|

Excerpts from Phillip Securities report

Analyst: Ben Yik

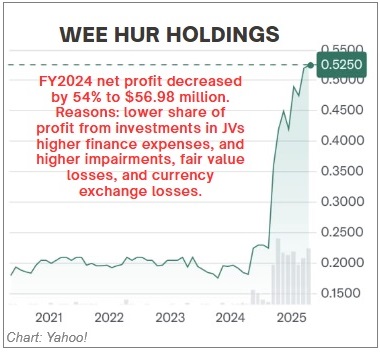

▪ Wee Hur held its 18th AGM on 30 April. Key resolutions approved in the AGM included final dividends and special dividends from the PBSA Fund I sale.  Total dividends of S$0.078 per share (yield: ~15%) will be paid on 23 May 2025. The last day to own Wee Hur shares to receive dividends is 7 May 2025. Total dividends of S$0.078 per share (yield: ~15%) will be paid on 23 May 2025. The last day to own Wee Hur shares to receive dividends is 7 May 2025. ▪ Wee Hur announced a new S$236.4mn BTO (HDB build-to-order) project, boosting its order book by ~90% to ~S$499.7mn (Dec’24 order book: S$263.3mn). The BTO project is expected to last till 4Q29. Wee Hur also announced that the Development Application (DA) for a new 683- bed PBSA property is obtained, and construction will begin in June 2025. A new PBSA Fund III is expected to be set up for this property by June 2025. ▪ We maintain Buy with an unchanged target price of S$0.62 (or S$0.55 ex-special dividend). |

| Key Highlights |

▪ S$0.07 of special dividends per share from PBSA Fund I sale was approved by shareholders. Inclusive of final dividends of S$0.008 per share, shareholders would receive dividends of S$0.078 paid on 23 May 2025.

The last day to own Wee Hur shares to receive dividends is 7 May 2025.

▪ Wee Hur was recently awarded a new S$236.4mn BTO project.

The BTO project is expected to last till 4Q29. It increased its previous construction order book value by ~90% to ~S$499.7mn (Dec’24 order book: S$263.3mn).

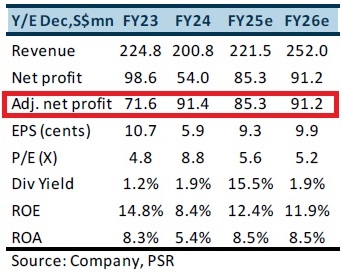

We raised our FY25e and FY26e revenue by 9% and 26% respectively.

▪ New properties in Australia. Wee Hur obtained Development Application (DA) for a 683-bed PBSA property.

Construction will commence in 2H25e, and Fund III is expected to be set up for this asset by June 2025.

Wee Hur also obtained DA for a 358-residential lot Lowood, under its Australia property development segment.

We expect the sale of Lowood’s residential lots to contribute to Wee Hur’s FY26e revenue.

Within our SOTP model, we raised Building Construction’s FY26e’s expected sales to ~S$107mn (prev: S$67mn) due to the new BTO project awarded, which increased Wee Hur’s order book by ~90%.  Ben Yik, analystThe Worker Dormitory segment’s WACC is raised to 13.4% (prev: 9.7%) due to uncertainty in whether lease extension is possible for Tuas View Dormitory, lease ending in November 2026. Ben Yik, analystThe Worker Dormitory segment’s WACC is raised to 13.4% (prev: 9.7%) due to uncertainty in whether lease extension is possible for Tuas View Dormitory, lease ending in November 2026. We cut FY25e PATMI to S$85.2mn (prev: S$113.5mn) due to ~S$26mn expected YoY decline in share of profits from joint ventures from the sale of PBSA Fund I. Wee Hur is trading at an attractive discount to book value of ~26%, as it has intention to sell its remaining PBSA stake valued at ~S$232mn (~49% of its market capitalisation). |

Full report here.