OSK-DMG says S'pore will roar in 2014 and names its top stock picks

Terence Wong, CFA, research head, OSK-DMGAnalysts: Terence Wong, CFA, and the Singapore Research Team

Terence Wong, CFA, research head, OSK-DMGAnalysts: Terence Wong, CFA, and the Singapore Research Team

In the last few years, clients have been commenting that the Singapore market has little to offer. Many funds had underweighted Singapore, which on hindsight was a good move.

Between 2010 and 2013, Indonesia, the Philippines and Thailand roared ahead with total gains of 72-103%. Singapore, on the other end of the scale, eked out gains of a mere 10% in four years, not enough to beat the inflation rate.

Even Malaysia, which is largely seen as a defensive market, has done way better than Singapore.

Terence Wong, CFA, research head, OSK-DMGAnalysts: Terence Wong, CFA, and the Singapore Research Team

Terence Wong, CFA, research head, OSK-DMGAnalysts: Terence Wong, CFA, and the Singapore Research TeamIn the last few years, clients have been commenting that the Singapore market has little to offer. Many funds had underweighted Singapore, which on hindsight was a good move.

Between 2010 and 2013, Indonesia, the Philippines and Thailand roared ahead with total gains of 72-103%. Singapore, on the other end of the scale, eked out gains of a mere 10% in four years, not enough to beat the inflation rate.

Even Malaysia, which is largely seen as a defensive market, has done way better than Singapore.

Indeed, Singapore stock market prospects seemed to have dimmed compared to other parts of Asean and investors have been flocking to other markets in the world that look more appealing.

In 2013, while the regional markets flat-lined, the US markets charted new highs. During the 4-year period, the total returns for the US markets were at least five times better than Singapore’s.

In 2013, while the regional markets flat-lined, the US markets charted new highs. During the 4-year period, the total returns for the US markets were at least five times better than Singapore’s.

In view of the country’s sound fundamentals, reasonable valuations and the prospect of Singapore being a safe haven, we are staking our bets on the Singapore stock market making a comeback in 2014.

Flight to safety: Stable politics and currency. Politics will be a key factor influencing some of the regional markets, particularly Indonesia and Thailand.

Indonesia will be holding its elections next year, while Thailand - also due to hold its polls in February 2014 - is currently facing a political quagmire that can potentially cripple growth, as seen in 2010.

Indonesia will be holding its elections next year, while Thailand - also due to hold its polls in February 2014 - is currently facing a political quagmire that can potentially cripple growth, as seen in 2010.

Given the region’s less stable political environment and the US Federal Reserve (Fed)’s quantitative easing (QE) possibly dealing a blow to the currencies of the emerging markets in the ASEAN region, the SGD is likely to be the last bastion of strength and stability in the region.

The strong Singapore dollar should attract foreign funds that have parked their money in other ASEAN markets.

The strong Singapore dollar should attract foreign funds that have parked their money in other ASEAN markets.

The STI is trading at a 13.2x forward P/E, which compares favourably against the 5-year average of 14.2x. In terms of P/BV, the STI is trading at 1.3x, below the 5-year average of 1.44x.

Ong Pang Aik, executive chairman of Lian Beng Group, has been a regular buyer of his company's shares.

Ong Pang Aik, executive chairman of Lian Beng Group, has been a regular buyer of his company's shares.

NextInsight file photo

Ong Pang Aik, executive chairman of Lian Beng Group, has been a regular buyer of his company's shares.

Ong Pang Aik, executive chairman of Lian Beng Group, has been a regular buyer of his company's shares. NextInsight file photo

Small caps rock! While the blue chips are expected to deliver decent returns, what looks more interesting are the small caps.

The small caps under our coverage are currently trading at 9x FY14 P/Es and are enjoying growth rates exceeding 20%, vs the large caps’ 14x and mid caps’ 15x FY14 P/Es.

Construction sector and S-chips, both of which are largely in the small caps space, should see a pickup in investor interest.

The small caps under our coverage are currently trading at 9x FY14 P/Es and are enjoying growth rates exceeding 20%, vs the large caps’ 14x and mid caps’ 15x FY14 P/Es.

Construction sector and S-chips, both of which are largely in the small caps space, should see a pickup in investor interest.

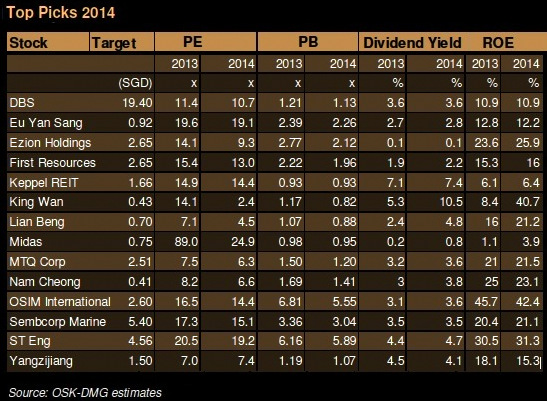

Our Top Picks are DBS, Ezion, Eu Yan Sang, First Resources, Keppel REIT, King Wan, Lian Beng, Midas Holdings, MTQ, Nam Cheong, OSIM International, Sembcorp Marine, ST Engineering, and Yangzijiang.

Recent stories:

LIAN BENG: Directors pump millions in insider buying in 2013

Recent stories: