Yangzijiang has 6 yards strategically located along the Yangtze River.

Yangzijiang has 6 yards strategically located along the Yangtze River.

Photos: Company

THE SHIPBUILDING INDUSTRY narked its 5th year of downturn in 2013 but Yangzijiang Shipbuilding sailed through on diverse income streams. It continued to clinch shipbuilding orders. As recently as last week, it announced orders for 18 vessels worth S$1.03 billion. Executive chairman Ren Yuanlin, in his message to shareholders in its just-published 2013 annual report, explains in detail the company's strategy to weather downturns. We reproduce excerpts from the annual report that focus on its diversification strategy, and the mid term goals for each business segment. For the full-blown annual report, click here.

Five Segments of Yangzijiang

The Group remains committed to executing its plans to transform into an integrated marine group with diversified revenue streams. We have used the opportunity created by the down cycle to strengthen our capabilities and to foray into new businesses. In 2013, the Group re-organized and streamlined its business operations into five main segments: 1) Shipbuilding and Offshore, 2) Financial Investments, 3) Shipping Logistics and Chartering, 4) Ship Demolition, Steel Fabrication and related trading businesses, and 5) Property Development.

While the Shipbuilding & Offshore and Financial Investments segments will remain as the largest revenue and profit contributors in the near future, the Group is also growing the other three business segments.

What we want is to develop each segment into self-sustained units that create synergies for each other. We envisage non-core segments contributing 40% to Group revenue, while the contribution from Shipbuilding and Offshore Engineering will be about 60% in the long run.

|

Executive chairman Ren Yuanlin Executive chairman Ren Yuanlin

(1) Shipbuilding and Offshore

During 2013, we secured newbuilding order worth US$2.9 billion, comprising of 61 bulk carriers and 12 containerships. This is much higher than the US$300 million worth of orders that we secured in 2012.

During the first two months of 2014, we secured orders for another 6 bulk carriers and 2 containerships. In addition, we have 11 options for newbuilding contracts worth US$830 million that remain to be exercised by our customers. The options are for 8 containerships worth US$720 million and 3 multi-purpose bulk carriers worth US$110 million.

As at 27 February 2014, we had a substantial outstanding order book of US$4.6 billion comprising of 111 vessels.

Work on these contracts will fill our yard capacity until 2016. The Group’s strong order book momentum does not reflect the state of the shipbuilding industry, which continues to be challenged by weak demand and excess shipbuilding capacity. We have strong order flow because ship owners choose to place orders with stronger shipyards with a reputation for timely delivery.

Our industry position has been improving significantly through the severe industry consolidation in the current down cycle. In 2007 when we secured new orders worth USD5 billion, our market share was only 2.7%. Last year, we secured new orders of only USD2.9 billion, but our market share had doubled to 4.9%. We expect this trend to continue.

Last September, we proudly launched the first 10,000-TEU containership built by a PRC yard. In February this year, the vessel successfully sailed its trial voyage, with performance and quality to the satisfaction of the ship-owner.

In addition to expanding our capability and offering in the building of sea cargo transportation vessels, we have diversified into offshore vessels and related engineering work. We have strong support from multinational suppliers of drilling equipment and engines as well as inspection services providers.

Support from these established industry players ensure that the rigs manufactured in our shipyard will be of world-class standards. As our business partners, they have helped our foray into the oil rig market because they see big opportunities in China.

More than a year ago, at the end of 2012, we secured our maiden oilrig contract for a jack-up. We recently secured our second oilrig contract to construct two semi-submersible rigs for US$825 million, with options for 2 additional similar units. The recent contract will only be effective when the Group receives the deposit for the rigs.

|

|

CFO Liu Hua (in red) and visiting analysts at Yangzijiang's yard. CFO Liu Hua (in red) and visiting analysts at Yangzijiang's yard.

(2) Financial Investments

NextInsight file photoLast year, we increased our financial assets held-to-maturity by 24.2% to RMB14.1 billion and redeemed RMB8.9 billion of this amount. The rate of default was less than 5%. Most of the default investments were reclaimed through the sale of collaterals. NextInsight file photoLast year, we increased our financial assets held-to-maturity by 24.2% to RMB14.1 billion and redeemed RMB8.9 billion of this amount. The rate of default was less than 5%. Most of the default investments were reclaimed through the sale of collaterals.

About 60% of our capital is redeemed every year. In 2014, we will develop a model to manage financial assets for higher yields within acceptable risk constraints for a cumulative annualized yield of 12%. We will work toward maximizing our assets under management by tapping on domestic PRC and overseas financial markets, as well as by leveraging on government support for shipbuilding enterprises.

The experience that our investment team has gleaned from our venture capital forays has helped us to articulate an investment mandate suitable for the Group’s capital ventures. We target cumulative annualized yield of 15% over a 3-year investment horizon.

We intend to exit these venture investments by spinning off the subsidiary for an IPO or by reverse takeover of a listed shell in China. This will expand our access to funds to include the domestic PRC capital market, in addition to our Singapore and Taiwan listed company status.

|

|

(3) Shipping Logistics and Chartering

To ride on the improving outlook for the commercial shipping market, we are building 4 bulk carriers at our New Yangzi yard in addition to the existing 10 vessels for chartering service, the enlarged shipping logistics & chartering fleet is to seize the opportunity presented at the current shipping markets bottom out stage, which showing a steady adjustment trend of recovery.

This segment is looking into getting a grip on the provision of affreightment services, financing, and being profitable. We are targeting for profitability of this segment over 3 years.

|

|

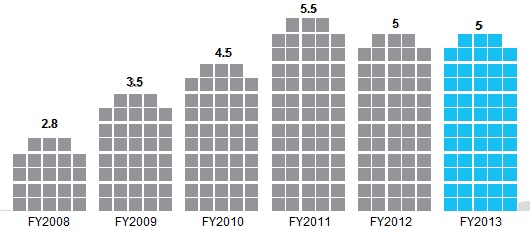

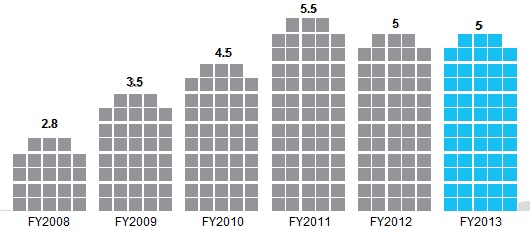

Yangzijiang has paid consistent dividends through the industry downturn. Above: annual dividends in Singapore cents. Yangzijiang has paid consistent dividends through the industry downturn. Above: annual dividends in Singapore cents.

(4) Ship Demolition, Steel Fabrication and related trading businesses

As a shipbuilding enterprise that uses a high volume of steel, the Group possesses strong competitive advantages to enter the steel trading business. These advantages are:

* Established and reliable channels for steel procurement

* Relatively low cost of steel inventory – We make bulk purchases to meet the high volume of steel usage by our shipbuilding activities.

* Huge treasury and ample free cash flow – High working capital is required by the steel trading business.

* Good reputation for quality of steel inventory – Compared to other industries, the maritime industry is known for its rigorous requirements on quality materials. Yangzijiang’s reputation as a leading shipbuilder globally gives our import and export trading customers added assurance on the quality of our steel inventory.

* Access to scrap metal – Our ship demolition yard gives us a ready inventory of scrap metal which can fetch good prices during upturns in the PRC scrap metal market.

We will seize opportunities to expand our trading gains through interest rate carry trade, currency exchange rate carry trade and economies of large scale trading. Our trading business is still at its infancy stage but plans to grow this business are underway. We have already incorporated two trading subsidiaries in Singapore.

The PRC government policy encourages the demolition of vessels more than 15 years and provides incentives for the replacement vessels to be constructed in China. In conjunction with our facility upgrading exercise at Changbo Yard, our ship demolition site located at the western wing of Er’wei Port will also be upgraded. The facility upgrade exercise will further improve our productivity.

|

|

(5) Real Estate Development

Real estate development is a new business segment that we have identified as being synergistic with the Group. Firstly, our yards are located on coastal land. Given the vicinity’s urbanization, we were able to acquire the land previously occupied by our old yard to redevelop the surrounding site for residential and commercial use. We relocated our old yard last year and have embarked on redevelopment of the seafront land with Jiangsu Huaxi Property Development Co Ltd and Jiangsu Huadu Real Estate Co Ltd.

Secondly, many of our financial investments customers put up properties and land use rights as collateral. In the event of default, the foreclosed collateral can be redesignated as our property development land bank. In such foreclosures, our land bank cost will be relatively low as collateral is valued at a fraction of the borrower’s land acquisition price.

Thirdly, we are one of Jiangsu province’s top contributors of tax revenue. Hence we have a favourable position in tender for urban redevelopment projects in view of our strong financial position and prospective tax revenue arising from our projects.

On 27 February 2014, the Group announced the acquisition of a property developer, Jiangsu Hengyuan Real Estate Development Co Ltd, at its book value of RMB300 million. The acquisition will give the Group manpower to run our property development projects independently.

We will also conduct market research on how to formulate a 3-5 year plan to gradually grow this segment into a stable contributor that supplements the Group’s top line. The plan will be formulated in a way that allows us to expand organic operations, scale the learning curve in our new ventures and invest with strict and prudent budgetary guidelines.

|

Related story: YANGZIJIANG: Shipbuilding Downturn, Yes, But We Will Prevail With New Income Streams

Yangzijiang has 6 yards strategically located along the Yangtze River.

Yangzijiang has 6 yards strategically located along the Yangtze River.