|

Excerpts from DBS report

• Intel set to build multi-generations of custom data center and client CPUs in partnership with NVIDIA

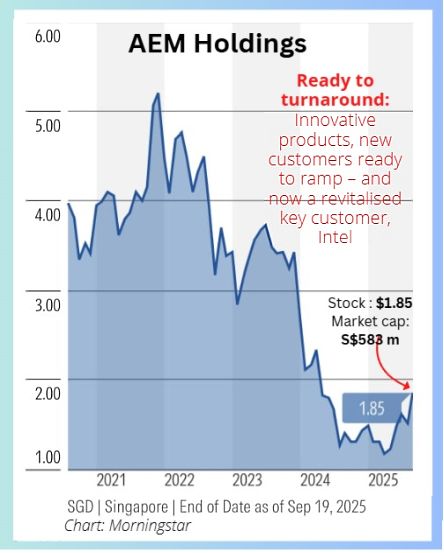

• Implications for AEM while net positive in the medium term, will be subject to volume growth and ramp-up timing • Maintain BUY with TP SGD2.10. |

||||

| Intel-NVIDIA collaboration improves ... |

Intel-NVIDIA collaboration improves Intel’s competitiveness and reinforces AEM’s outlook. For data centers, Intel will build custom x86 CPUs that Nvidia will integrate into its AI infrastructure platforms.

For personal computing, Intel will build x86 system on chips that integrate Nvidia RTX GPU chiplets.

In addition, the substantial USD5bn equity investment by Nvidia in Intel, is a strong vote of confidence in Intel’s long term outlook and provides capital to accelerate execution of its roadmap, in our view.

Together, these developments should strengthen Intel’s positioning in the x86 market, supporting its turnaround story and creating downstream demand for testing, where AEM is the plan of record provider for Intel’s testing and stands to benefit from higher test requirements.

| Implications for AEM are positive, though ... |

Implications for AEM are positive, though we note the benefit will be volume dependent and subject to ramp-up timing.

SAMER KABBANI, 51 SAMER KABBANI, 51• Joined AEM in 2020 as Chief Technology Officer. • In 2022, appointed President (in addition to being Chief Technology Officer). • Current AEM stock holding: 455,399 ordinary shares; 1,017,979 restricted shares |

The extent of the uplift will hinge on production scale and the speed of execution, but we believe the outlook for the group brightens.

If Intel successfully scales up on these new architectures with Nvidia, AEM could see higher demand for test equipment and consumables.

While no product release timelines have been disclosed, there could be a time lag as new designs are qualified and production ramps, suggesting the impact on AEM will be more visible in the medium term.

Nonetheless, given NVIDIA’s scale in the data center market, the collaboration is likely to be meaningful, and particularly relevant for AEM once the current non-cancellable purchase orders with Intel are fully drawn down through FY27.

There could also be additional upside if the partnership were to extend to NVIDIA outsourcing chip manufacturing to Intel Foundry, which would drive further demand for AEM’s solutions, though there is currently no indication that Foundry involvement will materialise.

Maintain BUY, TP SGD 2.10.

See more on the Intel Foundry angle: AEM and Intel Foundry Partner to Bring Next-Gen Chip Tests to New Customers See more on the Intel Foundry angle: AEM and Intel Foundry Partner to Bring Next-Gen Chip Tests to New Customersand... AEM: Flat 2025 Outlook, but New Customers' Ramp Sets Stage for FY26 Growth |