|

The global trade is bigger than any one country, even the US. |

As for those that currently call at US ports, there's a plausible way for some to adjust in order to avoid fees, as highlighted in a WorldCargoNews.com article.

Ship operators may redirect these Chinese-built vessels to non-U.S. ports, such as those in Canada or Mexico, transshipping goods into the U.S. via rail or truck.

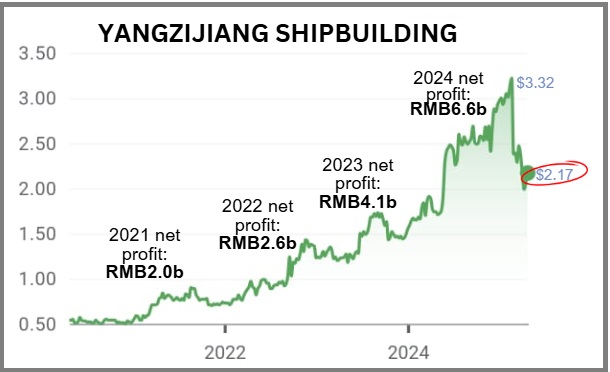

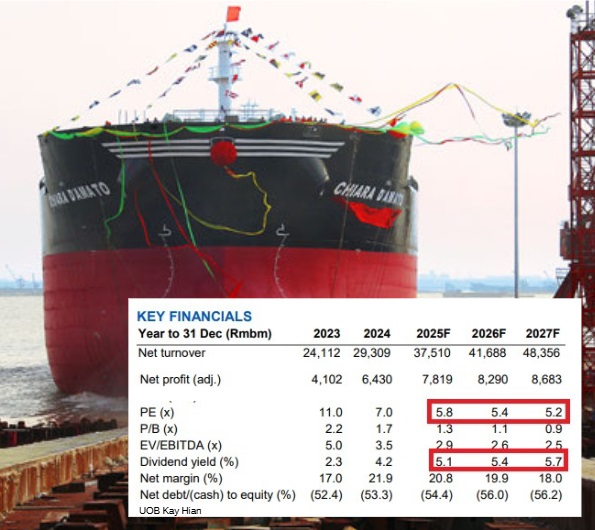

Thus, it stands to reason that ship owners -- currently in a wait-and-see mode -- will resume placing orders for new ships from Chinese yards, as has been the dominant trend in recent years benefitting the likes of Yangzijiang. UOB Kay Hian has flagged the dirt-cheap valuation of Yangzijiang given its profitability in the next few years.

UOB Kay Hian has flagged the dirt-cheap valuation of Yangzijiang given its profitability in the next few years.

Ref: YANGZIJIANG: US Fee Threats Dent Shares, but Robust Backlog Keeps Analysts Bullish

All this is not to say that the US port fees are insignificant in their impact on those ships that call -- there's no doubt that the US is a key market for containerized goods, and the fees will impact freight rates.

A S$8.4 billion shipbuilder listed on the Singapore Exchange, Yangzijiang does not bear the direct brunt of the fees. That's why it has reported zero order cancellations or delays for ships.

Still, order wins virtually dried up in Q1 2025 when it booked six new orders worth US$300 million.

| REDEPLOY |

| Carriers will revise how fleet is used across alliance partners. If they can avoid using the largest China-built ships on US services, they could minimize the impact greatly. -- WorldCargoNew.com |

Its blockbuster backlog stands at 230 vessels valued at US$23.2 billion, with deliveries lined up through 2030.

That pipeline will keep its yards full until 2027.

New ship orders can be expected to flow again to Chinese shipyards including Yangzijiang's simply because they still lead on price and speed, thanks to state subsidies, low labor costs and an integrated supply chain.

That's why they have captured lots of newbuild orders in recent years.

Buyers pay 10–15% less per ship than at Korean or Japanese yards and often get financing support from Chinese banks to boot.

Some owners may flirt with South Korean yards for earlier delivery slots.

But Yangzijiang’s scale and proven build flexibility mean it can jump back to the front of the queue. The question is when and what's the magnitude.

It might take a while even if there are positive signs as reflected by the action of this giant German shipowner: "Hapag-Lloyd revisits Chinese shipyard after considering Hanwha Ocean deal"

TradeWinds reported that the price of a 16,000 TEU dual-fuel ship from China is around US$190 million, compared to about US$225 million from Korean yards. This price gap, along with eased U.S. port fees, led Hapag-Lloyd to reconsider its order location.

|

Crucially, global fleet renewal is only ramping up.

|