Analysts: Nancy Wei & Stella Tan

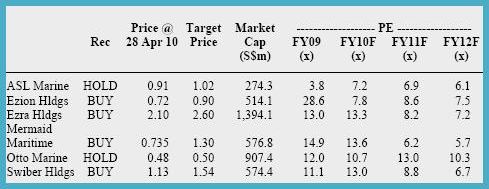

Long offshore contractors and vessel owners. In the offshore contractor and vessel owner space, we initiate coverage on Ezion Holdings (BUY/Target: S$0.90), Mermaid Maritime (BUY/Target: S$1.30) and Swiber Holdings (BUY/Target: S$1.54).

We maintain our recommendation for Ezra Holdings (BUY/Target: S$2.60), but lower our target price to S$2.60 on the back of valuation adjustments to ensure uniformity across the sector. We are neutral on shipyards, and initiate coverage on Otto Marine (HOLD/Fair: S$0.50) and re-initiate coverage on ASL Marine (HOLD/Fair: S$1.02).

UOB Kay Hian's $1.30 target price for Mermaid has the highest upside potential.

Bottom-up strategy in 2H10 for outperformance. We recommend a bottom-up strategy for oil service stocks in 2H10 on the primary premise that field development work volume is back in full swing after a dearth of contract awards in 2009. This time, however, we are fussy about asset type and expertise because we expect the weakened correlation between valuations and oil price movements to be a persistent trend.

This upcycle will play out differently to favour field development. The last oil cycle was characterised by record capital expenditures on offshore marine assets. Orders for offshore vessels placed to shipyards over the 2004 to 2007 period grew at a CAGR of 64.6%, essentially more than quadrupling from US$3.5b to US$15.6b as oil price escalated from US$30/bbl to US$100/bbl.

Oil price is back in the US$80/bbl territory, but we think this cycle will play itself out differently because we are entering this new cycle with a sizeable offshore vessel orderbook, and capital expenditures are being channelled into field development rather than exploration assets.

Mermaid chairman M.L. Chandchutha Chandratat, 43.

Discernment pays. Our top segmental picks are players in the offshore construction space because we like platform/subsea installation and maintenance contractors as direct entry points to the field development segment. For vessel owners, we segregate players according to asset type, and favour those with higher-spec and specialised vessels and also those with assets backed by long-term charters over owners of generic, smaller vessels. In our view, it is not time for entry to small-cap shipyards yet.

Stabilisation of oil price shores up capex confidence. Since bottoming out in 1Q09, oil price has rebounded back toUS$80/bbl, and has hovered within the US$70-90/bbl band for the better part of the last six months. We believe this is a level sufficiently comfortable for oil companies to become increasingly liberal with exploration and production capital expenditures.

Infield Systems estimates sanction rates (hurdle prices for development projects) at US$25-65/boe for all key project types, which would make the US$80/bbl price tag for oil a comfortable price for projects to be green-lighted.

2010 is capex recovery year. Upstream producers are restarting development projects. Our collation of selected listed upstream producers, represented by international oil companies, national oil companies and independents, corroborateswith this view. According to our list of upstream producers, capital spending is slated to rebound to US$385.2b (+23.9% yoy) in 2010. We expect the capex figures, which are consensus estimates, to be adjusted upwards further through the course of the current calendar year.

Source: UOB Kay Hian

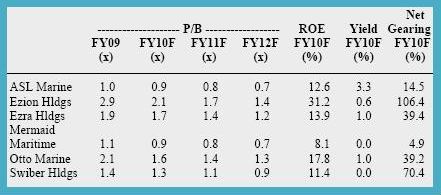

Valuations no longer in lockstep with oil price. Our analysis of segment-specific valuations indicates that while oil related stocks moved either ahead of or in line with oil price momentum in the last oil cycle, this is no longer the case. Valuations are lagging oil prices this time round, with average Fwd PEs trading at discounts of 20-60% to the last time oil price surpassed the US$80/bbl mark in 2007.

Offshore contractors have been the hardest hit, as the low level of contract awards dragged earnings down to breakeven levels during the credit crunch. In view of varying prospects for the different segments and taking into account the types of assets owned and operated by the companies under our coverage, we value offshore contractors at Fwd PE of 11.0x, based on 2-SD above historical mean, vessel owners at Fwd PE of 9.0x, based on 1-SD above historical mean, and small-cap shipyards at Fwd PE of 7.0x, at historical mean.