Katrina Group listed on SGX Catalist on 26 July 2016 at an IPO price of S$0.21 per share. It has done well since, trading at 33.5 cents recently.

Excerpts from analyst's report

DBS Vickers analyst: Alfie Yeo

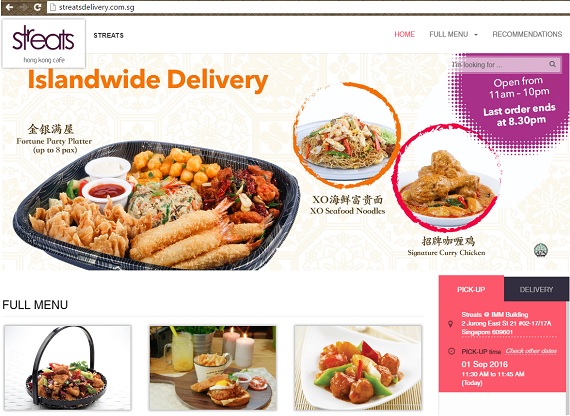

Katrina has web portals for online food order and delivery for its Bali Thai, Streats and So Pho restaurants. Katrina has web portals for online food order and delivery for its Bali Thai, Streats and So Pho restaurants.

3-Pronged growth strategy Katrina aims to grow into a regional F&B foodservice player, penetrating Malaysia, Indonesia and Vietnam while securing a strong foothold in the Singapore market with more stores and online sales.

Online business set to grow Katrina’s recent deal to place all nine brands’ food offerings with Foodpanda will help to expand its online business. Currently, the online business operates from three of its own web portals for Bali Thai, Streats and So Pho. Its online sales are already sizeable at S$100,000 per month, equivalent to S$1.2m per year, close to the sales of an average mid-range F&B restaurant in Singapore. We expect increase in online business to enhance overall margins going forward.

Project 13-17% growth for FY17-18F. We project double digit earnings growth throughout our forecast period. This will be driven by slight margin expansion as the online business grows, more store openings, and regional expansion plans. Our projections are consistent with its target to reach 60 stores by 2019, and improving annual sales per store towards industry average for Casual Dining and China full-service restaurants.

Initiate with BUY and S$0.43 TP The stock currently trades at an undemanding 13.3x FY17F PE, below regional peer average of 20x. Due to its relatively smaller size and lack of overseas presence compared with leading F&B companies in Singapore, we peg our valuation of Katrina at 18x FY17F PE, a 10% discount to peer average. Delivery of growth expectations could potentially re-rate the stock. Initiate with BUY call for 36% upside, target price 43cts.

|

||||

| ♦ 43-cent Target Price |

|

"Initiate with BUY call for 36% upside, target price 43cts."

-- Alfie Yeo, |

Katrina is a F&B Restaurant brand owner and operator in Singapore and China. It operates nine different F&B brands and concepts including Bali Thai, Streats, Rennthai, Bayang, Muchos, So Pho, Indobox, Hutoang and Honguo, serving mainly Indonesian, Chinese, Mexican and Vietnamese cuisines.

- Targets 60 stores by 2019

It has 34 stores including two in China and targets to reach 60 stores by 2019. Store growth will mainly be driven by its three key brands Bali Thai, Streats and So Pho both in Singapore and regionally. This is in line with its aim to become a regional player offering various dining concepts. - Aims to be a regional player

It endeavours to grow regionally in Malaysia, Indonesia and Vietnam. It aims to satisfy the growing appetite for alternative cuisine and modern dining concepts in these markets and aspires to ultimately become a provider of various dining concepts regionally through its key brands. - Growing though online channels

It has an established and fast-growing online business and has recently positioned itself to grow further through its cooperation with Foodpanda. It is currently well positioned to benefit from the growing demand for foodservices in the online channel.

Challenges

- Concentrated in Singapore

Katrina is mainly a Singapore business, with only two stores in China. Almost all of Katrina’s FY15 revenue is concentrated in Singapore. Overseas plans are only beginning to be executed. Prospects are largely tied to the Singapore economy’s appetite for mid- to high-end foodservice consumption. - Ability to lease new premises or renew existing leases

Securing leases for store space is crucial for Katrina’s operations. Non-renewal of leases will mean relocating to new premises and potential loss of regular customers.

For full report, click here.

"Due to its relatively smaller size and lack of overseas presence compared with leading F&B companies in Singapore, we peg our valuation of Katrina at 18x FY17F PE, a 10% discount to peer average. Delivery of growth expectations could potentially re-rate the stock.

"Due to its relatively smaller size and lack of overseas presence compared with leading F&B companies in Singapore, we peg our valuation of Katrina at 18x FY17F PE, a 10% discount to peer average. Delivery of growth expectations could potentially re-rate the stock.