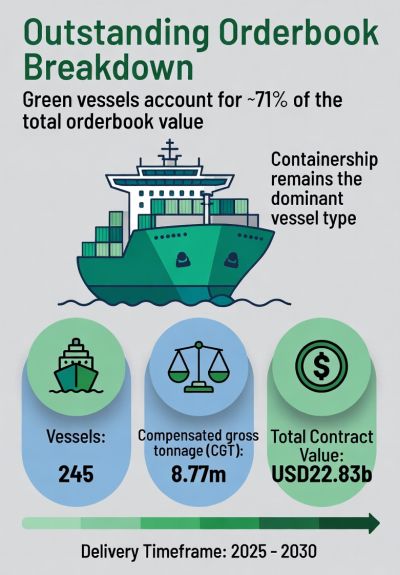

| It's been only about 9 months since the bad news that sunk Yangzijiang Shipbuilding's stock -- from $3.30 in February to $1.88 within 6 weeks. The US proposed steep port fees on Chinese-built and operated vessels, aimed at curbing China's dominance in global shipbuilding. Fast forward, and the stock has recovered to ~$3.50 recently, as shipbuilding orders chalked up for Yangzijiang and other Chinese yards, whose competitive pricing reflects greater efficiency and lower costs. Yangzijiang's 3Q2025 business update did not provide financial performance figures. Its massive orderbook stood at USD22.8bn as at end 3Q, providing multi-year revenue visibility (through FY2030). Both DBS Group Research and CGS International maintain a positive investment recommendation (BUY/ADD).  |

But DBS and CGS have markedly different price targets due to valuation and time horizon.

CGS analysts, Lim Siew Khee and Meghana Kande, in fact raised their target price (to S$4.51) compared to DBS analyst Ho Pei Hwa maintaining hers (SGD3.80).

This difference stems largely from CGS rolling forward its valuation time horizon to CY27F and applying a 10x P/E multiple. They see Yangzijiang's current valuation as being "undemanding" relative to peers.

Here are some metrics for comparison:

|

DBS [Analyst: Ho Pei Hwa] |

CGS Int'l [Analysts: LIM/KANDE] |

|

|

Call |

BUY |

ADD |

|

Target Price |

SGD3.80 |

S$4.51 (Raised from S$3.90) |

|

Upside/ |

Upside 8.6% from S$3.50. Attractive dividend yield (4-5%). |

38.3% upside (from S$3.26). "Undemanding valuations" (8x CY26F P/E vs. peers’ 17x). |

|

Financial Assumptions (Key) |

Forward P/E: 8.5x; |

FY25F/FY26F gross margin: 35% (raised from 32%/30%). |

Agreement on Margin Drivers and Execution: Both DBS and CGS analysts expect margins will expand due to the company's focus on high-value, high-specification vessels, particularly dual-fuel/green vessels.

The CGS analysts raised their gross margin forecast to 35% for FY25F/26F, supported by low and locked-in steel costs.

CGS expected numbers are:

|

Item |

Dec-23A |

Dec-24A |

Dec-25F |

Dec-26F |

Dec-27F |

|

Revenue (Rmb ‘m) |

24,112 |

26,542 |

28,203 |

33,958 |

36,515 |

|

Net Profit (Rmb ‘m) |

4,102 |

6,834 |

8,319 |

9,519 |

9,895 |

|

Normalised EPS (Rmb) |

1.04 |

1.68 |

2.11 |

2.41 |

2.50 |

|

Normalised EPS Growth |

56.6% |

61.7% |

25.4% |

14.4% |

4.0% |

|

FD Normalised P/E |

17.14 |

10.80 |

8.45 |

7.39 |

7.10 |

|

Dividend/share (Rmb) |

0.34 |

0.83 |

0.98 |

0.94 |

0.98 |

|

Dividend Yield |

1.94% |

3.51% |

4.61% |

5.28% |

5.44% |

|

ROE |

21.3% |

28.1% |

28.9% |

27.8% |

24.6% |

|

Source: CGS |

|||||

Both reports emphasize the strategic importance of green vessels, which account for 71-74% of Yangzijiang's order book value. |

→ See the full DBS and CGS reports.

→ See the full DBS and CGS reports.

→ See also: YANGZIJIANG: Goldman Sachs Initiates ‘Buy’ And $4 Target On Earnings Boom Amid Industry Upcycle