Medtecs' range of personal protective equipment. Image: Company

Medtecs' range of personal protective equipment. Image: Company

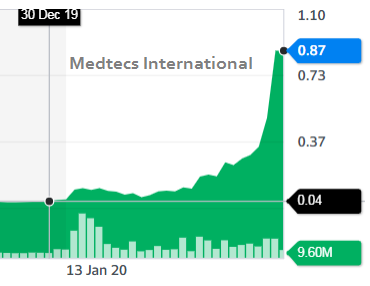

Medtecs International's share price has surged spectacularly this year as Covid-19 drove demand for its products.  Medtecs currently has a market cap of S$478 million. Chart: Yahoo!From 4 cents at the start of the year, the stock closed at 87 cents last week. (In Taiwan, the TDR of Medtecs closed at 23.40 NTD, or S$1.10)

Medtecs currently has a market cap of S$478 million. Chart: Yahoo!From 4 cents at the start of the year, the stock closed at 87 cents last week. (In Taiwan, the TDR of Medtecs closed at 23.40 NTD, or S$1.10)

The breathtaking run-up has been buoyed by demand for its products which is global and intense amid a once-in-a-century pandemic.

Still, investors have nagging worries: Is the industry increasingly seeing large additional supply coming online?

Won't demand take a dive when Covid-19 is finally tamed (but the infection curve is still far from flattening especially in the US where the Trump administration has bungled big-time)?

Yet another concern: Is personal protective equipment (PPE) commodity-like? Are products from competing suppliers highly similar?

Is there scope for product differentiation?

Some insights to the last two questions, notably, were given at Medtecs' AGM on 19 June 2020, when the Chairman spoke about his company's "branding" and the "high trust level" it has achieved with customers.

The following comes from the AGM minutes:

| Branding: The Chairman highlighted that “Trust" is the key where a supplier and a buyer decide to close a deal in the current economic climate. The Company has been around for more than 30 years and has established production lines in Taiwan, the Philippines, and Cambodia. It was noted that the Company had served many reputable medical institutions in Taiwan and the Philippines and had been listed on the stock exchanges in Singapore and Taiwan.

Indirectly, the Company had built its brand awareness in the new markets and formed alliances with different industries to create further value and generate more revenue. |

Medtecs has been operating in Cambodia since 1999 and employs 5,500 people at its Kampong Cham factory, with 82% of the workforce composed of female workers. Photo: Company

Medtecs has been operating in Cambodia since 1999 and employs 5,500 people at its Kampong Cham factory, with 82% of the workforce composed of female workers. Photo: Company

Coincidentally, on 9 July 2020, the Asian Development Bank put out a press release about its purchase of PPE from various suppliers but singled out Medtecs.

Wouldn't getting a contract from a blue-chip customer like the ADB be reflective of Medtecs' brand and high quality?

ADB said that as of end-June 2020, it had procured and awarded US$15 million of contracts with various suppliers of PPE, testing kits, diagnostics equipment, lab reagents, and other critical items to fight the disease.

| "Medtecs Group was one of the suppliers selected through the competitive procurement process conducted by PPFD* and was awarded a contract for $5 million to produce protective gowns, coveralls and shoe covers to be distributed to frontline health workers in 11 developing member countries." -- Asian Development Bank (* Procurement, Portfolio, and Financial Management Department of the Asian Development Bank) See ADB press release here. |

| Medtecs' business strategy, as articulated in an AGM Q&A, seeks to be sustainable: "We have decided not to increase output with large capital expenditures, but instead have chosen to augment our production capacity with cost-effective alternatives "... for items that we do not or cannot produce at short notice, but which are sought after on an urgent basis, we have actively sourced the items from reputable suppliers so as to meet the demand of our clients." See more : » MEDTECS: 2H20 profit growth will be "at least on par" with 1H20 » Which company had words "vigilance against pandemics" in its annual report every year? |