Maybank Research's 12 Jan note provides a comprehensive investment outlook for the Singapore market in 2026, highlighting a shift towards a more resilient, technology-driven economy.

The note also details a significant construction boom involving over SGD100 billion in mega-projects, alongside a deepening role for Singapore in the global AI supply chain. Ultimately, the analyts set an ambitious target (5,600 points) for the Straits Times Index, supported by expectations of improved retail participation and robust corporate earnings growth. |

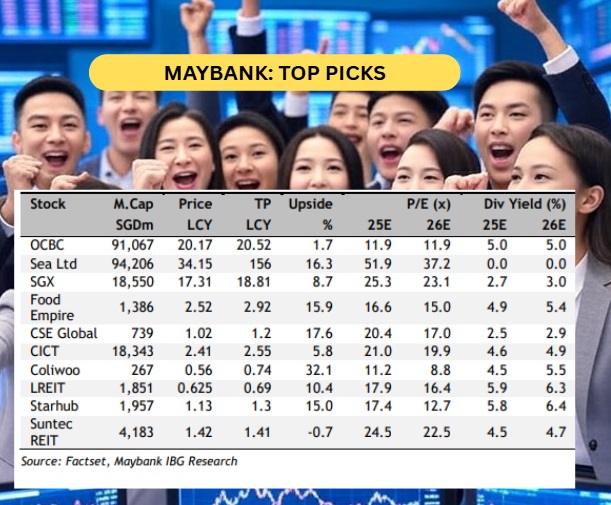

Thilan Wickramasinghe, Head of Research Singapore & Regional Head of FinancialsThe Maybank report provides brief investment thesis for specific picks, including:

Thilan Wickramasinghe, Head of Research Singapore & Regional Head of FinancialsThe Maybank report provides brief investment thesis for specific picks, including:

SEA: After a ~36% correction from its 2025 peak, Sea offers an attractive risk-reward with key risks largely priced in.

Shopee’s VIP and fulfilment investments deepen its ASEAN moat, while Lazada’s decline supports a rational duopoly and 2027 monetisation upside.

ASEAN (~75% of GMV) offsets Brazil/Taiwan headwinds, with deferred monetisation supported by Monee’s high-margin BNPL growth and Garena risk capped at ~15% of SoTP. Cafe Pho is Food Empire's top selling product in Vietnam.Food Empire: We expect Vietnam/Southeast Asia to continue deliver strong growth and margins to expand.

Cafe Pho is Food Empire's top selling product in Vietnam.Food Empire: We expect Vietnam/Southeast Asia to continue deliver strong growth and margins to expand.

We expect at least a net margin of 11% for FY25E and potential special dividends to reward shareholders after another record year.

CSE Global: Only proxy in SGX for US Data Centre (DS) and electrification play.

Likely to gain more market share from AI-DC with potentially more customers other than Amazon.

Specifically for Amazon, CSE could likely enjoy USD1.5bn of orders over 5 years.

Coliwoo: It is a leading co-living players in Singapore and aims to expand its portfolio to almost 4,000 rooms by end2026 from 2,933.

It has a strong pipeline of launches for the next 2-3 years (add about 800 rooms yearly).

It is exploring capital recycling initiatives to become more asset light and bulk up its ROE.

For more, see the report here.