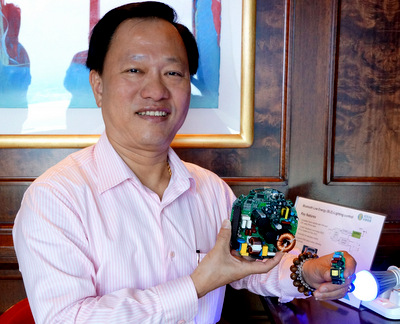

Serial System reported net profit of US$6.1 million for 1H2017, compared to a net loss of US$3.3 million for 1H2016, as profit margins rose and losses from associate companies narrowed.  Serial System executive chairman Derek Goh. Serial System executive chairman Derek Goh. File photoA smaller currency translation loss, as well as reduced allowance for inventory obsolescence, also supported the bottom line of the SGX Mainboard‐listed distributor of electronic components and consumer products in 1H2017. Gross profit margin inched up to 7.1% from 6.6%, driven mainly by the higher margin achieved by the consumer products distribution business. However, the electronic components distribution business posted lower gross profit margin in 1H2017 due to keen competition.

|

Serial System’s share of losses from associated companies narrowed to US$0.6 million in 1H2017 from losses of US$3.7 million a year earlier, when Bull Will Co., Ltd had to make significant provisions for doubtful debts and inventory obsolescence.

Bull Will, in which Serial System has a 29.03% stake, manufactures magnetic components for electronic products.

Revenue from the core business -- electronic components distribution -- increased 17% to US$677.3 million as growth in Hong Kong, China and South Asia Pacific offset lower contributions from Taiwan and South Korea.

|

Stock price |

18.1 c |

|

52-week range |

12.8 – 19.3 c |

|

PE (ttm) |

8.6 |

|

Market cap |

S$162 m |

|

NAV |

15.1 US cts |

|

Dividend yield |

2.54% |

|

Year-to-date return |

27% |

|

Source: Bloomberg |

|

Among the three growth markets, sales in China rose the most in 1H2017 – by 35%.

Consumer products distribution business accounted for the remaining US$27.5 million in revenue for 1H2017.

This marked a 79% decline from 1H2016, due to lower sales across all subsidiaries, which made concerted efforts to exit or reduce exposure to non‐performing markets and low‐margin products.

The Group’s ongoing efforts to streamline operational efficiency continued to bear fruit as total expenses as a percentage of revenue declined to 6.2% in 1H2017 from 7.1% a year earlier. Distribution expenses alone fell 7% in 1H2017.

Serial's net asset value per share amounted to 15.11 US cents as at 30 June 2017, up from 13.93 US cents as at 31 December 2016.

|

Spin-off of HK subsidiary |

|

As part of efforts to further expand its presence in Hong Kong and China, Serial System said on 22 June 2017 that it intends to spin off its Hong Kong electronic components distribution entity, 91% owned Serial Microelectronics (HK) Limited group (“SMHK group”) through a listing on the mainboard of the Stock Exchange of Hong Kong. |

Despite keen competition, the Group expects to remain profitable in FY2017 as global semiconductor sales worldwide could reach a new high this year, according to Dr Derek Goh, Serial System’s Executive Chairman and CEO, citing recent data from Gartner.

In its latest assessment of the global semiconductor industry, Gartner said in July 2017 that it expects semiconductor sales worldwide to reach US$401.4 billion this year, an increase of 16.8% from 2016 and more than the market research firm’s projection of US$386 billion made in April 2017.

This will be the first time that global semiconductor revenue surpasses US$400 billion in any single year if the forecast comes to pass.

Memory products will be the main driver of semiconductor sales in 2017, according to Gartner.

For more, see Powerpoint materials here.