| • Few -- very few -- S-chips have the longevity, as a listco, of China Sunsine. It's been 17 years since its listing on the Singapore Exchange. And unlike China Sunsine, few S-chips have won a Most Transparent Company award from the Securities Investors Association of Singapore. • Few of these China-origin listcos have increasingly focused on shareholder returns. But on top of frequent share buybacks, China Sunsine has been upping its dividend payouts in recent years:

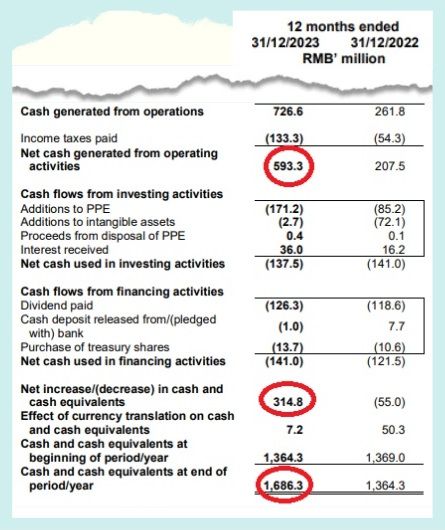

• The share buybacks and dividends look sustainable given the company's strong cash generation and cashpile, as shown below. Its net cash level is 81% of its current market cap.  • China Sunsine's 2023 net profit tumbled y-o-y. Yes, selling prices of its specialty chemicals for the global tyre manufacturing industry can be volatile and margins can be compressed. Read what CGS-CIMB has to say below ..... |

Excerpts from CGS-CIMB report

Analyst: Kenneth Tan & Ong Khang Chuen, CFA

■ 2H23 net profit (-17% yoy) was a beat, as GPM (-4.1% pts yoy) held up better than we expected. 1.0 Sct special DPS proposed, FY23 DPS 2.5 Scts.

■ Reiterate Add with an unchanged TP of S$0.47, still based on 0.6x CY24F P/BV (1 s.d. below 5-year historical mean). |

|||||

| 2H23: better-than-expected spread, 1 Sct special DPS proposed |

China Sunsine Chemical Holdings’ 2H23 net profit of Rmb178m (-9% hoh, -17% yoy) was a beat, with FY23 net profit of Rmb372m (-42% yoy) at 13% above our forecast.

| Record high |

| "Rubber chemical sales volumes hit a record high in 2H23 (+8% hoh, +12% yoy) on recovering tyre demand and ramp-up of newer production lines (commenced in 1H22)." -- CGS-CIMB |

The beat was driven by resilient GPM of 22% (-4.1% pts yoy), as we had expected a steeper decline in gross profit per tonne in view of intense domestic competition.

Rubber chemical sales volumes hit a record high in 2H23 (+8% hoh, +12% yoy) on recovering tyre demand and ramp-up of newer production lines (commenced in 1H22).

Sunsine proposed a final DPS of 1.5 Scts and special DPS of 1.0 Sct, above our expectation of 1.2 Scts.

| Profit spread could see some qoq softness in 1Q24F |

Recall that Sunsine typically locks in rubber accelerator prices with major customers at the start of the quarter, while taking spot prices for raw materials (aniline).

According to data provider sci99.com, rubber accelerator ASPs at the start of Jan 24 were c.19% lower vs. end-Sep 23 prices, while average aniline prices in Jan-Feb 24 were c.7% lower vs. average 4Q23 prices.

In comparison, rubber accelerator ASPs started off high in Oct 23 (+37% vs. end-Jun 23), while average 4Q23 aniline prices were c.2% higher vs. 3Q23 average.

We believe pricing trends could indicate qoq softness in Sunsine’s 1Q24F GPM.

| Competition still intense, but volumes should remain healthy |

We think competition should stay elevated in FY24F on the back of capacity expansion projects by peers; we hence expect FY24-25F GPM to remain dampened at c.22% on continued pricing pressure.

Nevertheless, we believe FY24F volume growth should remain healthy (+c.5% yoy), premised on:

1) rising tyre manufacturer utilisation rates, and

2) further ramp-up in newer lines.

Despite the tough operating environment, we believe Sunsine could maintain its DPS at 2.5 Scts in FY24F (6.5% yield) given its elevated net cash position and strong operating cash flow generation.

|

Full report here

See also: CHINA SUNSINE: This stock's 5 key metrics have grown 6-8X in 15 years