|

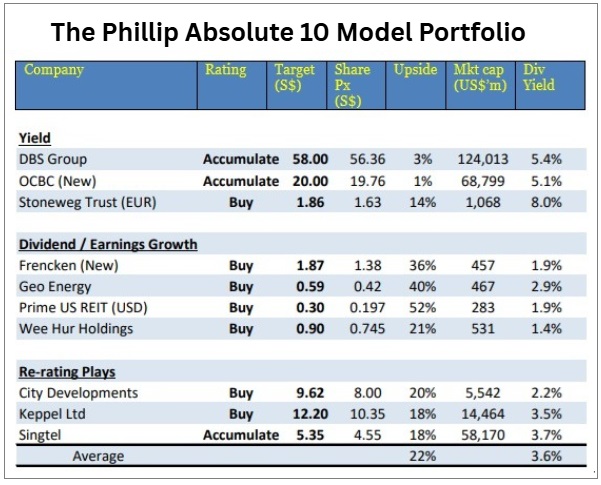

Singapore’s stock market has entered 2026 with strong momentum, helped by lower interest rates, resilient domestic activity and renewed interest in small and mid-cap ideas. Geo Energy is a way to play coal-linked cash flows with an emerging infrastructure toll-road angle; Frencken is a geared, but diversified, way to ride the next wave of semiconductor and industrial investment; and Wee Hur is a direct beneficiary of Singapore’s elevated construction pipeline and ongoing worker-dorm shortage. |

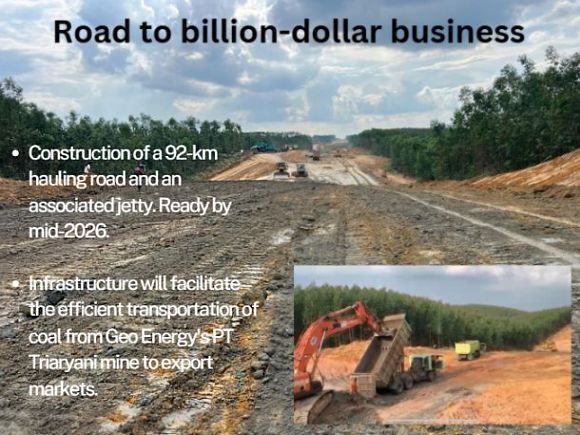

| Geo Energy: coal miner turning infrastructure owner |

The Geo Energy note authored by Paul Chew is titled “Banner year expected in 2026,” signalling how pivotal the coming 12–18 months could be.

He notes that “construction of the new 92km US$190mn hauling road and jetty in Sumatra is progressing to schedule… currently 50% completed,” with the road “on track to be completed by mid‑2026."

Crucially, the analyst sees this as a step-change in the business model: “The completion of the hauling road is a major earnings driver for Geo. We view the company as an infrastructure company, with toll collection and barging fees as new sources of earnings. 2026 will be the pivotal year following the completion of the integrated infrastructure.”

He spells out four earnings levers:

-

Raising coal mine production “from the current 11mn to gradually hit 25mn by FY29e.”

-

New toll revenue from other miners for usage of the road’s 25m MT extra capacity.

-

River transhipment fee from tugs and barges to be acquired.

-

Potential asset monetisation from partial sale of the entire infrastructure.

While coal prices have been weak in 1H2025, the report notes that the Indonesia 4,200 kcal benchmark “bottomed in July at around US$41 before recovering to currently US$46 per MT,” and expects prices to be “stable, depending on weather conditions and inventory levels in China.”

The stock is rated BUY with a DCF-based target price of S$0.59.

| Frencken: leveraged to the next leg of semi capex |

Within the electronics section, Phillip analyst Ben Yik flags that “Frencken guided for temporary demand softness in 1H26e because of longer EUV lead times and pull-in of China demand in 2024.”  Frencken CEO Dennis AuThis acknowledges that the semiconductor equipment cycle is not in a straight-line uptrend.

Frencken CEO Dennis AuThis acknowledges that the semiconductor equipment cycle is not in a straight-line uptrend.

However, the analyst stresses that its medical and industrial automation segment’s growth is expected to offset this temporary slowdown, due to strong demand for its medical and data storage products.

Valuation is a key part of the thesis: “Frencken trades at an attractive 15x one-year forward PE, compared to its peers’ average of 27x forward PE,” and is rated BUY with a target price of S$1.87.

In the construction chapter, the sector is rated OVERWEIGHT, with the analysts pointing out that “construction output grew 8% YoY in the first 10 months of 2025,” supported by a “healthy pipeline of construction projects awarded.” Wee Hur is his preferred small-cap in the space: “We expect Wee Hur’s S$629mn construction order book and a 67% increase in worker dormitories capacity (10,500‑bed Pioneer Lodge by 2025e) to drive its 2026e revenue/PATMI growth.” |

Read the Phillip Securities report here.