big thing for CAO is its expansion into a fast-growing niche, sustainable aviation fuel (SAF). • As if that's not enough, CAO continued to grow its cashpile, reaching US$515.3 million by end-1H2025, up from US$500.3 million at end-2024 and after paying US$24.4 million in dividends. • The cash amounts to ~60% of its current market value of S$1.13 billion. • For more, read what CGS says below ... |

Excerpts from CGS report

Analyst: Tan Jie Hui & Lim Siew Khee

■ US-China flight restrictions and low oil prices challenge margins, but growing regional traffic and SAF trading provide upside, in our view. |

|||||

| Expecting robust aviation volume in 2H25F amid festive holidays … |

We believe China Aviation Oil (CAO) would have benefited from the summer holidays (midJul to late-Aug 2025) and the Golden Week festivities (29 Sep-10 Oct 2025), in terms of:

1) increasing jet fuel supply volumes across major Chinese airports, and

2) greater contributions from its 33%-owned associate Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA).

According to the Civil Aviation Administration of China (CAAC), international air passenger volume grew c.16% yoy in Jul-Aug 2025, averaging c.7.3m passengers per month.

International passenger traffic during the Super Golden Week is projected to have increased c.10% (vs. last year’s festive period) to 6.0m, based on scheduled seat capacity data from Cirium Aviation Analytics.

Shanghai Pudong International Airport served as the main international hub during the Super Golden Week holidays, handling c.800,000 international travelers, which should benefit CAO, we believe

| … but partially offset by geopolitical tensions and weaker oil prices |

Ongoing US government restrictions on Chinese carriers and persistent trade tensions may continue to suppress CAO’s long-haul jet fuel demand, in our view.

The recovery of US-China air travel remains limited, with capacity in 3Q25 reaching only c.25% of prepandemic 2019 levels, according to VariFlight.

Meanwhile, Brent crude prices remained subdued at c.US$69/bbl in 3Q25 (-14% yoy).

This may result in limited opportunities for favourable arbitrage trades, lowering margins.

Lower oil prices may also dampen associate contributions, particularly from SPIA, due to mark-to-market revaluations of oil inventories.

For 2H25F, we expect CAO’s gross margin to improve from 0.22% in 2H24 to 0.27%, driven by increased SAF trading, supported by the EU’s ReFuelEU Aviation mandate, but to decline from 0.35% in 1H25 on fewer arbitrage opportunities.

We forecast associate contributions to rise 13% yoy to c.US$26m, led by stronger regional flight volumes (e.g. China-Japan and China-Vietnam), though slightly lower hoh (-6%) on fewer long-haul USChina flights.

|

Key Financial Highlights |

1H2025 |

1H2024 |

Change (Y-o-Y) |

|

US$'000 |

|||

|

Revenue |

8,560,530 |

7,535,525 |

13.6% |

|

Gross profit |

30,383 |

24,181 |

25.7% |

|

Total expenses |

9,855 |

9,180 |

7.4% |

|

Share of results of associates |

27,444 |

23,144 |

18.6% |

|

Net profit |

50,042 |

42,264 |

18.4% |

|

Net Asset Value per Share (US cents) |

118.15 |

114.66* |

3.0% |

* As at 31 December 2024

Reiterate Add on CAO, supported by its solid earnings outlook and decent 3-3.5% dividend yields for FY25–27F.  Tan Jie Hui, analystWe roll forward our TP to FY27F with a higher TP of S$1.52, still based on 10x P/E (10-year historical mean). Tan Jie Hui, analystWe roll forward our TP to FY27F with a higher TP of S$1.52, still based on 10x P/E (10-year historical mean). Key catalysts: stronger rebound in outbound China air traffic, GM expansion, higher-than-expected oil prices, stronger associate contributions. Downside risks: potential deregulation of China’s jet fuel market and rising competition in less established markets, such as the US and Europe. |

The CGS report is here.