Excerpts from latest analyst reports…..

Kim Eng upgrades RAFFLES EDUCATION to a ‘buy’ and 40-c target

Analyst: Eric Ong

During our recent conference call with Raffles Education (RLS), management affirms its plan to venture into property development in China.

Despite the shift away from its core business, we see the move as being pragmatic that allows RLS to leverage on its low land cost when it acquired OUC back in October 2007. On the other hand, student enrolments are expected to remain challenging in the near‐term given the structural issues facing China’s education sector.

RLS has obtained approval from relevant authorities to convert about 280,000 sqm of land area in OUC for residential development. It is currently in talks with different interested parties to form a joint venture to co‐develop the site. Based on current achievable selling price, management is confident of generating substantial returns.

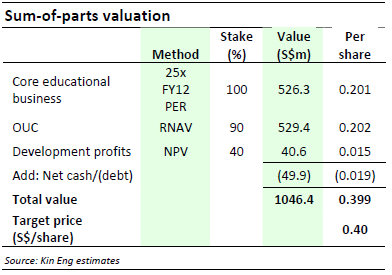

To better reflect the value of RLS’s underlying assets, our primary valuation methodology has been changed to sum‐of‐the‐parts. We are upgrading the stock to a BUY recommendation with new target price of $0.40. Potential rerating catalysts are i) successful listing of OUC and ii) faster‐than‐expected turnaround in enrolment number.

Recent story: RAFFLES EDUCATION, OKP, YONGNAM, PEC, LONGCHEER: What analysts now say.....

CIMB maintains ‘buy’ and 88-c target for PAN HONG PROPERTY

• The company announced its 3Q11 earnings. The company saw a 360.2% yoy growth in revenue.

Higher revenue was attributable to more residential units sold in Nanchang Honggu Kaixuan Phase 2, Hua Cui Ting Yuan Phase 1 and Hangzhou Liyang Yuan and commercial units sold in Huzhou Liyang Jingyuan Phase2 and Nanchang Honggu Kaixuan.

• The company saw an improvement in gross profit margin due to the different mix of units sold in 3Q11 which comprised of a larger proportion of commercial units.

• Higher revenue saw an increase in net profit of 118.8%yoy to RMB125.4m in 3Q11.

• Pending review, we maintain our Buy recommendation at a Target Price of S$0.88.

Recent story:PAN HONG: CIMB maintains 'Buy' rating and 88ct target post 2Q11 update

OCBC maintain ‘buy’ and $2.36 target for YANGZIJIANG SHIPBUILDING

Analyst: Low Pei Han

Yangzijiang Shipbuilding (YZJ) recently announced that its subsidiary has entered into an agreement with four other companies to establish a JV that will provide marine electrical systems for shipbuilding of commercial vessels and marine engineering projects.

Though we are not expecting a significant impact on earnings in FY11, we think this development should not be viewed in isolation but together with recent initiatives.

YZJ has undertaken a series of acquisitions and collaborations since early 2010, and like recent initiatives, huge emphasis will be placed on R&D as the group seeks to broaden its product offering and scale up the value chain. The group looks on track in its strategic initiatives.

Meanwhile, we do not think that YZJ is done with its acquisition spree, especially with it still sitting on RMB4.7b cash and cash equivalents (excl. restricted cash) as at 30 Sep 2010. Maintain BUY with S$2.36 fair value estimate.

Recent story: YANGZIJIANG: Credit Suisse and CIMB maintain ‘Outperform’ after shipyard secures US$415 million of contracts