Excerpts from CGS-CIMB report

Analysts: Lim Siew Khee & Izabella Tan

YANGZIJIANG SHIPBUILDING

Riding the LNG momentum

■ YZJ has secured orders for 4 units of 8,000 TEU LNG dual-fuel containerships from PIL. We estimate that these are worth US$100m/vessel.

■ Reiterate Add and TP of S$1.63, still based on 10x CY23F P/E (2-year historical average). We see positive share price movement from this news. |

||||

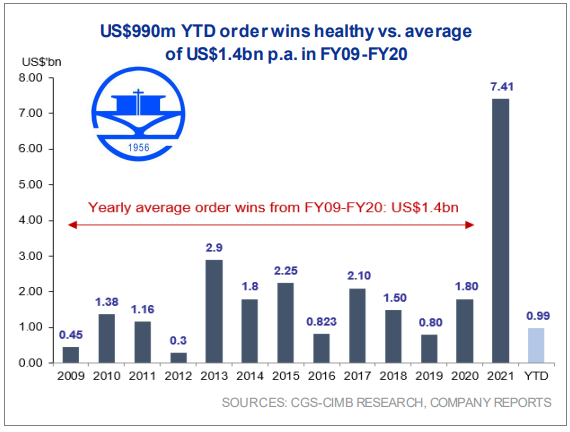

| YTD order wins of US$990m; US$8.15bn orderbook for 137 vessels |

● YZJ has won orders for 4 units of 8,000 TEU liquefied natural gas (LNG) dual-fuel containerships from Pacific International Lines (PIL). These orders will be progressively delivered in Jan, Mar, Apr, and Jun 2025.

● Including the orders for PIL, YZJ has secured YTD order wins for 16 vessels as of 6 Jul22. These vessels are: 4 units of 1,800 TEU containerships, 4 units of 8,000 TEU LNG dual-fuel containerships, 4 units of 66,000 DWT and 2 units of 63,200 DWT bulk carriers, and 2 units of 36,000 CBM liquefied ethylene gas (LEG) carriers.

● We are positively surprised by the YTD total orders of US$990m given its capacity constraints till 2024. However, deliveries are scheduled till 2025, building earnings visibility beyond FY24.

● We deem YTD US$990m of order wins as healthy compared to their average order wins of US$1.4bn p.a. in FY09-FY20. Pivoting to LNG carriers for future growth; positive for its ESG

● We estimate that these 4 units of 8,000 TEU LNG dual-fuel containerships secured from PIL are w orth US$100m/vessel.

● The 4 units of 8,000 TEU LNG dual-fuel containerships w ill be equipped w ith a self-developed GTT Mark III membrane containment tank system that is ammonia-ready.

Ammonia-ready fuel tanks provide shipow ners w ith the flexibility to switch to ammonia, which is a zero-carbon fuel. According to YZJ, the GTT Mark III technology signifies its breakthrough into Type ‘C’ tanks, which can be applied to build larger LNG carriers, enabling YZJ to further penetrate the clean energy sector and the LNG market.

Lim Siew Khee, analyst● We think YZJ’s order wins for the LNG and LEG vessels will allow it to catch up to its Korean peers in terms of valuation. Lim Siew Khee, analyst● We think YZJ’s order wins for the LNG and LEG vessels will allow it to catch up to its Korean peers in terms of valuation. Increasing average LNG vessel prices and YZJ’s focus on margins further drive future earnings, in our view. We base our TP on 10x CY23F P/E (2-year historical average). It is currently trading at 5.7x CY23F P/E. |

● Re-rating catalysts: faster-than-expected delivery of orders, more order wins, increase in dividend payout.

Key downside risks: sharp rise in steel prices, cancellation of orders

Full report here.