| There's a “golden goose” in Wee Hur Holdings's diversified business: the workers’ dormitories. At the company's AGM this week, Chief Investment Officer Goh Wee Ping, who called them “the golden goose" said a second major facility, Pioneer Lodge, will open doors for 3,000 beds by the end of this quarter, reaching its full capacity of 10,500 beds by end 2025.  Pioneer Lodge will open in 2Q2025 with 3,000 beds, and the rest of the 10,500-capacity by end-2025. Amenities include multi-purpose rooms, gymnasiums, minimarts and canteens. Pioneer Lodge will open in 2Q2025 with 3,000 beds, and the rest of the 10,500-capacity by end-2025. Amenities include multi-purpose rooms, gymnasiums, minimarts and canteens.Wee Hur's other dormitory, Tuas View Dormitory, with its 15,744 beds, has been a star performer. Thanks to a shortage of places to stay, last year alone this dorm pulled in $86.4 million in revenue -- a whopping 43% jump from the year before. That works out to $492 per bed per month (based on reported 93% occupancy rate). |

"In 2024, demand for workers' dormitory bed spaces remained robust, driven by ongoing construction projects, infrastructure developments, and industrial activities. The constrained supply continued to sustain high occupancy levels and drive rental rate increases. Given prevailing market dynamic, the Group expects rental rates to remain resilient throughout 2025, supported by limited new supply within the sector." "In 2024, demand for workers' dormitory bed spaces remained robust, driven by ongoing construction projects, infrastructure developments, and industrial activities. The constrained supply continued to sustain high occupancy levels and drive rental rate increases. Given prevailing market dynamic, the Group expects rental rates to remain resilient throughout 2025, supported by limited new supply within the sector."-- Wee Hur Holdings, FY2024 results statement |

If the new dorm does just as well, we’re looking at about $48 million a year in revenue once it’s up and running at full blast.

Things are looking bright for the dorm business this year and next.

But there’s a bit of a question mark after 2026 as the lease for Tuas View Dormitory ends in October 2026.

The plan is to ask the authorities for an extension.

For some history, construction of Tuas View Dormitory began in 2012 on a 3-year lease with a 3-year option to extend.

Multiple extensions have been granted with the current lease expiring in Oct 2026.

| Diversification & Riding the Student Accommodation Wave in Australia |

Founded as a construction company 45 years ago, when Singapore was urbanising rapidly, Wee Hur has since diversified into a broad range of businesses. The company’s student accommodation business in Australia caught investors' attention in late 2024 when it was sold to Greystar for a cool A$1.6 billion (with Wee Hur retaining a 13% stake).

The company’s student accommodation business in Australia caught investors' attention in late 2024 when it was sold to Greystar for a cool A$1.6 billion (with Wee Hur retaining a 13% stake).

Mr Goh, the CIO and son of the executive chairman, called it “a very significant milestone,” which along with the sale two years ago of 50% of the student accommodation portfolio to GIC of Singapore “cemented our track record being able to handle institutional capital.”

On 1 April, after receiving net proceeds of S$300 million, Wee Hur declared a special dividend of 7 cents/share (plus an ordinary dividend of 0.8 cent).

Wee Hur isn’t stepping back from the Aussie student housing sector.

|

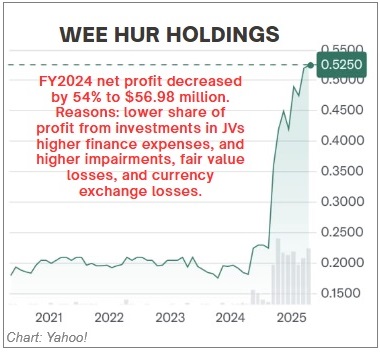

Stock price |

52.5 c |

|

52-wk range |

17 – 55 c |

|

PE |

8.8 |

|

Market cap |

S$483 m |

|

Shares outstanding |

919 m |

|

Dividend |

15%* |

|

1-yr return |

188% |

|

P/B |

0.7 |

|

Based on 8 cents/share for FY24, incl special dividend. Source: Yahoo! |

|

It's planning new projects, and is already on track to launch a third fund to keep the momentum going.

Notably, a 683-bed Purpose Built Student Accommodation in Adelaide will start construction in late 2025.

Wee Hur’s push into fund management and alternative investments is also gathering steam.

The group is dipping its toes into private equity and venture capital, always with a focus on long-term, generational wealth.

In Australia, Wee Hur has obtained Development Approval (DA) for Park Central, but high costs have delayed progress.

DA was also secured for 358 residential lots in Lowood, with infrastructure works ongoing. |

For more, see the AGM Powerpoint deck here.

See also: WEE HUR: Dormitories & Dividends. This Developer is Unrattled by Tariffs