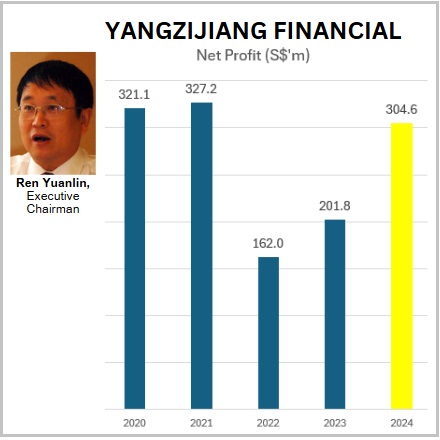

Yangzijiang Financial operates like a fund, investing in debt and equity securities as well as maritime assets and services -- including ship finance, leasing and brokerage services. Yangzijiang Financial operates like a fund, investing in debt and equity securities as well as maritime assets and services -- including ship finance, leasing and brokerage services.• Once a forgotten stock for two years after its listing on SGX, Yangzijiang Financial (YZJF) is one of the strongest gainers in 2025 (see chart). • Born from a strategic spin-off in 2022, the stock ($1.12) has surged an impressive 170% year-to-date. This was catalysed by YZJF's strong set of FY2024 results (net profit grew 51%, reaching S$304.6 million) as it continued to make strategic shifts from Chinese debt investments to Singapore-based assets, now 53% of its S$4.1 billion AUM (assets under management).  In 1H2025, net profit attributable to equity holders rose 28% to S$137.7 million. In 1H2025, net profit attributable to equity holders rose 28% to S$137.7 million.• What’s got the market buzzing lately? News of an upcoming spin-off for its fast-growing maritime business. The fund grew 150% to S$579.3 million in 2024, capitalizing on global demand for eco-friendly shipping. Headed by Ren Yuanlin, a seasoned expert in the maritime business, the spin-off, coupled with strategic asset shifts, could unlock even more value in YZJF in the months ahead. • Read what CGS says below .... |

Excerpts from CGS International report

Analyst: Lim Siew Khee

■ We lift our SOP-based TP to S$1.25 (1.2x CY26F P/BV for its maritime fund and 0.8x CY26F P/BV for remaining business). Reiterate Add. |

|||||

| Unlocking value; plans maritime fund spin-off in Nov 25 |

Yangzijiang Financial Holding (YZJFH) plans to spin off its maritime fund and maritime investment business through a capital reduction exercise and distribution in specie of all shares in Yangzijiang Maritime Development Ltd (YZJ Maritime), with a planned SGX Mainboard listing by introduction, and up to a S$250m placement to institutional and accredited investors.

The timeline of the spin-off is likely sometime in Nov 25F, according to YZJFH.

Ren Yuanlin (right) is executive chairman of YZJ Financial while Liu Hua (left) is Deputy CEO. • Ren is the founder and longtime leader of Yangzijiang Shipbuilding, one of China’s largest private shipyards. • He helped transform it into a global shipbuilding powerhouse, later passing executive roles to his son. • Ren steered the set-up and growth of YZJ Financial. • Reflecting his industry roots and vision, this year, Ren announced plans to spin off Yangzijiang Maritime from YZJ Financial. He will lead Yangzijiang Maritime as executive chairman. |

Post spin-off, YZJFH will retain its investments, fund management business, and debt investments in China.

The above transaction will lower YZJFH’s consolidated NTA from S$4.07bn (S$1.17/share) to S$1.87bn (S$0.54/share) and its FY24 EPS from 8.66 Scts to 3.51 Scts, with no change to its issued share capital of 3.48bn shares.

Assets to be spun off accounted for c.53.7% of the group’s NAV and 56.0% of its net profit in 1H25.

| Targets AUM of US$1bn for YZJ Maritime |

According to YZJFH, YZJ Maritime will become a pure-play maritime platform focused on:

|

Stock price |

$1.12 |

|

52-week range |

34-$1.4 |

|

Market cap |

S$3.9 b |

|

PE |

11.4 |

|

Dividend yield |

3.2% |

|

P/B |

0.98 |

|

52-week change |

220% |

1) maritime investments and services, which include ship agency and shipbroking, ship leasing and sales facilitation, direct vessel investments, and ship chartering;

2) loan services, which include ship financing services, pre-delivery loans, and secured loans; and

3) imports & exports, which include distribution of merchant ships and offshore engineering products and equipment.

The target AUM for YZJ Maritime will be US$1bn, of which the company has deployed c.US$680m, YZJFH said.

| Reserve list on FTSE and commitment to SG equity market |

Last week, YZJFH was added to the STI reserve list following the latest semi-annual review changes to the FTSE ST Index Series.

Earlier in Aug, XZJFH said its S$100m commitment would anchor Singapore ICH Asset Management’s investment fund targeting Singapore small-to-mid-cap companies, complementing the Equity Market Development Programme.

|

→ Full CGS report here. → Full CGS report here.→ See also: YANGZIJIANG FINANCIAL: From Under the Radar to Center Stage: A Financial Star Rises |