| Generally speaking, returns from the stock market are likely to be modest in 2024, according to UOB Kay Hian. It said the muted outlook next year arises from "concerns over inflation and higher-for-longer interest rates". Still, there are stock picks that can do well, it said. "While we forecast a modest 2.4% EPS growth for 2024, we nevertheless see a number of stocks within our universe that should deliver strong returns, backed by sustainable dividend yields." |

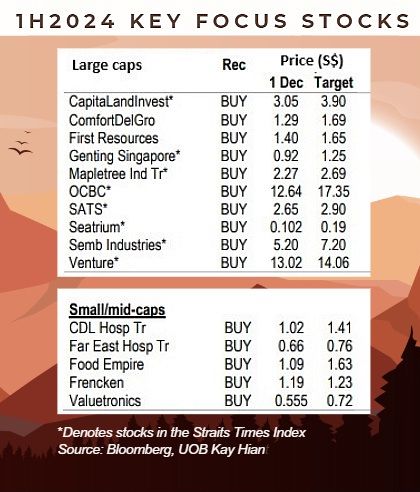

UOB KH in a report today titled Searching For Golden Needles In The Haystack said: "We highlight our focus list of 15 stocks which we believe will generate above-normal returns in 1H24."

"Our top large-cap picks are CapitaLand Investment, ComfortDelGro, First Resources, Genting Singapore, Mapletree Industrial Trust, OCBC, SATS, Seatrium, Sembcorp Industries and Venture Corp."

"We believe that investors should focus on stocks that have revenue certainty over the next 6-12 months and trade at reasonable valuations and look for yield protection.

"Invariably, quality companies like those listed below have strong business resilience that should enable them to withstand an economic downturn and yet be well placed to take advantage of a rebound post-recession."

a) Revenue certainty: CapitaLand Ascott Trust, ComfortDelGro, Genting Singapore, Mapletree Logistics Trust, OCBC, Sembcorp Industries, Yangzijiang Shipbuilding. MacCoffee is a top-selling brand of Food Empire.b) Technology focus: AEM, Aztech, Frencken, UMS, Valuetronics. MacCoffee is a top-selling brand of Food Empire.b) Technology focus: AEM, Aztech, Frencken, UMS, Valuetronics.c) Cashed-up companies: Singapore Airlines (SIA), Genting Singapore, Yangzijiang Shipbuilding. d) Laggard plays: City Developments, REITs with foreign assets, Venture, Lendlease REIT, Thai Beverage, Seatrium. e) Small/mid caps with earnings power: CDL Hospitality Trust, Far East Hospitality Trust, Food Empire. |