|

|

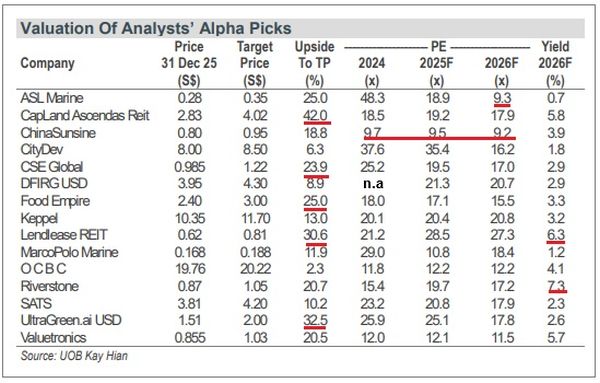

The full table is here.

The full table is here.

1. Growth at a Discount: ASL Marine & China Sunsine

The 2026F PE for ASL Marine is 9.3X. Despite a clear earnings recovery and rising vessel utilization, the stock trades at a 25% discount to its peers.

The company continues to deleverage and capture robust shiprepair demand.

Similarly, the entire PE range (2024–2026F) for China Sunsine is at less than 10x.

With a dominant 75% market share in supplying rubber chemicals to top global tyre makers and a new 40% minimum dividend payout policy, analysts see Sunsine as a high-visibility growth play trading at an attractive entry point.

2. The Yield Giants: Riverstone & Lendlease REIT

For income-focused investors, the 7.3% 2026F yield for Riverstone is a highlight. Riverstone's executive chairman Wong Teek Son

Riverstone's executive chairman Wong Teek Son

Backed by a debt-free balance sheet and RM661m in net cash, Riverstone is riding a "cleanroom-led recovery" fueled by AI and semiconductor demand.

This yield is considered superior to industry peers, offering both income and a discounted valuation.

Lendlease Global Commercial REIT also stands out with 6.3% 2026F Yield.

Analysts are bullish on its "precinct dominance" in Singapore, particularly with the acquisition of a 70% stake in PLQ Mall, which is expected to boost DPU significantly.

3. Big Upside Potential: CLAR & UltraGreen.ai

-

CapitaLand Ascendas REIT (CLAR): At 42.0% upside, it is the highest in the UOB KH portfolio.

Analysts view CLAR as a prime beneficiary of preferential tariffs and are particularly keen on its recent acquisition of a Tier 3 data centre in Singapore, which offers immediate rental uplift potential. -

UltraGreen.ai: This market leader in surgical imaging shows a 32.5% upside. As the world’s largest supplier of indocyanine green (ICG) with 85% gross margins, its growth is being fueled by the rapid global adoption of fluorescence-guided surgery.

4. The Valuation Gap: Food Empire

Analysts reckon there is 25% upside for Food Empire rooted in a record-breaking performance where 3Q25 revenue surged 28% year-on-year.  Executive Chairman Tan Wang Cheow and CEO Sudeep Nair at the opening of Food Empire's new HQ in Tampines in 2025.

Executive Chairman Tan Wang Cheow and CEO Sudeep Nair at the opening of Food Empire's new HQ in Tampines in 2025.

Despite record revenues, FEH trades at a 33% discount to its regional peers.

Strong brand equity has allowed for effective pricing and resilient demand across its core markets in Russia, Southeast Asia, and South Asia.

5. Amazing Amazon Catalyst: CSE Global

|

The UOB KH report is here.