| China Sunsine, a rare survivor among S-chips, has been compounding value in the rubber chemicals industry since its IPO back in 2007. Fast forward to this month (Nov 2025), and its majority shareholder, Success More Group, decided to cash in on a modest stake – selling 42 million shares at S$0.66 apiece, totaling S$27.72 million. Worth noting -- this was Success More's first ever sale. "The sale fulfils my desire to utilise part of the sales proceeds for philanthropic activities in China, as well as to reward past employees who have contributed to the success of the Group," said Executive Chairman Xu Cheng Qiu, 81, who is the majority shareholder of Success More. This pares Success More's ownership from 61.6% down to 57.2%. The shares were snapped up by solid investors like Azure Capital, Avanda, Asdew, ICH Capital and Lion Global, among others.  |

Let's rewind: China Sunsine started in 1998 with a management buyout of a state-owned enterprise in Shandong Province, China manufacturing a variety of chemical products.

Mr Xu Cheng Qiu, then aged 54 and a supervisor-cum-factory manager, rallied 43 fellow employees to buy it over from the PRC government for RMB1.04 million.

They subsequently specialised in producing rubber accelerators – those essential ingredients that make tires durable and safe for the road.

By 2006, to fuel growth, they incorporated in Singapore and set up Success More in the British Virgin Islands as the holding company.

Xu held the lion's share of Success Moore at 74.3%, with his two sons and key lieutenants owning the rest.

According to the 2007 IPO prospectus, China Sunsine raised S$46.8 million by issuing 120 million shares at S$0.39 each.

Back then, production capacity stood at 32,000 tonnes a year, which would grow to a whopping 254,000 tonnes across various chemical products in 2025.

Plans included capacity expansion, better environmental practices, and upstream integration, which they've executed admirably over the years.

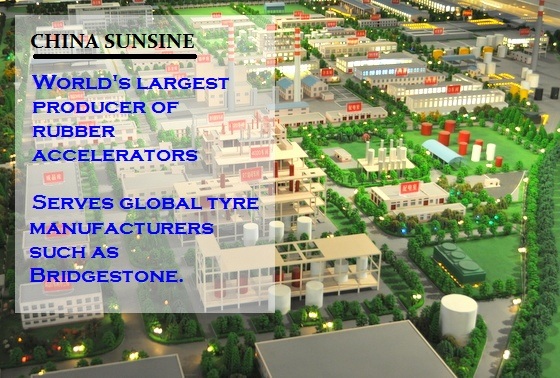

Fast forward nearly two decades, and China Sunsine has blossomed into the world's top producer of rubber accelerators and China's leading maker of insoluble sulphur.

They supply over three-quarters of the global top 75 tire manufacturers – think Michelin, Goodyear, Pirelli, Bridgestone, Continental.

| Mr. Xu is now 81, having devoted over four decades to this business, starting in the chemicals field in the 1970s. This transaction lets him and Success More shareholders harvest a portion of the fruits – funding philanthropy in China, as Mr. Xu mentioned, and rewarding loyal past employees. Success More's six-month moratorium on further sales underscores their commitment to the long haul of a company that has journeyed remarkably from a modest MBO to a global leader with a market cap of approximately S$740 million. Its share sale will boost liquidity of the stock, broaden the shareholder base with institutional money, and optimize the structure without changing control. Lim & Tan Securities commented: "We see the entry of the numerous institutional names into the company as a vote of confidence for this S-Chip company, given the numerous blow-ups in the past decade. China Sunsine also has an impeccable track record in rewarding shareholders via its steady and consistent dividend payments since its IPO in 2007, a rare attribute that is unseen of by Chinese companies listed on SGX. Its dominant market position with a significant market share in China amongst world ranked automotive related clients is likely one of its rare positive attributes that institutional funds are favourable to, in addition to its strong cash holdings of close to S$400mln. "We believe that China Sunsine will be on the “watch-list” of more brokers including ourselves now that the stock has been institutionalized and validated by world-renown funds. Forward PE is 8x while ex-cash PE is 3-4x while yield is 5-6% (including special dividends). Consensus target price is bandied around 75 cents." |

→ See also: Two Bargain Stocks in UOB KH’s Alpha Portfolio Have 3X ex-cash PE, Lots of Cash, and Growth Catalysts

→ See also: Two Bargain Stocks in UOB KH’s Alpha Portfolio Have 3X ex-cash PE, Lots of Cash, and Growth Catalysts