Kevin Scully, executive chairman of NRA Capital, wrote the following article in a posting on his blog yesterday. It is reproduced here with permission.

THE CURRENT CORRECTION was started by sovereign risk concerns in Europe for Greece and possibly Portugal, Spain, Ireland and Italy.

This caused the VIX index to rise to almost 30 but because the quantum of the Government debt is small about US$35bn....compared to the problems of some US banks, it is clearly solvable and a rescue package is already being put together by other EU members.

The VIX index has also eased back to the 20 level over the last few weeks as the risks associated with debt problems in Europe is seen as being quite minor and unlikely to derail the Global economic recovery.

The second wave of selling came late last week off an unexpected 25 basis point hike in the US discount rate.

This is more a timing rather than a negative factor for the market. We all expected the low interest rate regime to be reversed in 2010 as the Global economic recovery gained pace.

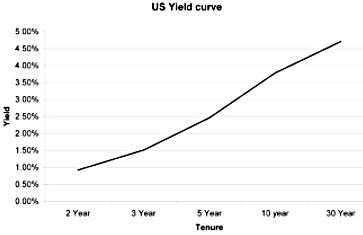

I was looking at the second quarter of 2010 so last week's hike was ahead of expectations but there was no inflationary pressure so rather than seeing it as a negative, it probably reflects a more comfortable view on the pace of economic recovery. The US yield curve (see chart below) was already priming investors for a hike in short rates.

The Singapore market seems to have had its correction, the STI Index has moved back above its 100-day moving average which seems to be a positive sign.

The second more important positive is the current results season for FY2009 earnings.

As at today, the STI index was trading at 23 times historical PER but only 14.7 times prospective earnings.

This is an improvement of 18 times prospective a few weeks ago and comes on the back of better than expected earnings and/or guidance.

The Singapore market is now looking a little more attractive and less over-priced. While I don't know how long this correction/consolidation will last, the latest fundamental data confirms that its a good buying opportunity.

So start to accumulate stocks which have met or beaten FY2009 earnings forecasts and who are giving an optimistic outlook for 2010. My preferred list of stocks can be found in my stock picks/model portfolio section.

Recent story: KEVIN's take on ... CHINA ANIMAL HEALTHCARE, JAYA HOLDINGS