This article was recently published on www.nracapital.com and is republished with permission. Kevin Scully, executive chairman of NRA Capital.I AM REMOVING Jaya Holdings from both My Stock Picks growth even though it was also a proxy for my Yield portfolio as they have now divested their core business and are in the process of paying out the proceeds as dividends.

Kevin Scully, executive chairman of NRA Capital.I AM REMOVING Jaya Holdings from both My Stock Picks growth even though it was also a proxy for my Yield portfolio as they have now divested their core business and are in the process of paying out the proceeds as dividends.

I have been looking for yield plays and at the recommendation of one of our analysts I met the founder and major shareholder of Serial Systems Derek Goh some weeks ago.

As a rule, I don’t like distribution companies because their margins are very low and these can be wiped out quite easily.

They are usually also quite highly geared as they tend to finance their customers which makes earnings very volatile. Given this they are not known to be good dividend payers.

I was therefore pleasantly surprised that in Serial we have good gross margins of around 10% and net margins of 1-2%. I mentioned to Derek my concern about receivables and that he was financing his customers about US$60-70mn at any one time.  Derek Goh, CEO of Serial, at its recent AGM.

Derek Goh, CEO of Serial, at its recent AGM.

Photo by Cheng Siew Hooi.If they didn’t or couldn’t pay, this would hit his P&L hard. He didn’t disagree but indicated that he managed to insure all his receivables which has led to a slight narrowing of his net margins but at least that has removed the risks of bad debts significantly.

I guess he was able to do this because of the quality of his customers and also because there are more than 6000 of them so that single customer risks is actually quite small. A quick look at his 2013 annual report shows that his customers are major global MNCs in the electronics space.

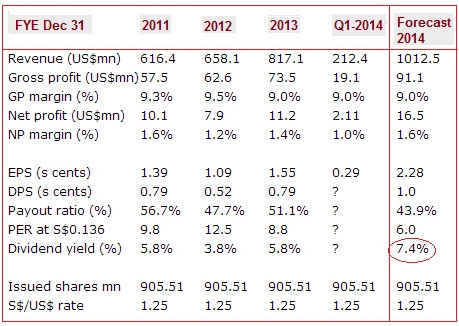

Putting my prejudices aside, I noticed that Serial has consistently been able to grow its top line at good double digit rates by entering new markets and expanding his product offering.

This has allowed his revenue to potentially exceed US$1bn in 2014 and by this sheer size and importance to his customers, he has been able to sustain and maintain his gross margins at a healthy 9-10% level.

I also noticed that he is gradually moving out of electronic distribution into other sectors which will help lessen the cyclical nature of his electronics revenue.

Snap shot of his financials/ratios:

|

Our analyst has been recommending the stock for some time but I am today adding Serial Systems to my Yield Stock Picks. Serial seems to be a nice yield play stock to accumulate at current levels which is below its NAV of S$0.148. |

Recent story: SERIAL to book $1.7 m gain, WE Holdings buys 25.5% stake in Jubilee