ONE OF THE facts that jump out of Mencast Holdings’ 1H results announcement is that its net profit margin was a hefty 31.7%. Its gross margin was 56.4%, a record for the company.

Such margins are usually associated with niche service businesses, among others, and this is the case with this relatively unknown company.

One of the two business divisions of Mencast reconditions sterngear equipment of ships, and repairs worn-out or damaged sterngear equipment.

Glenndle Sim, chairman and CEO, Mencast.

Glenndle Sim, chairman and CEO, Mencast. Photo: Leong Chan Teik

This division contributed $8.4 million to 1H revenue. Mencast’s other division, sterngear manufacturing, contributed a lower amount of $6.7 million.

Though the company didn’t give figures, clearly the service division commanded a higher profit margin than the manufacturing side.

Mencast chairman and CEO Glenndle Sim told an analysts’ briefing on Wednesday (Aug 18) that the outlook for sterngear manufacturing is weak, reflecting the weak shipbuilding industry.

As of end June this year, Mencast’s orderbook for manufacturing is S$8.2 million which will be fulfilled by 1Q next year.

However, its sterngear services are seeing increased demand as the global ship fleet has enlarged significantly in recent years.

Mencast services ships that dock at Marco Polo Marine, Drydocks and ASL Marine yards in Batam.

Aside from individual ships, Mencast is venturing into managing fleets. A good start was made recently when it signed on PSA to manage its 36 pilot boats for 2 years.

Mencast’s Mr Sim says a key competitive edge of the company is that it is an approved workshop that meets the requirements of a wide range of classification societies that cover a wide range of ocean-going vessels.

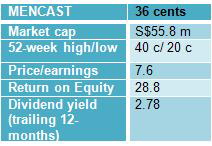

Source: Bloomberg

Source: Bloomberg

Simply put, a ship’s sterngear equipment that goes through Mencast will have the necessary approval for it to be deemed seaworthy and the ship can be allowed to sail.

The company is in the midst of constructing a manufacturing plant on leased waterfront in Tg Penjuru Road. Its site area of 19,266 sqm is nearly 2X as large as the current operations area of Mencast.

When ready next year, the new site will enable Mencast to target bigger vessels as it will manufacture heavy rudder assemblies and high-end sterngear equipment.

CIMB analyst William Tng yesterday maintained his ‘buy’ recommendation and target price of S$0.45, still based on 10% discount to CY11 sector average P/E of 7.8x.