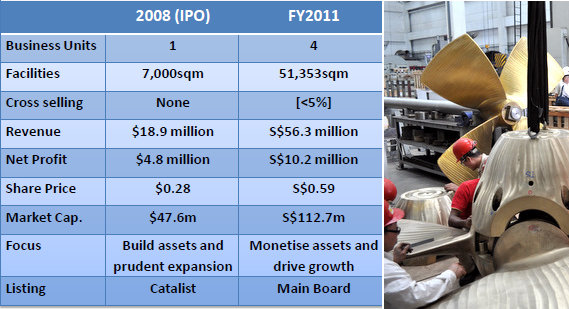

THREE YEARS after its listing in 2008, Mencast Holdings has transformed and elevated its business enough to be rewarded with a doubling in its market value.

From $47.6 million, its market cap reached $112.7 million recently.

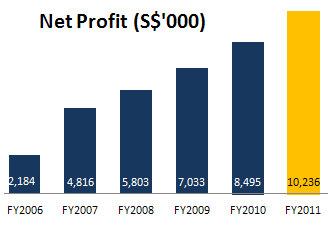

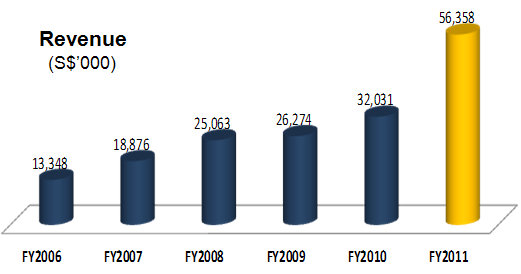

That’s supported by a big jump in net profit (from $4.8 million in FY07 to $10.2 million in FY11) and revenue (from $18.9 million to $56.3 million).

On the ground, Mencast has grown and diversified its business assets.

From 7,000 sq km of facilities, Mencast now has 51,353 sq m, largely as a result of the acquisition of a strategic waterfront (35,500 sq m) in Penjuru Road, off the Ayer Rajah Expressway.

The waterfront, which is under development, will enable Mencast to take on jobs that it previously couldn’t and on a scale it previously couldn't.

Its business used to be largely the manufacture and servicing of sterngear equipment for vessels, and was heavily dependent on new shipbuilding – which we all know is in a slump.

But through two more acquisitions last year, Mencast transformed into a maintenance, repair and overhaul (MRO) solutions provider for offshore and marine vessels.

“MRO is a time-sensitive business. By executing well, that’s how we get the margin, the branding and the trust,” said Mr Glenndle Sim, executive chairman and CEO of Mencast, at a results briefing last week.

Mencast has become a play on the oil & gas sector, as it provides services pertaining to drilling equipment, oil rigs, jack-ups, etc.

Key to that are the two acquisitions made last year:

* Top Great Engineering & Marine provides engineering design, procurement, fabrication and installation of structural and precision engineering systems.

* Unidive offers diving services for subsea inspection, repair and maintenance.

These two acquisitions contributed 51.7% of Mencast’s total revenue of $56.4 million last year.

Mencast has proposed a first and final dividend of 1.2 cent a share, up from 1.1 cent for FY2010.

UOB Kayhian analyst Tan Jun Da, who is the only one covering the stock currently, has maintained his ‘buy’ call on Mencast, with a target price of S$0.70 (previously S$0.71), representing 16.7% upside from the recent price of 60 cents.

Mencast's FY2011 net profit of S$10.2m, up 20.5% yoy, was 20.0% below UOB Kayhian’s forecast mainly due to:

a) a one-off third-party claim against a subsidiary,

b) higher rental expenses attributable to the group’s additional plot of land in Penjuru Road, and

c) higher-than-expected administrative costs arising from newly-acquired Top Great and Unidive.

Notably also, Mencast's earnings per share rose 7%, trailing its 20% net profit growth, mainly as a result of new shares issued (along with some cash payment) for the acquisitions of Top Great and Unidive.

Profit growth could turn out to be exciting, going forward, if the order book is any indication.

The order book as at end-2011 stood at $19.1 million, up by 127.4%.

Using an analogy to describe Mencast’s enhanced and diversified capabilities, Mr Sim said: “For two years, we entered a tennis training programme. Now we are trained, we have the proper mindset. This year, we enter an amateur competition. We are ready to play. Hopefully, one day, we can make it to the Australia Open or Wimbledon.”

Mencast's powerpoint presentation can be accessed at the SGX website.

Recent stories:

MENCAST: Side-steps shipping downturn with oil & gas foray

MENCAST, MERMAID MARITIME, DUKANG: Latest Happenings…