|

The Singapore equity market has kicked off 2026 with remarkable vigor. |

1. Nam Cheong: The Undervalued Maritime Gem

Nam Cheong is a standout in the growth category, recently added as an "undervalued gem" with a steep 40-60% valuation discount relative to peers.

-

Investment Thesis: A key catalyst is the finalization of the commercial agreement between Petros (Sarawak) and Petronas, says a DBS Research report.

This resolution is expected to reignite upstream investment (likely including new shipbuildings) and drive demand for Offshore Support Vessels (OSVs), which are ships that carry supplies and crew to rigs. -

Earnings Driver: DBS' analyst anticipates an incremental 10-20% boost to the FY26 bottom line from this development, which is not yet factored into current valuations (target price: $1.25).

2. iFAST Corporation: Scaling the Wealth Wave

iFAST remains a high-conviction pick, with its growth trajectory largely fueled by its digital pension and banking initiatives.

-

Investment Thesis: Growth is primarily driven by the Hong Kong ePension business, with the 4Q25 performance expected to exceed 3Q25.

The company's scalability across wealth management and pension platforms provides a high-quality recurring fee base. -

Strategic Expansion: iFAST recently acquired a 30% stake in Financial Alliance Corp, further aligning with its goal to reach SGD100bn in Assets Under Administration (AUA) by 2028-2030.

3. Seatrium: The Laggard Opportunity

Added to the portfolio in early January 2026, Seatrium is viewed as a "laggard opportunity" within the industrials sector.

-

Investment Thesis: The stock is expected to benefit from significant contract wins and margin expansion.

Recent successes include a SGD2bn contract with GE Vernova for the BalWin5 project and securing BP’s Tiber deepwater FPU. -

Valuation: With a fundamental target price of SGD2.96, Seatrium represents a top pick as it resolves past disputes and streamlines its order book.

4. UMS Integration: The AI & Semiconductor Proxy

Andy Luong, chairman and CEO of UMS -- and JEP Holdings. As an integrated OEM for front-end semiconductor equipment, UMS is the preferred technology play for riding the global electronics upcycle.

Andy Luong, chairman and CEO of UMS -- and JEP Holdings. As an integrated OEM for front-end semiconductor equipment, UMS is the preferred technology play for riding the global electronics upcycle.

-

Investment Thesis: UMS is a "second-order AI beneficiary," gaining from its exposure to leading customers like Applied Materials.

Its "local-for-local" manufacturing strategy—with facilities in Singapore and Malaysia—helps it stay resilient against global trade tensions and tariff uncertainties. -

Growth Outlook: Despite near-term volatility, the global semiconductor market is forecast to grow nearly 18% in 2026, positioning UMS for a major production ramp-up.

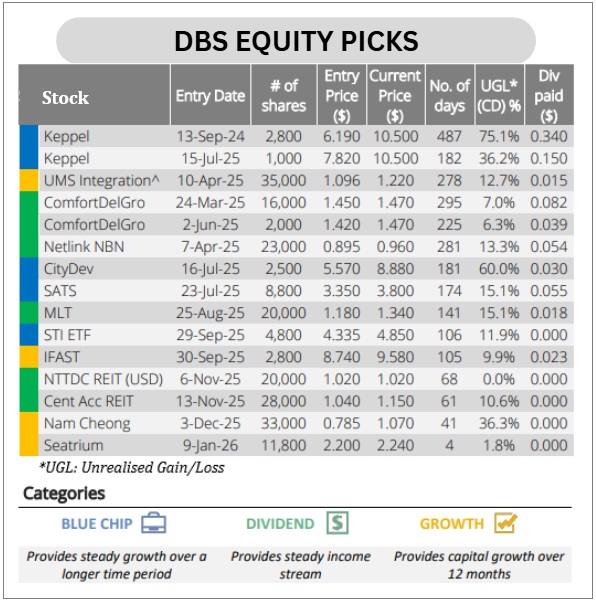

Portfolio Summary: The growth segment of the DBS Equity Picks portfolio emphasizes stocks with strong near-term catalysts.

|

Stock |

Entry Date |

Current Price (SGD) |

Entry Price (SGD) |

UGL % |

|

Nam Cheong |

3-Dec-25 |

1.070 |

0.785 |

36.3% |

|

iFAST |

30-Sep-25 |

9.58 |

8.740 |

9.9% |

|

Seatrium |

9-Jan-26 |

2.24 |

2.200 |

1.8% |

|

UMS |

10-Apr-25 |

1.22 |

1.096 |

12.7% |

UGL: Unrealised Gain/Loss.

Data based on 12-Jan-26 closing prices. → The full DBS report is here.

→ The full DBS report is here.

→ See also: This Singapore Tech Firm Is Poised to Ride Global Chip Rebound and Regional Boom