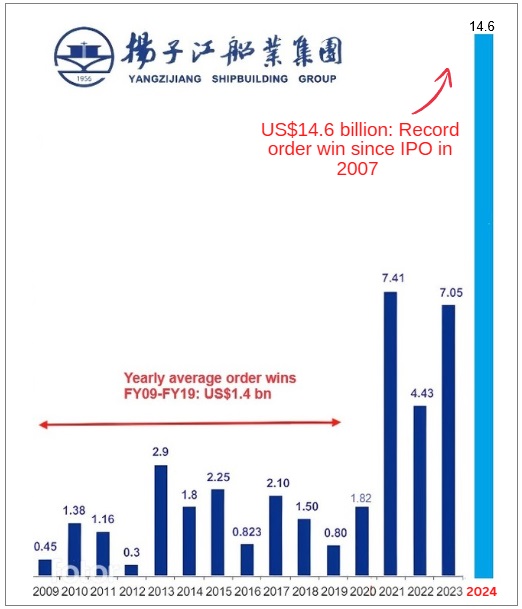

| Yangzijiang Shipbuilding's massive orderbook is untouched by US tariffs and new US port fees to be levied on Chinese-built vessels. "None of our existing clients are saying anything about later delivery or cancelling, or converting to other types of ships. None. None of them. It’s quite safe at the moment,” said executive chairman Ren Letian, in response to shareholder questions at the company's AGM yesterday (29 Apr).  Shareholder Mano Sabani speaking at the AGM held at Capital Tower in Robinson Road. Shareholder Mano Sabani speaking at the AGM held at Capital Tower in Robinson Road.Shareholders congratulated the company on a record-breaking 2024, where it landed USD 14.6 billion in new orders, the biggest haul since it went IPO in 2007 on the Singapore Exchange. Clean energy vessels made up 74% of the total order value, up from 58% the year before. The company's total outstanding order book has hit an all-time high of USD 24.4 billion, which will keep its shipyards busy all the way to 2028.  |

Mr Ren acknowledged that some potential clients are delaying new orders as they await clarity on tariffs, but Yangzijiang continues to receive inquiries, particularly for vessel types less affected by US measures.

"We still have a lot of opportunities and we will try our best to secure some medium sized containers."

The US trade actions have caused shareholders of Yangzijiang to voice a range of concerns and suggestions to management, focusing on the sharp fall in share price.

Shareholder Mano Sabnani said, “The bashing of the stock is overdone”.

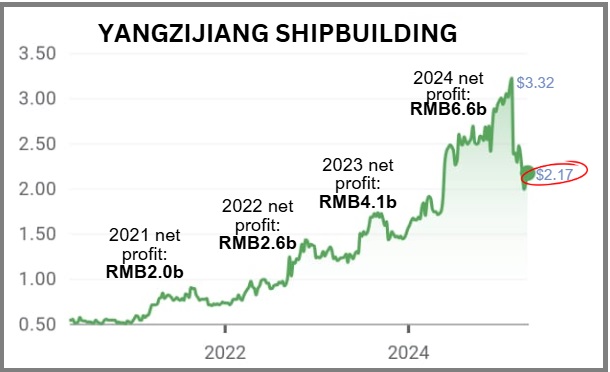

Opining that the stock is undervalued, he added: "Right now the dividend yield is more than 5%, which in the Singapore context is quite attractive”.

Yangzijiang is paying a dividend of 12 Singapore cents -- a whopping 84.6% jump from the year before.

On dividends, another shareholder urged the company to continue its dividend payout, or even raise it to 50% "because that helps the share price to hold on”.

The CFO noted, “The company is committed to declaring 30 to 40% of its net profit as a dividend every year,” and that share buybacks would be used “when the share price is volatile to protect shareholders interest”.

There was also a call for more aggressive share buybacks: “If you do aggressive buyback... this gives confidence to the market for Yangzijiang, really”.

|

|