|

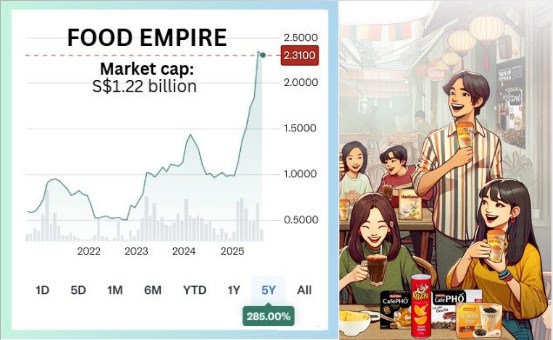

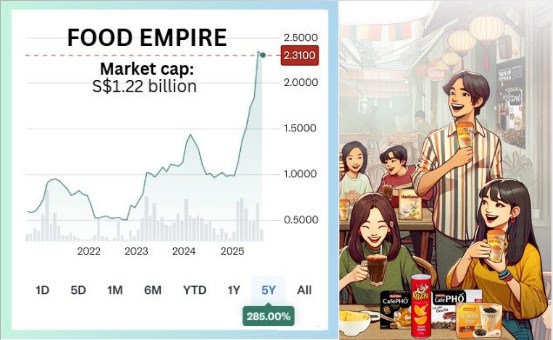

If you have been even casually tracking Food Empire, a producer of 3-in-1 coffee and related products, you'd have little difficulty connecting its meteoric stock price with its rising profitability.

Understanding what drives the profit requires analysis, especially if you wonder how far the business can grow.

Aside from a roaring stock price, investors will be rewarded with Food Empire's first-ever interim dividend declaration of 3.0 cents per share for 1H2025, payable on Sept 10. The dividend reflects the management's confidence in cash flow and a commitment to rewarding investors. Illustration: Food Empire Aside from a roaring stock price, investors will be rewarded with Food Empire's first-ever interim dividend declaration of 3.0 cents per share for 1H2025, payable on Sept 10. The dividend reflects the management's confidence in cash flow and a commitment to rewarding investors. Illustration: Food Empire

|

FY

|

Dividend per Share (cents)

|

Notes

|

|

2021

|

2.2

|

Final dividend (incl special 0.6 cent dividend)

|

|

2022

|

4.4

|

Final dividend

|

|

2023

|

10.0

|

Final dividend (incl special 5 cent dividend)

|

|

2024

|

8.0

|

Final dividend (incl special 2.0 cent dividend)

|

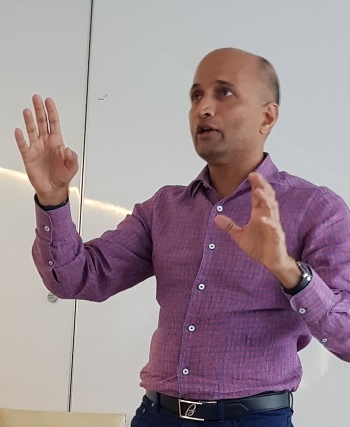

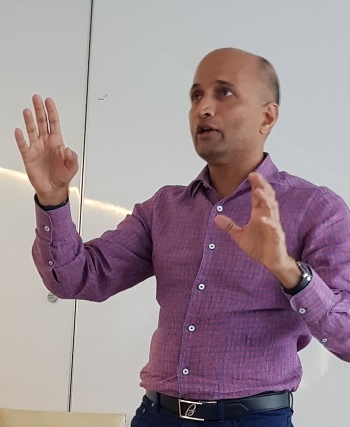

Ask CEO Sudeep Nair and he says, at the heart of it is the strength of the brand.

To investors who focus on hard numbers, the concept of brand may be less intuitive.

In Sudeep's telling, at the 1HFY25 results briefing, Food Empire has achieved strong brand equity and, with volume sales of its products, enjoys strong cashflows and profit margins.

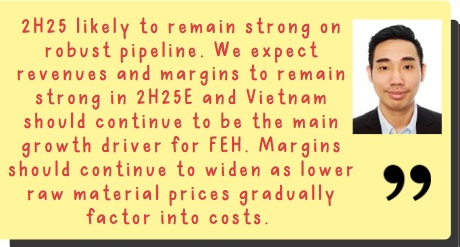

CEO Sudeep Nair has led Food Empire's transformation from a Russia-centric business to a diversified global player, growing rapidly in Vietnam especially, with strong emphasis on vertical integration and brand equity.And certainly in the coffee drinks business, there is plenty of competition. CEO Sudeep Nair has led Food Empire's transformation from a Russia-centric business to a diversified global player, growing rapidly in Vietnam especially, with strong emphasis on vertical integration and brand equity.And certainly in the coffee drinks business, there is plenty of competition.

"In our markets, we compete with players like Nestle, JDE and a bunch of local players. So if Food Empire can still lead in these markets, it tells you the strength of the brands which we have."

Next, Sudeep says Food Empire has the strategic flexibility to decide what margins it wants, taking into account what revenue growth it wants.

From this position of strength, Food Empire can continue its expansion through new SKUs, sub-brands, and channels -- even within single markets.

|

Food Empire has built market-leading brands -- like MacCoffee, Klassno and CafePho -- that have withstood volatility in geopolitics, supply chain, commodity prices, Sudeep points out.

In the face of such challenges, it has been able to raise the selling prices of its products -- without losing customers or market share.

"People don't economize much on a cup of coffee, they would economize more on high ticket items," as Sudeep quips.

In Vietnam, where its branded business began 15 years ago, the company is taking market share and aims to become the "number 2 and number 1 as a brand" by year-end through investments in new products and distribution.

Vertical integration, with factories in India and Malaysia, supports this by ensuring control over ingredients.

"We control every ingredient which goes into our brand all the way."

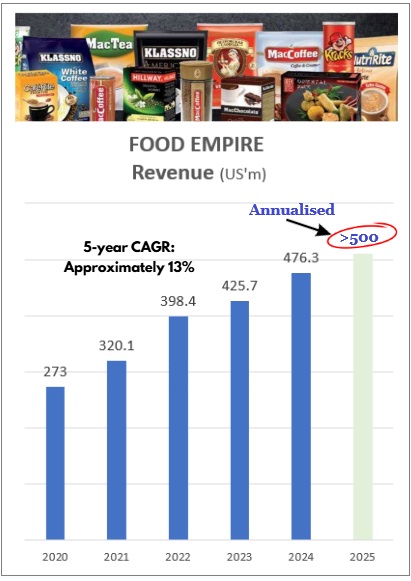

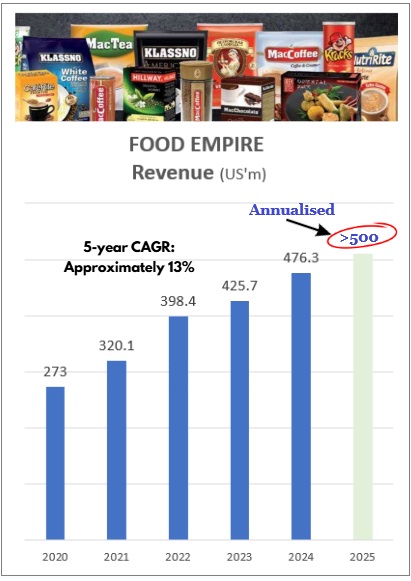

With revenues set to surpass US$500 million in 2025, up from US$320 million five years ago, Food Empire’s brands position it as a compelling growth story.

|

Highlights

(US$ '000)

|

1H2025

|

1H2024

|

Change

(%)

|

|

Total Revenue

|

274,060

|

225,246

|

21.7

|

|

Geography:

|

|

|

|

|

• Russia

|

82,796

|

68,067

|

21.6

|

|

• Southeast Asia

|

77,460

|

61,814

|

25.3

|

|

• Ukraine, Kazakhstan and CIS

|

68,411

|

57,301

|

19.4

|

|

• South Asia

|

36,983

|

29,556

|

25.1

|

|

• Others

|

8,410

|

8,508

|

(1.2)

|

|

Operating profit

|

42,757

|

28,464

|

50.2

|

|

EBITDA

|

19,623

|

36,444

|

(46.2)

|

|

EBITDA (normalised)

|

52,215*

|

36,444

|

43.3

|

|

Net loss/profit after tax

|

(1,094)*

|

23,219

|

NM

|

|

Net profit after tax (normalised)

|

31,498*

|

23,219

|

35.7

|

|

*Excludes a one-off, non-cash, fair value loss on redeemable exchangeable notes of US$32,592,000 due to fair value through profit or loss (“FVTPL”) accounting treatment, resulting from a significant increase in Company share price above the Exchange Price of S$1.09 to S$1.84 as at 30 June 2025. Following the entry into a Second Supplemental Agreement on 30 June 2025, the FVTPL accounting requirement will no longer be applicable after the date.

|

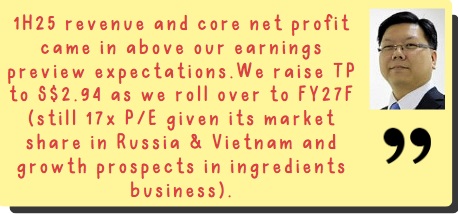

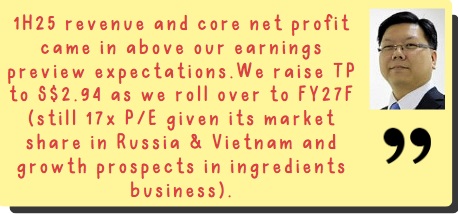

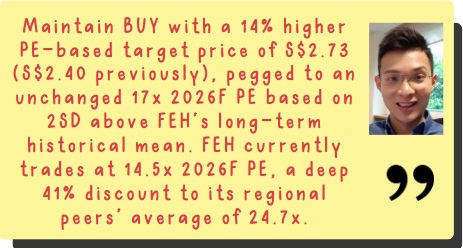

Looks like analysts love it — they are raising their target prices for the stock, saying growth in Russia and Vietnam looks set to lead the next leg.

Recognition has also come recently from a different source: Food Empire has been named in the 2025 Fortune Southeast Asia 500 list, joining the ranks of the region’s largest 500 companies by revenue. This marks the Group’s first inclusion on the list.

Bottom line: Food Empire isn't just serving coffee — it's serving up a growth story and higher dividends for investors to drink in.

CGS analysts William Tng (photo) and Tan Jie Hui

UOB Kay Hian analysts John Cheong (photo) & Heidi Mo

Maybank Kim Eng analyst: Jarick Seet with a $2.62 target price.

|

FOOD EMPIRE: Investing further in vertical integration for growth

|

|

Location

|

Project Description

|

Expected Completion

|

|

Kazakhstan

|

First coffee-mix manufacturing facility, establishing presence in Central Asia

|

End of FY2025

|

|

India

|

Expansion of spray-dried soluble coffee manufacturing facility, increases capacity by 60%

|

FY2027

|

|

Vietnam

|

New freeze-dried soluble coffee manufacturing facility, enhances Group's production capacity

|

FY2028

|

|

See Food Empire's 1H2025 Powerpoint deck here.