Excerpts from Deutsche Bank's report

Analysts: Joe Liew, CFA, & Joshua Lee, CFA

The worst hit stocks within our coverage were CMA (CapitaMall Asia), SMM (SembCorp Marine), OCBC, GENS (Genting Singapore), CIT (Cambridge Industrial Trust), and WIL (Wilmar International Ltd), all declining more than 9% YTD.

Soft property numbers, low CPO (crude palm oil) price, fragile sentiment in exporting markets were key drivers.

P/E discount versus historical average is the widest among ASEAN peers.

DB's average market P/E of 12.9x for 2014E versus EPS growth 13.6% in 2015E does not look as unattractive anymore.

No change in the three 2014 themes (1) Fed taper, (2) recovering global growth, and (3) being on the right side of government policies. It is not yet time to buy property developers and REITs in our view.

Analysts: Joe Liew, CFA, & Joshua Lee, CFA

The worst hit stocks within our coverage were CMA (CapitaMall Asia), SMM (SembCorp Marine), OCBC, GENS (Genting Singapore), CIT (Cambridge Industrial Trust), and WIL (Wilmar International Ltd), all declining more than 9% YTD.

Soft property numbers, low CPO (crude palm oil) price, fragile sentiment in exporting markets were key drivers.

P/E discount versus historical average is the widest among ASEAN peers.

DB's average market P/E of 12.9x for 2014E versus EPS growth 13.6% in 2015E does not look as unattractive anymore.

No change in the three 2014 themes (1) Fed taper, (2) recovering global growth, and (3) being on the right side of government policies. It is not yet time to buy property developers and REITs in our view.

|

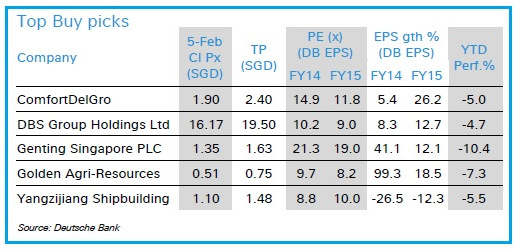

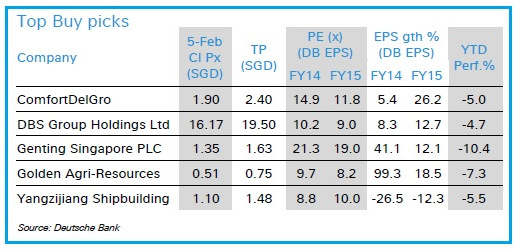

Top five Buy picks in Singapore We maintain our top Buy picks portfolio as we believe that they are exposed to our core theme of companies with global growth exposure (DBS, Golden Agri, Genting Singapore and Yangzijiang) and beneficiaries of government policies in Singapore (ComfortDelGro).

We would continue to stay away from property developers, REITs and dividend-yield plays with little earnings growth. Genting SP: Poorest performer YTD among our top picks, down 10% YTD.

Improving China macro outlook as 50-60% of VIP roll comes from HK / China. Operating cost stabilizing. Potential positive news in Japan.

Golden Agri: Poor performance caused by seasonal weakness in CPO.

We expect a recovery in 2Q. This is the most leveraged play to our forecasted CPO price increase over FY14/15, which is premised on a tightening supply environment supported by robust demand growth. Margins should improve on slower cost of production increases.  Ren Yuanlin, executive chairman of Yangzijiang Shipbuilding. NextInsight file photo. Ren Yuanlin, executive chairman of Yangzijiang Shipbuilding. NextInsight file photo.Downtown Line will be medium-term earnings accretive while rail profitability should improve over time.

Yangzijiang Shipblding: Capturing market share during current consolidation and promising new order flow momentum. Positive on recent ship price increase with better customer payment terms. DBS: Least exposure among peers to an ASEAN slowdown and higher exposure to Greater China. Best deposit franchise in Singapore insulating it from deposit competition and positions the bank well for rates rise. |