|

Excerpts from Evolve Capital report

Analyst: Ethan Aw

| Asset-light and well positioned for growth |

|

Investment Highlights

Although its multiples are at a premium to that of regional edible oil peers, we view this as justified by its structurally superior ROE (FY24: 35.2%), capital-efficient model, strong order book visibility and robust growth. The business is also highly scalable, as fabrication is primarily outsourced, allowing Oiltek to focus on project management and execution. More importantly, new contract wins can drive outperformance without the need for incremental capex. |

||||

• Asset-light model and low CAPEX needs. Oiltek operates an asset-light business model by specializing in the design, engineering, and sale of processing plants for edible and non-edible oil processing, rather than operating its own manufacturing facilities.

The company prepares all engineering and fabrication drawings, with components manufactured by third-party fabricators according to specifications provided by its clients. Hence, their key differentiated offering lies in their technical expertise and know-how.

• Growing orderbook with high forward revenue visibility. Since listing, the firm’s order book has consistently been on the rise, having more than doubled and reaching a peak of MYR430.9m in Jul 2024.

With projects typically completed within 18 to 24 months, this also provides solid forward revenue visibility. As of Aug 2025, its order book remained robust at MYR398.5m.

|

Stock price |

$1.01 |

|

52-wk range |

16.5 c – $1.16 |

|

Market cap |

S$433 m |

|

PE (trailing) |

43 |

|

Dividend yield (trailing) |

1.38% |

|

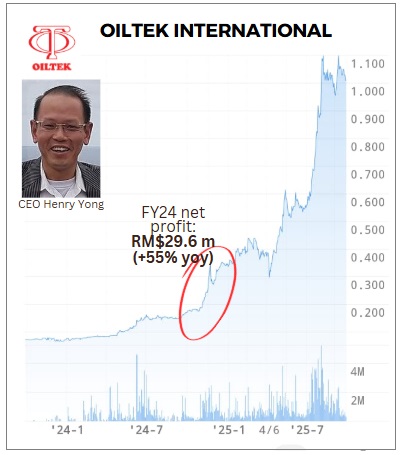

1-year return |

494% |

|

Shares outstanding |

429 m |

|

Source: Yahoo! |

|

Looking ahead, we expect initiatives in Indonesia and Malaysia to drive the next leg of growth for its renewable energy segment, though revenue growth is likely only to accelerate from FY27E onwards given project lead times of 18-24 months.

Per our estimates, we expect revenue growth to be approximately 17.1% in FY25E and 6% in FY26E, before reaccelerating to 11.7% YoY in FY27E.

• Strong net cash position supported by negative working capital cycle. Historically, Oiltek’s asset-light model has enabled it to fund growth without borrowings, allowing the company to steadily build its cash reserves, which stood at MYR111.7m as of 1H25.

Full report here.

See also: The 4 Undervalued Stocks AGT Partners Recently Scooped Up -- From Property To Vessel Operator See also: The 4 Undervalued Stocks AGT Partners Recently Scooped Up -- From Property To Vessel Operator |