|

The U.S. wants to boost its own shipbuilding industry, which has been struggling for years —it builds just five ships are built a year now versus 70 back in 1975 when it was No.1.

China builds a whopping 1,700 ships a year, in comparison.

So, the US is hitting ships with port fees. In early 2025, the news was that fees were going to be brutal—up to US$1.5 million per port stop!

But after a ton of complaints from shippers, the U.S. scaled it back in April 2025, and threw in exemptions for places like the Caribbean and Great Lakes.

Thus from Oct 2025, the fees will start at US$18 per ton for foreign-owned ones (going up US$5 a year) and US$50 per ton for Chinese-owned ones (up US$30 yearly).

That’s made it less of a headache for companies like Hapag-Lloyd, a big-time German operator with a fleet of about 300 ships. That’s made it less of a headache for companies like Hapag-Lloyd, a big-time German operator with a fleet of about 300 ships.

Hapag-Lloyd has been a long-time customer of Chinese yards. It ordered 24 new dual-fuel container ships for US$4 billion from Yangzijiang Shipbuilding and New Times Shipbuilding Company Ltd., in November 2024.

Early this year, facing the proposed sky-high US port fees on Chinese-built ships, Hapag-Lloyd signed a non-binding Letter of Intent with South Korean shipbuilder Hanwha Ocean for six vessels.

|

However, after US penalties were eased and with Chinese ships costing less than Korean ones, Hapag-Lloyd has recently returned to the table with Yangzijiang Shipbuilding, one of the largest, most efficient and most profitable shipbuilders in China.

For perspective, TradeWinds reported that the price of a 16,000 TEU dual-fuel ship from China is around USUS$190 million, compared to about USUS$225 million from Korean yards.

Source

Source

Hapag-Lloyd's an unusual piece of news in an industry where ship owners usually don't reveal which yards they do business with and shipbuilders don't reveal client names due to confidentiality or competitive reasons.

This raises the question of which other shipowners might be following a similar path quietly.

| REDEPLOY |

Carriers will revise how fleet is used across alliance partners. If they can avoid using the largest China-built ships on US services, they could minimize the impact greatly.

-- WorldCargoNew.com |

Not surprisingly, no specific shipowners have been publicly confirmed as mirroring Hapag-Lloyd’s decision to pivot back to a Chinese shipyard.

However, major carriers with significant past reliance on Chinese-built vessels or orders may consider similar moves.

South Korean and Japanese shipyards are gaining traction (e.g., Mitsui OSK Lines’ shift to South Korea yards) but face capacity constraints and higher costs.

US shipyards, producing only five ships annually, are not viable short-term alternatives.

Our earlier article (YANGZIJIANG: Its ship orders will recover. Why wouldn't they? But how soon) explored, among other things:

• the fact that plenty of non-Chinese built ships may be redeployed to incorporate US routes as part of their overall movements.

• how global ship operators can redirect their Chinese-built vessels to non-U.S. ports, transshipping goods into the U.S. via rail or truck.

|

Why it matters to investors

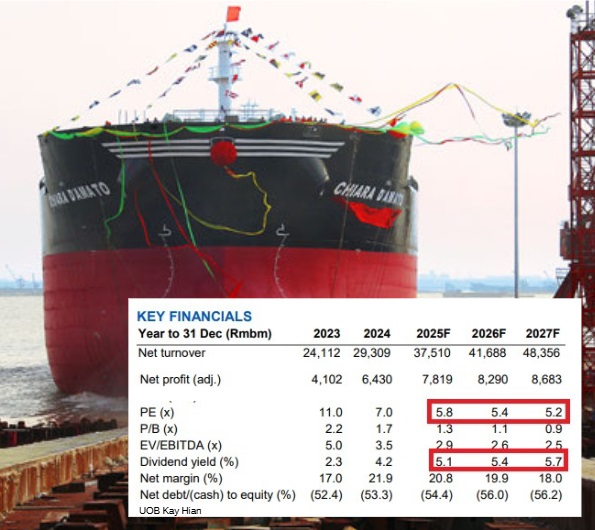

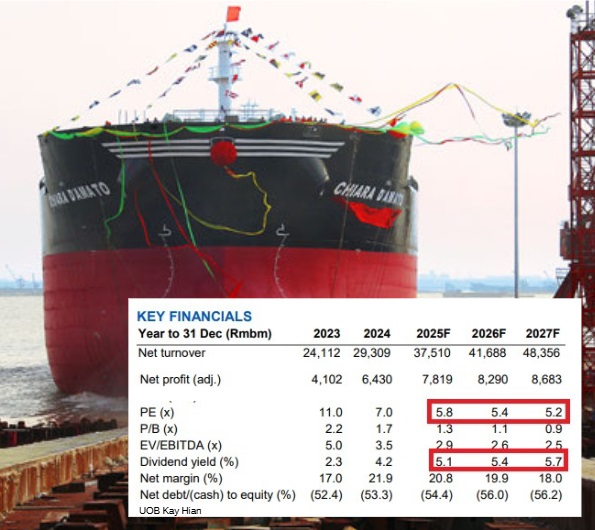

UOB Kay Hian has flagged the dirt-cheap valuation of Yangzijiang given its profitability in the next few years. Ref: YANGZIJIANG: US Fee Threats Dent Shares, but Robust Backlog Keeps Analysts Bullish UOB Kay Hian has flagged the dirt-cheap valuation of Yangzijiang given its profitability in the next few years. Ref: YANGZIJIANG: US Fee Threats Dent Shares, but Robust Backlog Keeps Analysts Bullish

For investors, betting on Chinese shipyards could pay off.

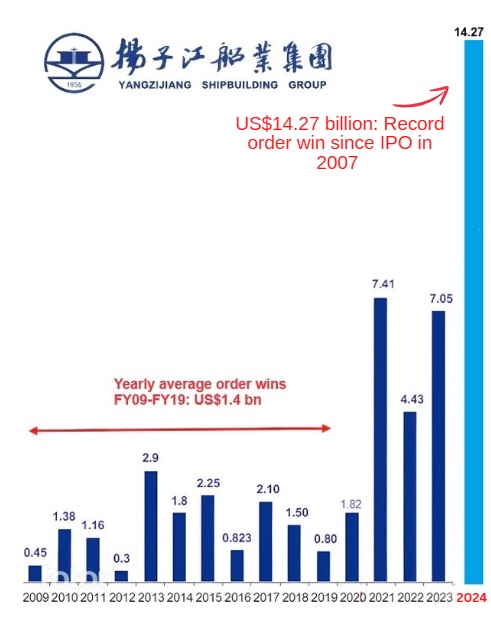

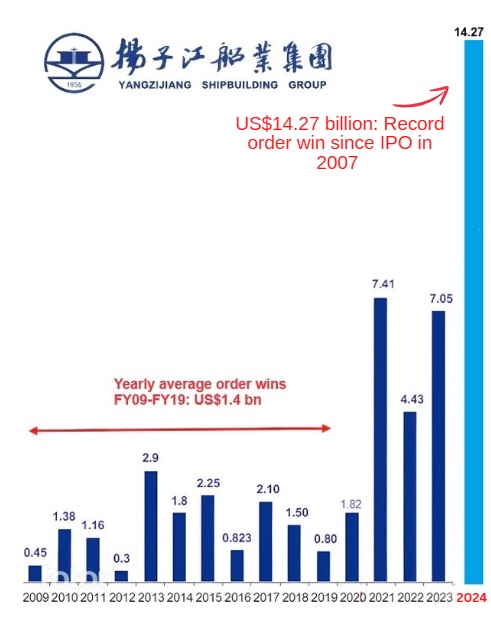

Yangzijiang has a US$24.4 billion order book through 2028 but order wins in 1Q2025 totalled just US$300 million.

Yangzijiang has said that its clients were taking a wait-and-see approach. Importantly, Yangzijiang has not received any order cancellations or requests from clients to delay deliveries.

If more shipowners mimic Hapag-Lloyd, prioritizing cost over fees, yards like Yangzijiang could resume announcing order wins, which would boost stock values of Chinese yards.

Yangzijiang’s stock has been pressured down ever since early this year when news of the proposed US port fees broke.

The risk is real though that order wins may take a long time to resume.

"During the (1Q2025) analyst briefing, the CFO’s tone was decidedly bearish given his caution that new order wins may not substantially increase from 1Q25 levels," as UOB Kay Hian reported.

"Overall, management expects global order wins to be weak this year due to macroeconomic headwinds and ongoing uncertainties (US tariff, USTR finalisation in 2H25 etc). In particularly, US trade policies and tariffs have a prominent impact on shipping, which have led shipowners to adopt a wait-and-see stance and are unlikely to return to the market in big way this year," says DBS Research.

"Furthermore, shipowners will likely favour Korean and Chinese peers who have earlier delivery slots in 2028-2029. Yangzijiang has limited delivery slots for small-mid-size vessels in 2028 and largely vessels in 2029."

"Nevertheless, order win should pick up from the exceptionally low level in 5M25 given the scaleback of USTR proposed port fees and de-escalation of US tariff."

|

See also: YANGZIJIANG SHIPBUILDING: US scales back port fees, DBS Research reiterates high stock target price

Source

Source