| AEM Holdings, being a semiconductor testing company, has a manufacturing facility in Penang, dubbed the Silicon Valley of the East, for several years. Early this year, Singapore-listed AEM (market cap: S$1.1 billion) officially opened a new facility 10X bigger than its previous one in the Malaysian state. The 365,000-sq-ft site hosts assembly, quality assurance, warehouse, and R&D functions. "It allows us to scale testing and handling capabilities to meet the growing demand for new semiconductor devices," says AEM. The Penang facility is by no means the only one that AEM has. Its other facilities are in Indonesia (Batam), Vietnam (Ho Chi Minh City), China (Suzhou), and Finland (Lieto).  Visiting new Penang plant in Jan 2023 (L-R): AEM non-executive chairman Loke Wai San, Penang Chief Minister Chow Kon Yeow and AEM CEO Chandran Nair. Photo: Company Visiting new Penang plant in Jan 2023 (L-R): AEM non-executive chairman Loke Wai San, Penang Chief Minister Chow Kon Yeow and AEM CEO Chandran Nair. Photo: Company |

AEM's investment in Malaysia, in addition to its trail-blazing success in the semiconductor industry, may have attracted the attention of Malaysia's Employees Provident Fund (EPF) Board, which manages the compulsory savings plan and retirement planning for private sector workers in the country.

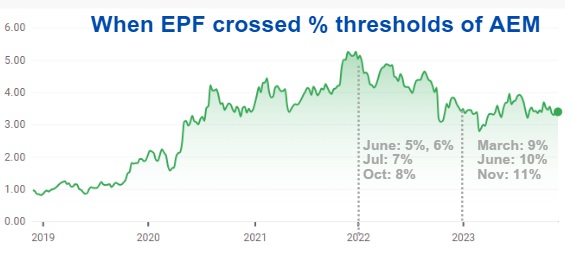

In June 2022, the EPF emerged as a substantial shareholder of AEM when it crossed the 5% threshold through open-market purchases of the stock (see chart).

Since then, it has accumulated more shares, reaching 11.1% with its purchase of 564,500 shares at an average price of S$3.35 per share on 10 Nov.

Its current holding of 34.43 million shares is worth approximately S$115 million. But there's not much of a profit, if any, to show, as AEM's stock has been weak amid a semiconductor downcycle.

At 11.1%, EPF's holding is almost neck to neck with the 12.5% held by Temasek Holdings, a global investment company owned by the Government of Singapore.

Temasek is the No.1 shareholder of AEM. For EPF to overtake Temasek, all it takes is just another S$15 million or so -- which amounts to loose change in the grand scheme of things.

But then, does it matter who is No.1 shareholder? Maybe not, maybe EPF can get a board seat if EPF so wishes.

Temasek's Russell Tham seats on AEM's board as a non-executive, non-independent director, bringing with him experience in the semiconductor industry as former President of Applied Materials Southeast Asia.

Temasek's equity interest in AEM started back in August 2021 when it approached AEM to buy a stake.

AEM agreed, issuing 26.8 million new shares for S$103.1 million, which instantly vaulted Temasek up to the No.1 position.

Since then, Temasek has bought more from the open market, raising its stake to 38.6 million shares (or a 12.5% stake).  Screenshot of March 2023 data on substantial shareholders -- there are only 3 -- from AEM's FY2022 annual report.

Screenshot of March 2023 data on substantial shareholders -- there are only 3 -- from AEM's FY2022 annual report.

At No.3 position is yet another fund manager that is similarly keen on the future prospects of AEM -- abrdn plc, a United Kingdom-based global investment company listed on the London Stock Exchange.

It too has been raising its stake this year (to 10.05%), taking advantage of weakness in the stock owing to a semiconductor cycle downturn.

9M 2023 was rough for AEM: Pre-tax profit before exceptionals was S$42.6 million (including exceptionals, pre-tax profit was S$10.1 million) compared to S$152 million in 9M2022.

It has guided for a much stronger 2024 outlook, especially from 2H. Its longer term prospects continue to be robust.

Chandran Nair, CEO, AEM."There's only one company in this world that has over 1,000 testers that deal with system level tests running 24/7 -- and that's us." Chandran Nair, CEO, AEM."There's only one company in this world that has over 1,000 testers that deal with system level tests running 24/7 -- and that's us." |