|

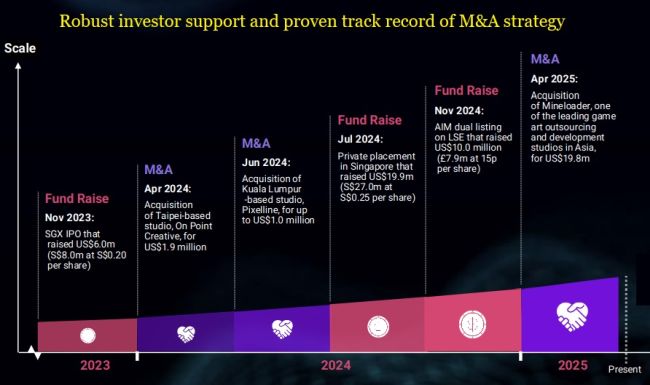

Singapore-headquartered Winking Studios (AIM/SGX: WKS), a leading AAA game art outsourcing and development firm, reported strong first-half results for 2025, underscoring resilience in the global gaming sector. A one-of-a-kind company on the SGX which listed on Catalist in 2023, Winking specializes in creating high-quality, premium video game content. |

Below are key 1HFY2025 financial metrics of Winking which, by the way, is 64.2% owned by Acer Group, a stake achieved through a combination of its pre-IPO stake, an investment during the 2023 IPO, and share acquisitions in 2024 and during the 2024 AIM listing:

|

US$’m, unless stated |

1H2025 |

1H2024 |

Change (%) |

|

Revenue |

19.4 |

15.2 |

+27.3 |

|

Gross Profit |

5.9 |

4.2 |

+38.2 |

|

Gross Margin (%) |

30.2 |

27.9 |

+2.3 pp |

|

Adjusted EBITDA |

2.4 |

2.1 |

+17.9 |

|

Adjusted EBITDA Margin (%) |

12.6 |

13.6 |

-1.0 pp |

|

EBITDA |

2.2 |

1.8 |

+18.3 |

|

Adjusted Net Profit |

1.4 |

1.1 |

+21.1 |

|

Net Profit |

0.9 |

0.9 |

+2.0 |

|

Cash & Equivalents + Bonds |

27.1 |

41.3 |

-34.4 |

|

Debt |

0 |

0 |

- |

Net profit edged up 2% to US$0.9 million, while adjusted net profit grew 21.1% to US$1.4 million, highlighting underlying strength after one-off expenses like share-based compensation and fees related to its Nov 2024 listing on AIM.

Segment-wise,

| • Art outsourcing—82.1% of revenue. This segment grew 25.9% to US$15.9 million on orders from China, the US, and Malaysia. (In this segment, Winking is delegated tasks involved in creating visual and artistic components of video games) • Game development jumped 36.8% to US$3.4 million, driven by demand in China and Australia. • Global publishing and other services dipped 33.3% to US$0.07 million, a minor segment. |

Geographically, Mainland China and Hong Kong led at 39.1% of revenue (up from 33%), but diversification efforts shone through with US revenue up 53.2% to US$2.9 million.

The company ended the period debt-free with US$27.1 million in cash and bonds, down from US$41.3 million due to the Mineloader deal, supporting further M&A.

CEO Johnny Jan emphasized M&A as a growth engine, noting ongoing talks in the UK and Europe.

Headcount expanded from 1,312 to 1,405 by July, with plans for Vertic Studios—a high-end art brand—in 2H2025.

A US$49.4 million project pipeline over 24 months (US$18.4 million for 2H2025) signals confidence, backed by involvement in 12 of Tencent's "evergreen" titles and next-gen consoles like Switch 2.

Outsourcing trends, post-COVID efficiencies, and AI exploration position Winking well, though rising administrative costs (up 57.9% to US$4.3 million) from acquisitions are a concern. |

|||||||||||||||||

See Winking Studios' PowerPoint deck here.