A shareholder of China Sunsine (market cap: S$384 million) contributed this article

After being listed on the SGX in 2007, China Sunsine grew to become the world's largest rubber accelerator producer, China's largest insoluble sulphur producer, and a sizable antioxidant producer.

The following table captures the immense growth of its key metrics:

After being listed on the SGX in 2007, China Sunsine grew to become the world's largest rubber accelerator producer, China's largest insoluble sulphur producer, and a sizable antioxidant producer.

The following table captures the immense growth of its key metrics:

Stable growth

Many companies grow vigorously only to find themselves in financial trouble later.

Sunsine timed its expansion in such a manner that its balance sheet stayed stable. It is now flushed with cash and has no bank loan.

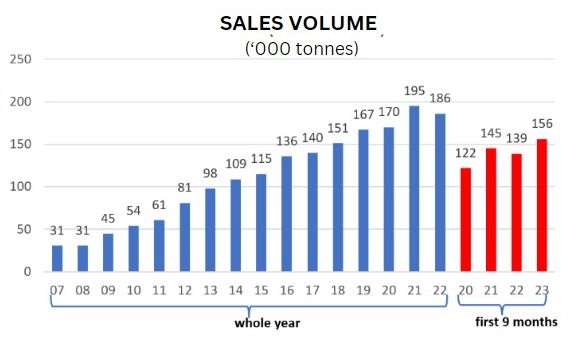

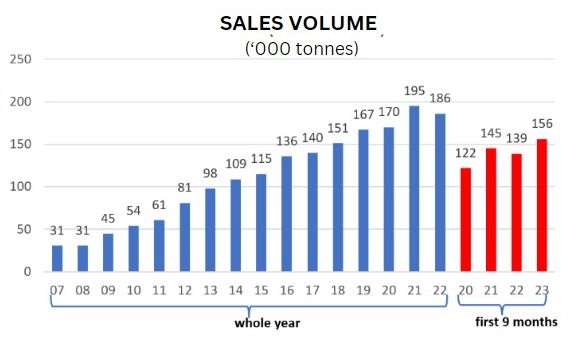

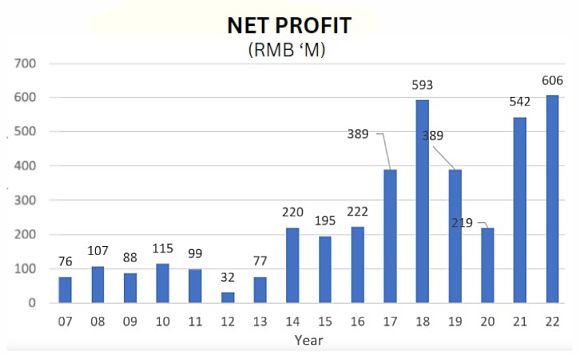

Growth in sales volume and profit

Sunsine timed its expansion in such a manner that its balance sheet stayed stable. It is now flushed with cash and has no bank loan.

Growth in sales volume and profit

Sales volume growth has been remarkable.

With 12% more rubber chemicals sold in the first nine months year-on-year, 2023 will be a record year eclipsing the 5% dip in 2022.

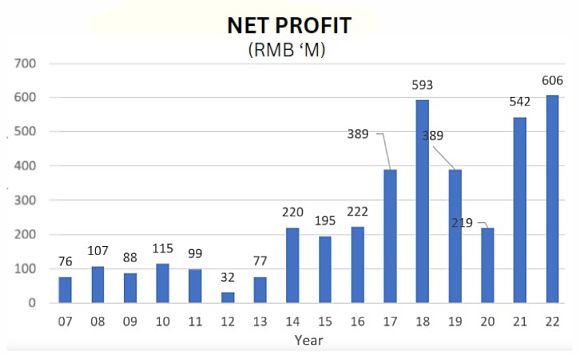

As products are priced in a cost-plus manner, Sunsine's profit fluctuates with shifting raw material prices.

But as sales volume rises, and raw material prices rebound after bottoming, and more efficient production processes are executed, profit trends up over time.

In the past 15 years, Sunsine has been profitable through various crises and market cycles.

Low profits are short-lived, not lasting more than two consecutive years.

Profit adjusted for tax credit due in 2017 but included in the 2018 financial statement, and for tax credit received in 2022 for overpayment in 2021.

Profit adjusted for tax credit due in 2017 but included in the 2018 financial statement, and for tax credit received in 2022 for overpayment in 2021.

With 12% more rubber chemicals sold in the first nine months year-on-year, 2023 will be a record year eclipsing the 5% dip in 2022.

As products are priced in a cost-plus manner, Sunsine's profit fluctuates with shifting raw material prices.

But as sales volume rises, and raw material prices rebound after bottoming, and more efficient production processes are executed, profit trends up over time.

In the past 15 years, Sunsine has been profitable through various crises and market cycles.

Low profits are short-lived, not lasting more than two consecutive years.

Profit adjusted for tax credit due in 2017 but included in the 2018 financial statement, and for tax credit received in 2022 for overpayment in 2021.

Profit adjusted for tax credit due in 2017 but included in the 2018 financial statement, and for tax credit received in 2022 for overpayment in 2021.Competition

Sunsine's mainstay is rubber accelerators with 23% of the global market share in 2022. Flexsys, the early-day top rubber accelerator producer with factories in Europe and the U.S.A., left the industry under cost pressure. (Ref: Flexsys-to-close-

Tianjin No.1 Organic Chemical Plant and Zhenjiang Zhenbang Chemical Industry Co., which were listed in Sunsine's IPO prospectus dated 25 June 2007 as its rubber accelerator main rivals, are no longer around.

Tianjin Kemai, Yanggu Huatai and Germany-based Lanxess are now Sunsine's main rivals in rubber accelerators.

After failing thrice to list on the Shanghai Stock Exchange (the last attempt in 2019), Kemai filed for registration in May 2022 with the National Equities Exchange & Quotations, an over-the-counter market in China, but was unsuccessful.

In Mar 2019, Yanggu Huatai aborted its 10,000-tonne TBBS project. (Ref: 阳谷华泰(300121)_公司公告_

Sunsine used to be concerned about competition but has become more confident lately.

During the 2021 AGM, the Board said, "There has always been an oversupply situation in China’s rubber chemicals industry.....the market recognition of prominent players is higher than other smaller producers. Over the years, the Group has been able to achieve an equilibrium between production and sales. As such, management is not concerned about the overcapacity situation in the industry."

After visiting Sunsine's chemical plants in Shandong, CIMB wrote on 21 Sep 23, "Management reiterated that while competition remains intense, it is not overly concerned given Sunsine’s dominant market leadership in the global rubber chemical industry."

Between 2020 and 2022, Sunsine signed on 469 new customers whose original rubber chemical suppliers had likely encountered difficulty amid the Covid-19 pandemic.

Although the car tyre industry has yet to recover to pre-COVID levels, Sunsine sold more rubber chemicals than in 2019:

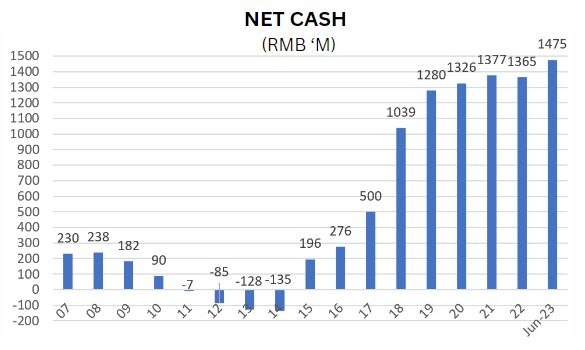

Cash accumulation

Tianjin No.1 Organic Chemical Plant and Zhenjiang Zhenbang Chemical Industry Co., which were listed in Sunsine's IPO prospectus dated 25 June 2007 as its rubber accelerator main rivals, are no longer around.

Tianjin Kemai, Yanggu Huatai and Germany-based Lanxess are now Sunsine's main rivals in rubber accelerators.

After failing thrice to list on the Shanghai Stock Exchange (the last attempt in 2019), Kemai filed for registration in May 2022 with the National Equities Exchange & Quotations, an over-the-counter market in China, but was unsuccessful.

In Mar 2019, Yanggu Huatai aborted its 10,000-tonne TBBS project. (Ref: 阳谷华泰(300121)_公司公告_

Sunsine used to be concerned about competition but has become more confident lately.

During the 2021 AGM, the Board said, "There has always been an oversupply situation in China’s rubber chemicals industry.....the market recognition of prominent players is higher than other smaller producers. Over the years, the Group has been able to achieve an equilibrium between production and sales. As such, management is not concerned about the overcapacity situation in the industry."

After visiting Sunsine's chemical plants in Shandong, CIMB wrote on 21 Sep 23, "Management reiterated that while competition remains intense, it is not overly concerned given Sunsine’s dominant market leadership in the global rubber chemical industry."

Between 2020 and 2022, Sunsine signed on 469 new customers whose original rubber chemical suppliers had likely encountered difficulty amid the Covid-19 pandemic.

Although the car tyre industry has yet to recover to pre-COVID levels, Sunsine sold more rubber chemicals than in 2019:

|

SALES VOL CHANGE OVER 2019 |

|||

|

|

2020 |

2022 |

9M2023 |

|

Global car tyre industry |

-15% |

-10% |

-11% |

|

China Sunsine |

+1% |

+11% |

+25% |

https://corporate.pirelli.com/

Cash accumulation

With the RMB 264m IPO proceeds as the only seed money and careful timing of expansion, Sunsine had amassed RMB 1,475m in cash by 30 June 2023, after repaying all bank loans in 2016, paying RMB 810m as dividends, RMB 2,084m on infrastructure, and RMB 1,457m as additional working capital.

It had also spent around RMB 50m by the end of 2023 to repurchase 24.13 m shares.

Between 2009 and 2015, Sunsine borrowed to fund expansions. After becoming debt-free in 2016, cash rose at a fast rate, from RMB 276m to RMB 1,475m on 30 June 2023.

It had also spent around RMB 50m by the end of 2023 to repurchase 24.13 m shares.

Between 2009 and 2015, Sunsine borrowed to fund expansions. After becoming debt-free in 2016, cash rose at a fast rate, from RMB 276m to RMB 1,475m on 30 June 2023.

Responding to calls for higher dividend payout, the Board said in April 2018 that the RMB 500m cash as of the end of 2017 was just enough for working capital, upgrading, and expansion.

Three years later, cash grew to RMB 1,326m.

In 2021, the Board said between RMB 700m and RMB 810m would be needed for various purposes, leaving between RMB 626m and RMB 516m for "unforeseen circumstances".

It should be noted that capital expenditure and additional working capital are spread over several years instead of being spent in a single year. Between 2018 and 2022, capital expenditure and working capital used up RMB 1,790m or a yearly average of RMB 360m.

In the past six years, Sunsine's profit was between RMB 389m and RMB 606m except for RMB 219m in 2020 when Covid-19 was at its worst.

A "low" profit of RMB 350m, together with depreciation & amortisation of RMB 160m, will be enough to pay RMB 360m for expansion, and RMB 150m for an SGD 0.03 dividend, leaving the cash pile intact.

The solid financial position will enable Sunsine to sail through adversities.

Its RMB 1,475m cash is more than four times the 2022 RMB 306m salaries. It is also 70% of 2022 raw material purchases.

Three years later, cash grew to RMB 1,326m.

In 2021, the Board said between RMB 700m and RMB 810m would be needed for various purposes, leaving between RMB 626m and RMB 516m for "unforeseen circumstances".

It should be noted that capital expenditure and additional working capital are spread over several years instead of being spent in a single year. Between 2018 and 2022, capital expenditure and working capital used up RMB 1,790m or a yearly average of RMB 360m.

In the past six years, Sunsine's profit was between RMB 389m and RMB 606m except for RMB 219m in 2020 when Covid-19 was at its worst.

A "low" profit of RMB 350m, together with depreciation & amortisation of RMB 160m, will be enough to pay RMB 360m for expansion, and RMB 150m for an SGD 0.03 dividend, leaving the cash pile intact.

The solid financial position will enable Sunsine to sail through adversities.

Its RMB 1,475m cash is more than four times the 2022 RMB 306m salaries. It is also 70% of 2022 raw material purchases.

| Cash already made up 40% of the equity as of 30 June 2023, vs 20% in 2016 when Sunsine became debt-free. A low dividend payout (currently at 20%) leads to a low return on equity, which in turn affects the market's recognition of Sunsine resulting in the share price not reflecting the fundamentals. Will Sunsine be more generous in future dividend payments? |