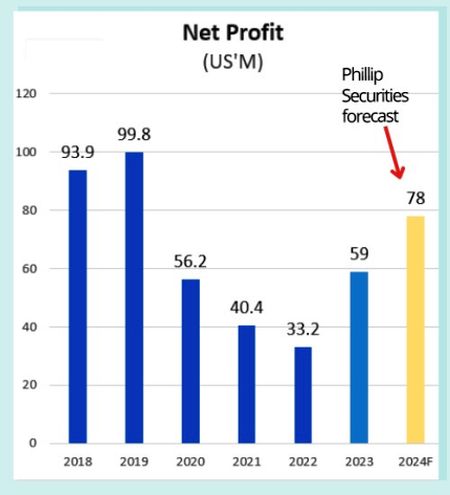

• A Singapore listco has clearly been benefitting from the recovery of domestic and international travel in China after the country reopened its borders in early 2023. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.• China Aviation Oil (CAO) reported an 182% increase in net profit to US$39.1 million in 2H2023. Compare that to a relatively unchanged net profit of US$19.7 million in 1H2023. • For the full year 2023, CAO's net profit rebounded 77% y-o-y to US$58.9 million. CAO's profit recovery is expected to extend into 2024 as air travel continues to recover, as this chart below suggests.  • To mark the 30th anniversary of its establishment in Singapore, CAO has proposed a special dividend. For more, read what Lim & Tan Securities says below ... |

Excerpts from Lim & Tan Securities report

| Valuations are attractive, earnings potential ahead |

| FY23 dividends of 5.05 S cts (2.71 S cts ordinary, 2.34 S cts special) came in as a positive surprise, mainly due to the inclusion of a special dividend as part of CAO’s 30th anniversary. At a 5.6% dividend yield and 55% DPR (dividend payout ratio), we view the special dividend as a one-off and DPR going forward will likely return back to its historical average of 30%. CAO has zero interest-bearing debt and a rising cash position, from US$308mln in FY22 to US$373mln as of end-FY23. CAO remains shielded in an elevated interest-rate environment and its sizable cash pile could support acquisitions in the jet fuel and oil products ecosystem. |

SPIA – a key earnings contributor.

Contributions from 33%-owned Shanghai Pudong International Airport Aviation Fuel Supply Company Ltd (SPIA) jumped 63.7% yoy to US$31.5mln in FY23.

|

CHINA AVIATION OIL |

|

|

Share price: |

Target: |

The rebound in international travel was more pronounced in the second half of 2023, which saw a 158.4% upsurge in 2H23 earnings to US$22.7mln.

SPIA is the sole supplier of jet fuel for the second largest airport in the PRC, handling the procurement, sales, transportation, storage and refuelling of jet fuel.

SPIA is a major earnings contributor and given its 47% drop in earnings since the pandemic, we see runway for outperformance in 2024 as China enters a post-Covid world.

CAAC estimates China’s international air travel market to hit 80% of pre-Covid levels by the end of 2024 and the market view is that a full recovery by the end of 2025 is possible.

China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.Capitalized at S$769.9mln, CAO trades at 7.9x FY24F P/E and 0.6x P/B. China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.Capitalized at S$769.9mln, CAO trades at 7.9x FY24F P/E and 0.6x P/B.After several years of a weakened aviation industry, CAO is expected to see an increase in jet fuel supply volumes and earnings growth ahead. We have lifted our previous FY24F profit estimates by 10% to account for stronger jet fuel demand, translating into 23% earnings growth for FY24F. Maintain BUY with a higher target price of S$1.24, pegged to 11.0x FY24F P/E (10% discount to 5-year average P/E of 12.3x). |