Excerpts from KGI Research report

Analyst: Amirah Yusoff

| • EC World REIT is the only specialized and e-commerce logistics S-REIT that provides investment access into China’s booming e-commerce industry. c.40% of its investment assets (by AUM valuation) are also quality port logistics assets with prime and coveted access to the Beijing-Hangzhou Grand Canal due to recent UNESCO Heritage Site zonings.

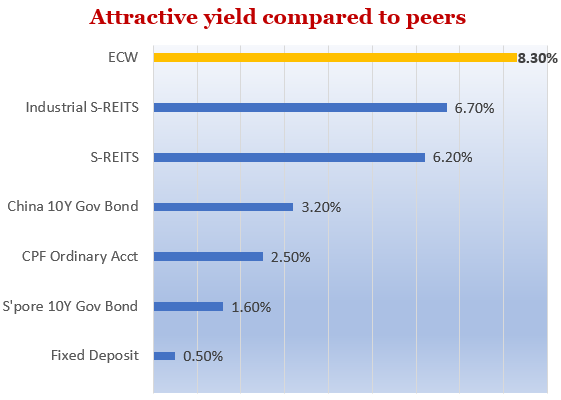

We believe that with the support and guidance of its sponsor, there is still a long runway for future growth and expansion. • We initiate coverage on EC World REIT (ECW) with an OUTPERFORM recommendation. Our target price of SGD$0.84 represents a total upside of 23.4%, inclusive of FY20F dividend yield of 9.1%. |

||||

Investment Thesis

High income visibility. ECW’s portfolio is well-diversified into the three main logistics segments: Port, Specialised, and ECommerce logistics, lending stability to its income.  L-R: Johnny Tng, CFO | Goh Toh Sim, CEO | Li Jinbo, Head of Investments, Asset Management and Investor Relations. Photo: GCP GlobalThey have also proven stable 99%-100% occupancy levels since IPO, and have a WALE of 4.3 years by net lettable area (NLA), as of 30 September 2019.

L-R: Johnny Tng, CFO | Goh Toh Sim, CEO | Li Jinbo, Head of Investments, Asset Management and Investor Relations. Photo: GCP GlobalThey have also proven stable 99%-100% occupancy levels since IPO, and have a WALE of 4.3 years by net lettable area (NLA), as of 30 September 2019.

Four of its eight properties are directly and indirectly master-leased to its sponsor (representing c.70% of gross rental income (GRI)), while another is leased to a China State-Owned-Enterprise (SOE), China Tobacco Zhejiang Industrial Co., Ltd.

Established, capable, & committed sponsor. The Sponsor, Forchn Holdings Group Co Ltd., is a well-established operator of port facilities in China with over 20 years of experience.

It has both constructed and operated the Chongxian Port facility - a key construction project duly recognised by the China government. Alongside partners Alibaba Group, Fosun Group, and other key logistics companies, the Sponsor was also one of the founding members of Cainiao Network Technology Co., Ltd. (菜鸟网络科技有限公司).

Right time, right industries. China has quickly emerged as a global leader in e-commerce with the rise of technology. This inevitably translates into demand for e-commerce logistics assets, which represent 40% of ECW’s portfolio.

Demand is further amplified with insufficient supply, especially in Hangzhou, one of the largest e-commerce hubs in China, where some of the largest online retail platforms, including the Alibaba Group, are headquartered.

With support, too, from the Chinese government to propel the e-commerce and technology space in the coming years, we believe that ECW’s assets are well-positioned to capture the vast growth opportunities.

| Valuation & Action We initiate coverage on ECW with an OUTPERFORM recommendation. Our target price of SGD$0.84 represents a total upside of 23.4%, inclusive of FY20F dividend yield of 9.1%. We used the DDM methodology for the valuation with a cost of equity of 9.7% and terminal growth rate of 1.5%. ECW currently trades at a FY19F/FY20F P/B ratio of 0.9x, a 25% discount to the average of its peers at 1.2x. |

Key Risks

Key risks include high dependency on its sponsor for rental income; non-renewal of upcoming lease expiry with China Tobacco Zhejiang Industrial Co., Ltd.; CNY/SGD currency fluctuations given current geopolitical tensions; and a relatively higher gearing.

Full report here. Source: EC World REIT presentation (Nov 2019)

Source: EC World REIT presentation (Nov 2019)