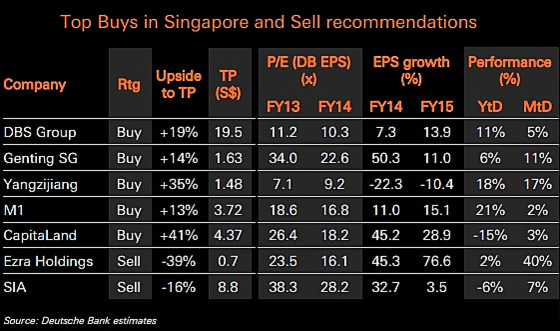

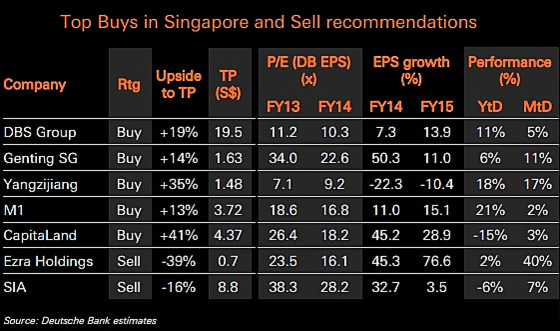

Excerpts from Deutsche Bank's report dated 1 Oct 2013.

Analysts: Joe Liew, CFA, & Joshua Lee, CFA

We drop ST Engineering because it has rallied 14% over the past 15 weeks. In its place, we have picked Genting because of its potential margin expansion at RWS, the improving China macro outlook and its operating leverage.

We see strong 50% earnings growth in 2014E.

Yangzijiang has become a market darling: At Deutsche's target price of $1.50, YZJ would trade at 10.5x FY13E PER. Photo: CompanyYangzijiang Shipbuilding replaces Keppel Corp, as we think order flow has better upside potential versus market expectations.

Yangzijiang has become a market darling: At Deutsche's target price of $1.50, YZJ would trade at 10.5x FY13E PER. Photo: CompanyYangzijiang Shipbuilding replaces Keppel Corp, as we think order flow has better upside potential versus market expectations.

The consolidating sector should increase its market share and a number of its 51 contract options issued should be exercised in the coming quarter.

Lastly, we have included DBS and dropped HPH Trust because we think DBS is well positioned for an eventual rate rise in the future.

The bank is growing its wealth management market in Singapore and Hong Kong, in addition to re-jigging its HK loan book from lower-margin mortgages to higher margin trade financing.

We maintain CapitaLand and M1 on the list.

Analysts: Joe Liew, CFA, & Joshua Lee, CFA

We drop ST Engineering because it has rallied 14% over the past 15 weeks. In its place, we have picked Genting because of its potential margin expansion at RWS, the improving China macro outlook and its operating leverage.

We see strong 50% earnings growth in 2014E.

Yangzijiang has become a market darling: At Deutsche's target price of $1.50, YZJ would trade at 10.5x FY13E PER. Photo: CompanyYangzijiang Shipbuilding replaces Keppel Corp, as we think order flow has better upside potential versus market expectations.

Yangzijiang has become a market darling: At Deutsche's target price of $1.50, YZJ would trade at 10.5x FY13E PER. Photo: CompanyYangzijiang Shipbuilding replaces Keppel Corp, as we think order flow has better upside potential versus market expectations. The consolidating sector should increase its market share and a number of its 51 contract options issued should be exercised in the coming quarter.

Lastly, we have included DBS and dropped HPH Trust because we think DBS is well positioned for an eventual rate rise in the future.

The bank is growing its wealth management market in Singapore and Hong Kong, in addition to re-jigging its HK loan book from lower-margin mortgages to higher margin trade financing.

We maintain CapitaLand and M1 on the list.

Increasingly visible structural reforms in China and growing domestic consumption should benefit CapitaLand.

We expect a margin improvement at M1 over time and like its recent positive ARPU momentum; we estimate a dividend yield of 4.4% in 2013, rising to 5.9% in 2015.

We expect a margin improvement at M1 over time and like its recent positive ARPU momentum; we estimate a dividend yield of 4.4% in 2013, rising to 5.9% in 2015.

Sell recommendations in Singapore

To fund the purchases, we would Sell Ezra Holdings and Singapore Airlines (SIA). Ezra is in a build-up phase and, as such, has seen heavy expenses, which have placed downside pressure on group earnings.

Execution risks also appear elevated for the group.

We have a Sell on SIA because of high fuel prices, a sluggish cargo business and downward pressure on passenger yields.

Over the longer term, we also worry about the competitive threat from LCCs and the Middle Eastern airlines (like Emirates).

Execution risks also appear elevated for the group.

We have a Sell on SIA because of high fuel prices, a sluggish cargo business and downward pressure on passenger yields.

Over the longer term, we also worry about the competitive threat from LCCs and the Middle Eastern airlines (like Emirates).